Exploring High Growth Tech Stocks Including 3 Global Leaders

Reviewed by Simply Wall St

As global markets navigate mixed signals from economic data and central bank policies, the tech sector remains a focal point for investors, with recent fluctuations in key indices such as the Nasdaq Composite reflecting ongoing concerns around valuations and spending in artificial intelligence. In this dynamic landscape, identifying high growth tech stocks involves assessing companies' innovative capabilities, market adaptability, and potential to capitalize on emerging technologies amidst evolving economic conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 36.73% | 38.14% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.60% | 32.84% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Aduro Clean Technologies (CNSX:ACT)

Simply Wall St Growth Rating: ★★★★★☆

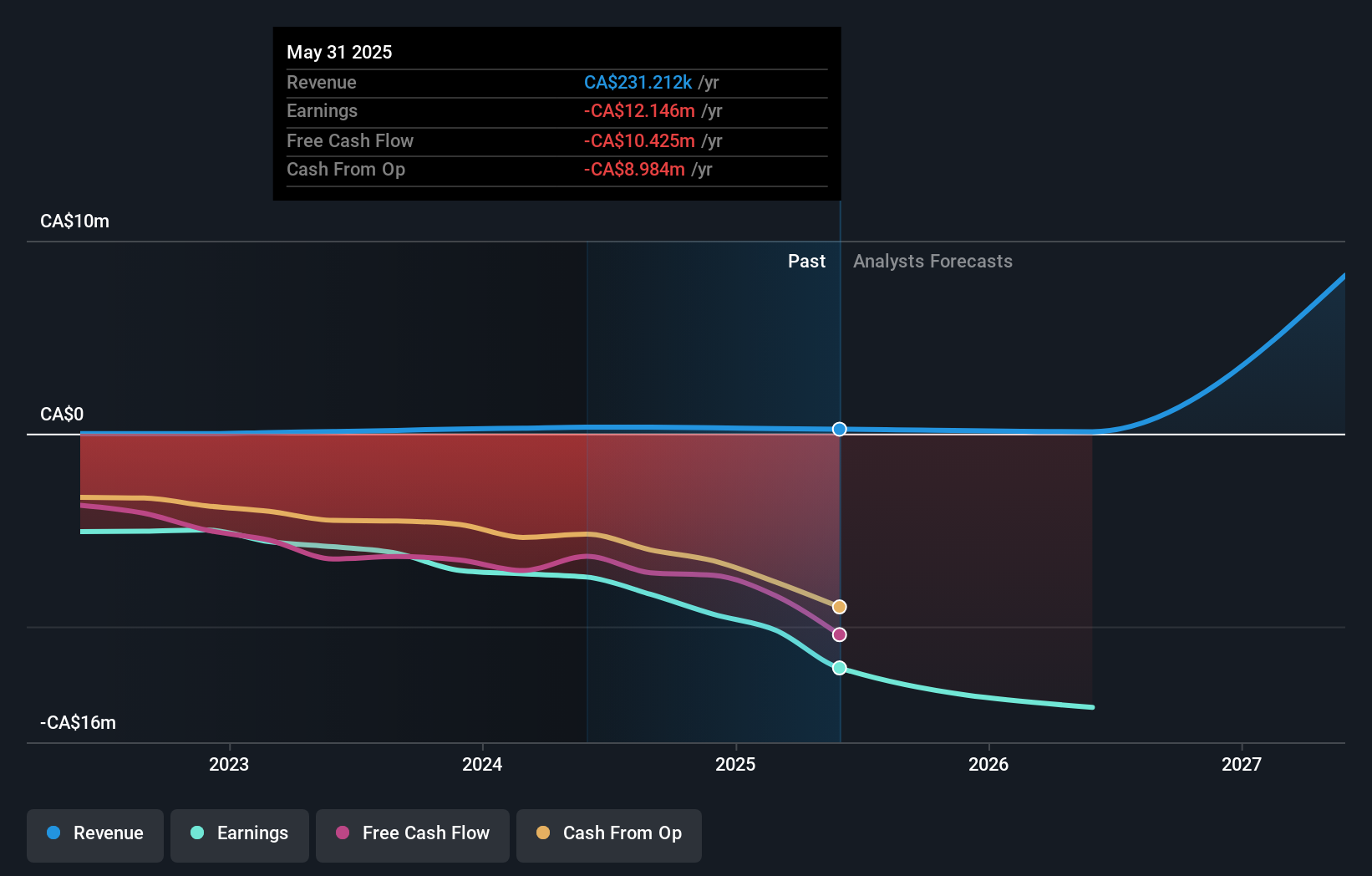

Overview: Aduro Clean Technologies Inc. focuses on developing water-based chemical recycling technologies and has a market cap of CA$504.09 million.

Operations: Aduro Clean Technologies Inc. generates revenue from its pollution and treatment control products, amounting to CA$0.22 million. The company is engaged in the development of water-based chemical recycling technologies.

Aduro Clean Technologies, a burgeoning name in the clean tech sector, has recently completed a significant $20 million follow-on equity offering and filed for a $60 million shelf registration, signaling robust financial maneuvers aimed at fueling its growth. The company's revenue is projected to surge by 70.1% annually, outpacing the Canadian market's growth of 5.4%. Despite current unprofitability, Aduro is expected to turn profitable within three years with earnings forecasted to grow at an impressive rate of 65.95% per year. These financial strategies are complemented by strategic partnerships like the one with ECOCE in Mexico to explore chemical recycling solutions for challenging waste streams—a move that not only expands Aduro’s operational footprint but also aligns with global sustainability trends and regulatory shifts towards recycled content in packaging.

- Click here and access our complete health analysis report to understand the dynamics of Aduro Clean Technologies.

Understand Aduro Clean Technologies' track record by examining our Past report.

Genmab (CPSE:GMAB)

Simply Wall St Growth Rating: ★★★★☆☆

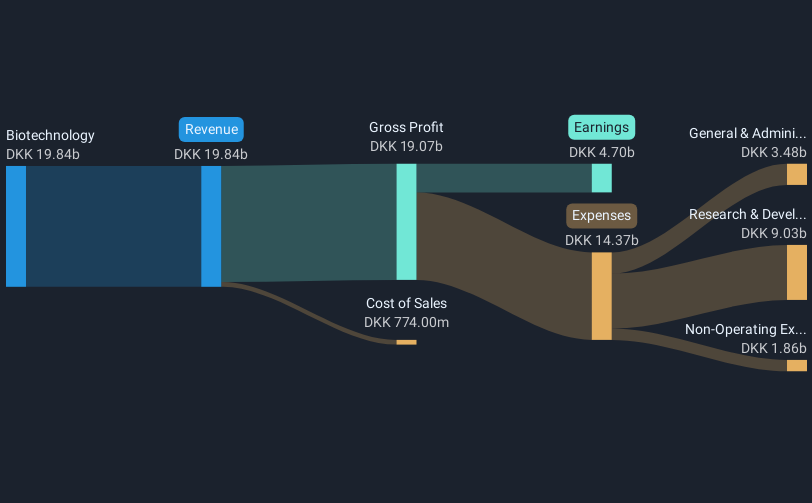

Overview: Genmab A/S is a biotechnology company focused on developing antibody-based products for cancer and other diseases in Denmark, with a market capitalization of DKK126.77 billion.

Operations: The company's primary revenue stream is derived from its biotechnology segment, generating $3.85 billion.

Genmab's recent strides in the biotech industry underscore its potential within high-growth tech sectors, particularly through innovations in antibody therapies. At the 2025 Antibody Engineering & Therapeutics Conference, insights into their advanced antibody formats showcased a commitment to pioneering treatments. Financially, Genmab's robust R&D investment strategy is evident from its significant allocation towards developing groundbreaking therapies like epcoritamab-bysp, which has shown promising efficacy in clinical trials for complex lymphomas. This focus on high-stakes research is supported by a solid financial base, with third-quarter sales rising to $1.02 billion from $816 million year-over-year and net income more than doubling to $401 million. These figures reflect not only Genmab’s strong market position but also its strategic foresight in addressing unmet medical needs through advanced science and targeted therapy solutions.

- Delve into the full analysis health report here for a deeper understanding of Genmab.

Gain insights into Genmab's past trends and performance with our Past report.

Zhongji Innolight (SZSE:300308)

Simply Wall St Growth Rating: ★★★★★★

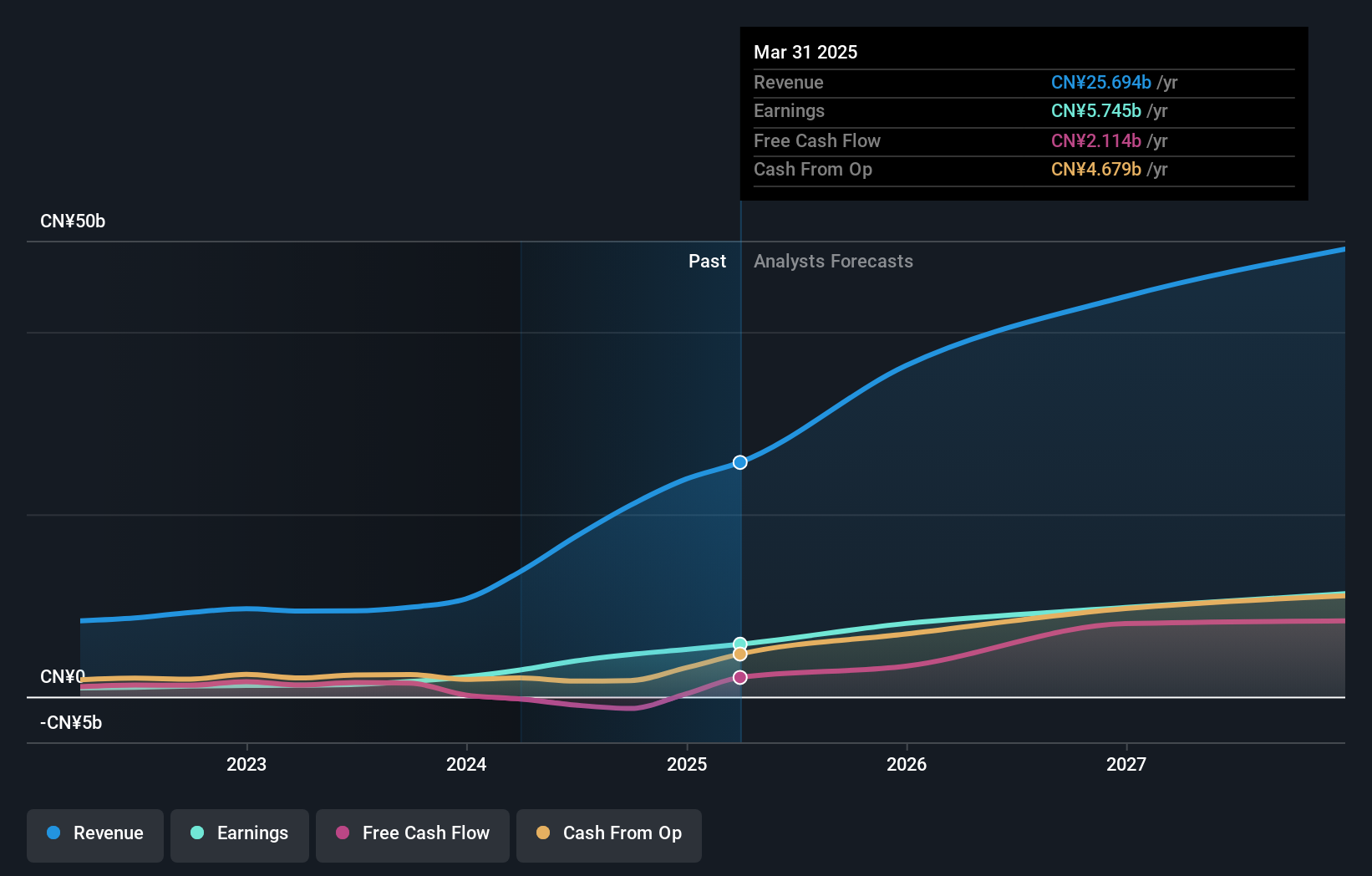

Overview: Zhongji Innolight Co., Ltd. specializes in the design, R&D, production, and sales of optical communication transceiver modules and devices in China with a market cap of CN¥635.23 billion.

Operations: Zhongji Innolight focuses on the optical communication sector, particularly in designing and producing transceiver modules and devices. The company operates primarily within China, leveraging its R&D capabilities to drive sales in this specialized market.

Zhongji Innolight's remarkable trajectory in the tech sector is underscored by its robust revenue and earnings growth, with a 35.1% annual increase in revenue and a striking 84.7% surge in earnings over the past year, significantly outpacing the industry average of 14.4%. This performance is bolstered by substantial R&D investments, aligning with its strategic focus on optical transceivers for burgeoning markets like cloud computing and data centers. The company's recent consideration for a Hong Kong listing highlights its proactive approach to capitalizing on global market opportunities, further positioning it as a dynamic player in high-tech innovations.

Key Takeaways

- Dive into all 247 of the Global High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:ACT

Aduro Clean Technologies

Engages in developing water-based chemical recycling technologies.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion