- China

- /

- Electronic Equipment and Components

- /

- SZSE:300338

Kaiyuan Education Technology Group Co., Ltd. (SZSE:300338) Surges 53% Yet Its Low P/S Is No Reason For Excitement

Kaiyuan Education Technology Group Co., Ltd. (SZSE:300338) shareholders are no doubt pleased to see that the share price has bounced 53% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

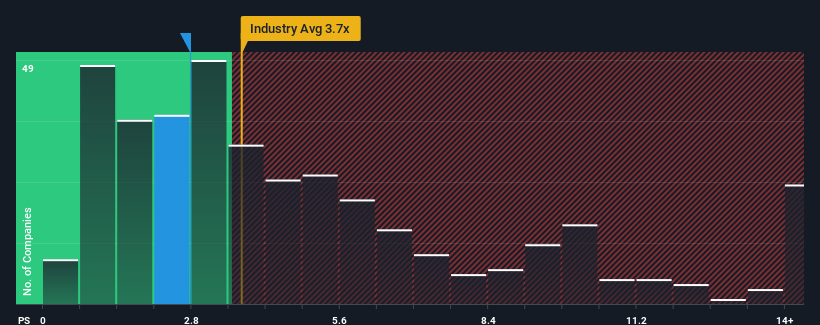

Even after such a large jump in price, Kaiyuan Education Technology Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.8x, since almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.7x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Kaiyuan Education Technology Group

What Does Kaiyuan Education Technology Group's P/S Mean For Shareholders?

For example, consider that Kaiyuan Education Technology Group's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kaiyuan Education Technology Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Kaiyuan Education Technology Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Kaiyuan Education Technology Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. As a result, revenue from three years ago have also fallen 49% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Kaiyuan Education Technology Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Final Word

Despite Kaiyuan Education Technology Group's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Kaiyuan Education Technology Group revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Kaiyuan Education Technology Group that you should be aware of.

If you're unsure about the strength of Kaiyuan Education Technology Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kaiyuan Education Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300338

Kaiyuan Education Technology Group

Kaiyuan Education Technology Group Co., Ltd.

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives