- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2317

Exploring High Growth Tech Stocks In November 2024

Reviewed by Simply Wall St

As global markets navigate the implications of the incoming Trump administration, investors have witnessed a partial retraction in U.S. stock gains amid policy uncertainties, with notable movements in sectors like financials and energy. In this environment of fluctuating market sentiment and economic indicators, identifying high-growth tech stocks requires an understanding of how these companies can leverage innovation and adaptability to thrive despite potential regulatory shifts and macroeconomic challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.59% | 31.50% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1301 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

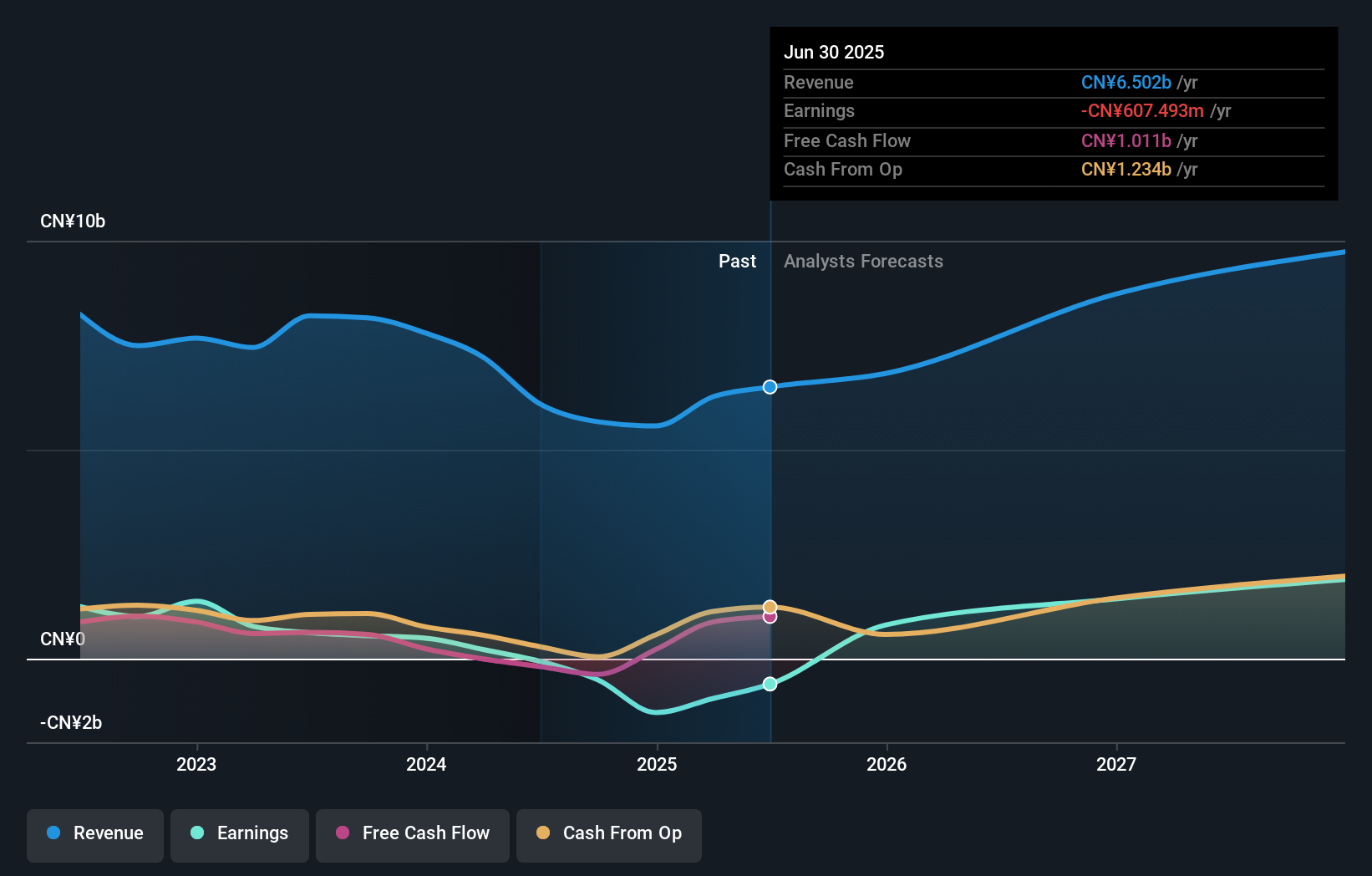

Perfect World (SZSE:002624)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Perfect World Co., Ltd. operates in the online games and movies and television sectors in China, with a market cap of CN¥22.59 billion.

Operations: Perfect World Co., Ltd. generates revenue primarily from its online games and movies and television segments in China. The company's market capitalization is approximately CN¥22.59 billion.

Perfect World, amidst a challenging fiscal period with a reported net loss of CNY 388.81 million for the nine months ending September 2024, contrasts sharply with its previous year's net income of CNY 614.71 million. Despite these financial setbacks, the company's proactive R&D investments and strategic share buybacks underscore its commitment to long-term value creation. Specifically, Perfect World has repurchased shares worth CNY 42.89 million since December last year, reflecting confidence in its future prospects. This approach is aligned with an expected revenue growth forecast of 23.2% per annum, outpacing the Chinese market projection of 13.9%. Moreover, earnings are anticipated to surge by an impressive 106.63% annually over the next three years, positioning Perfect World potentially as a resilient player in the entertainment sector poised for profitability and growth.

- Get an in-depth perspective on Perfect World's performance by reading our health report here.

Explore historical data to track Perfect World's performance over time in our Past section.

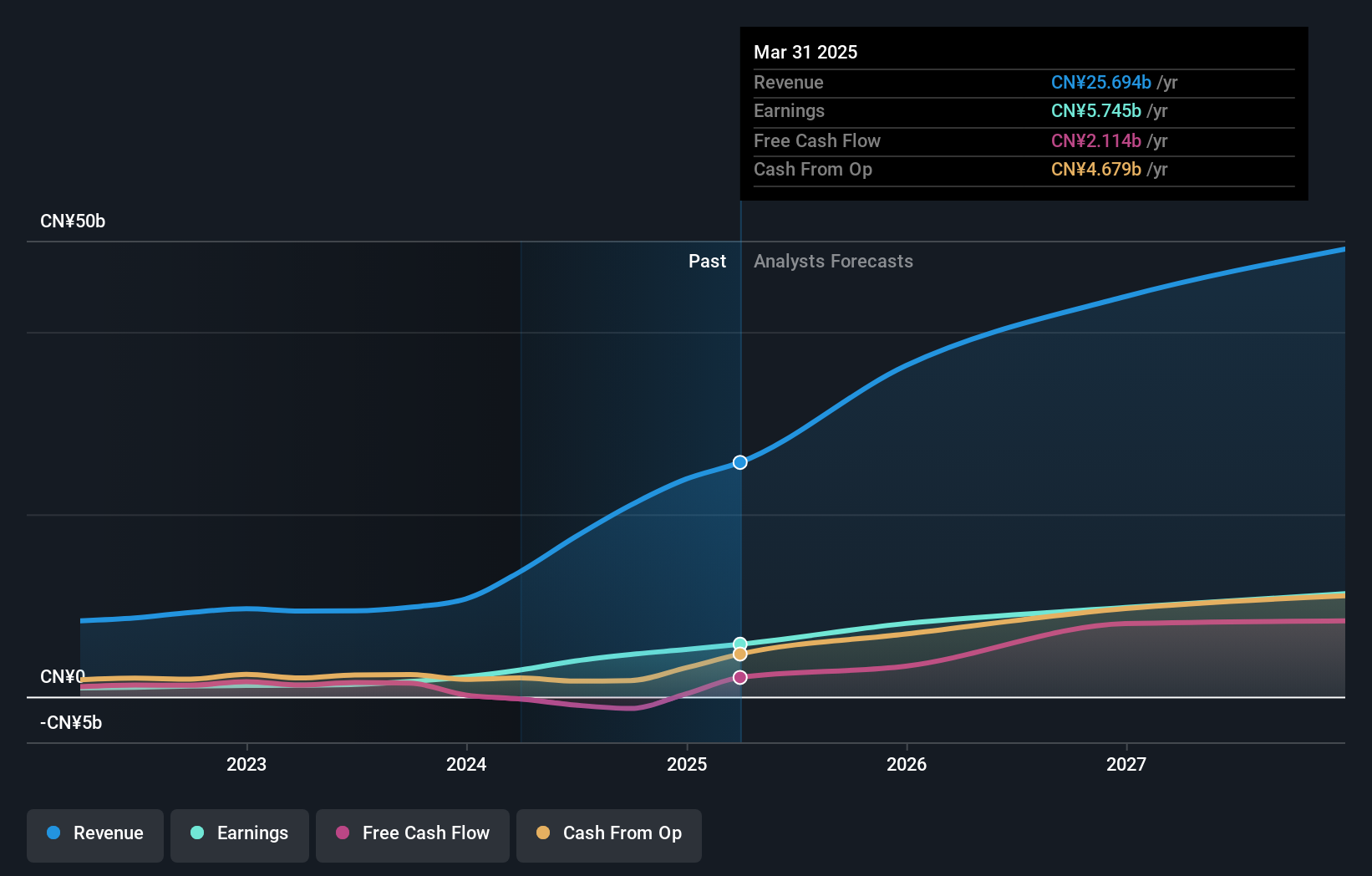

Zhongji Innolight (SZSE:300308)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhongji Innolight Co., Ltd. focuses on the research, development, production, and sale of optical communication transceiver modules and optical devices in China, with a market cap of CN¥145.83 billion.

Operations: The company generates revenue primarily from the sale of optical communication transceiver modules and optical devices. It operates within the Chinese market, focusing on advanced technology development in this sector.

Zhongji Innolight has demonstrated robust financial performance with a significant surge in sales, reporting CNY 17.31 billion for the nine months ending September 2024, up from CNY 7.03 billion the previous year. This growth reflects a remarkable increase in net income to CNY 3.75 billion from CNY 1.30 billion, driven by strategic expansions and innovations in their tech solutions. Their commitment to R&D is evident as they continue to invest heavily, aligning with their revenue growth which is projected at an impressive rate of 30.7% annually—outstripping the Chinese market's forecast of 13.9%. Moreover, earnings are expected to climb by approximately 32.6% per year, showcasing Zhongji Innolight's potential to outperform within its sector and enhance shareholder value through forward-thinking technologies and market adaptation.

- Unlock comprehensive insights into our analysis of Zhongji Innolight stock in this health report.

Gain insights into Zhongji Innolight's past trends and performance with our Past report.

Hon Hai Precision Industry (TWSE:2317)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hon Hai Precision Industry Co., Ltd., with a market cap of NT$2.81 trillion, is a leading provider of electronic OEM services.

Operations: The company's primary revenue stream comes from the Foxconn Population segment, generating NT$4.23 trillion. The FII Subgroup contributes significantly with NT$2.58 trillion, while the FIH Subgroup adds NT$181.90 billion to the overall revenue structure.

Hon Hai Precision Industry has been actively enhancing its market position with consistent revenue growth, reporting TWD 4.73 billion in the first nine months of 2024, up from TWD 4.31 billion in the same period last year. This financial uplift is supported by a notable increase in net income to TWD 106.38 million from TWD 88.95 million year-over-year, reflecting a strategic focus on lucrative tech segments and efficient operations management. The company's dedication to innovation is underscored by its R&D investments, which are crucial for sustaining long-term growth amidst evolving technological landscapes.

Where To Now?

- Navigate through the entire inventory of 1301 High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hon Hai Precision Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2317

Solid track record with excellent balance sheet.