- China

- /

- Communications

- /

- SZSE:300308

3 Global Stocks That May Be Trading At A Discount Of Up To 47.5%

Reviewed by Simply Wall St

As global markets grapple with concerns over AI-related valuations and mixed economic signals, investors are increasingly focused on identifying opportunities that may be undervalued in the current climate. In such an environment, a good stock is often characterized by strong fundamentals and potential for growth despite broader market volatility, making it crucial to assess whether certain stocks might be trading at a discount relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €2.988 | €5.94 | 49.7% |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.71 | CN¥9.38 | 49.8% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥14.80 | CN¥29.45 | 49.8% |

| LianChuang Electronic TechnologyLtd (SZSE:002036) | CN¥9.99 | CN¥19.97 | 50% |

| HMS Bergbau (XTRA:HMU) | €52.00 | €103.80 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.8% |

| cyan (XTRA:CYR) | €2.28 | €4.55 | 49.9% |

| ASE Technology Holding (TWSE:3711) | NT$217.50 | NT$432.29 | 49.7% |

| Allcore (BIT:CORE) | €1.33 | €2.64 | 49.7% |

| ALEC Holdings PJSC (DFM:ALEC) | AED1.40 | AED2.80 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

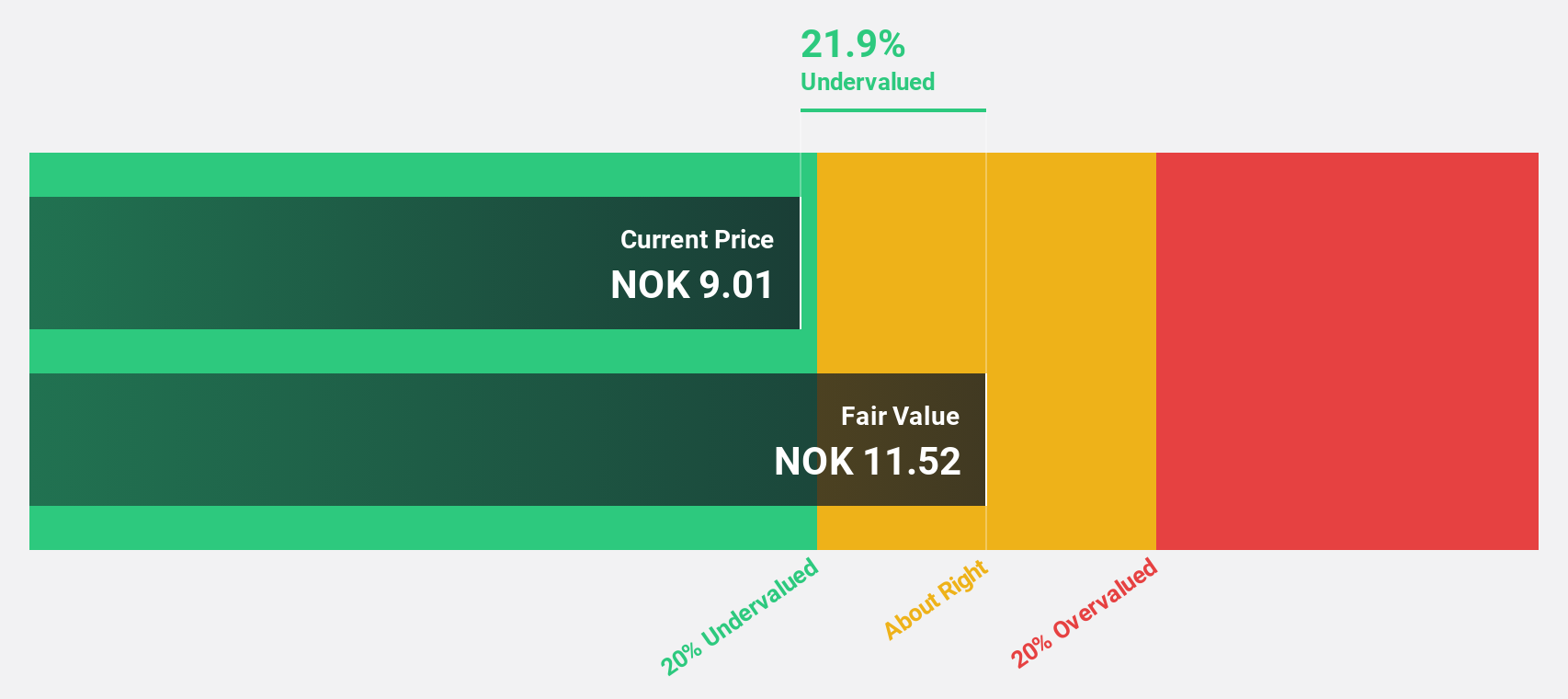

AutoStore Holdings (OB:AUTO)

Overview: AutoStore Holdings Ltd. is a company that offers robotic and software technology solutions across various regions including Norway, Germany, Europe, the United States, and Asia, with a market cap of NOK34.61 billion.

Operations: The company's revenue is primarily derived from its Industrial Automation & Controls segment, which generated $523.80 million.

Estimated Discount To Fair Value: 28.5%

AutoStore Holdings is trading at NOK10.3, significantly below its estimated fair value of NOK14.41, suggesting it is undervalued based on cash flows. Despite recent revenue declines to US$358.9 million for the nine months ending September 2025, earnings are forecasted to grow substantially by 35.34% annually over the next three years, outpacing the Norwegian market's growth expectations. However, profit margins have decreased from 22.4% last year to 15.5%.

- The growth report we've compiled suggests that AutoStore Holdings' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in AutoStore Holdings' balance sheet health report.

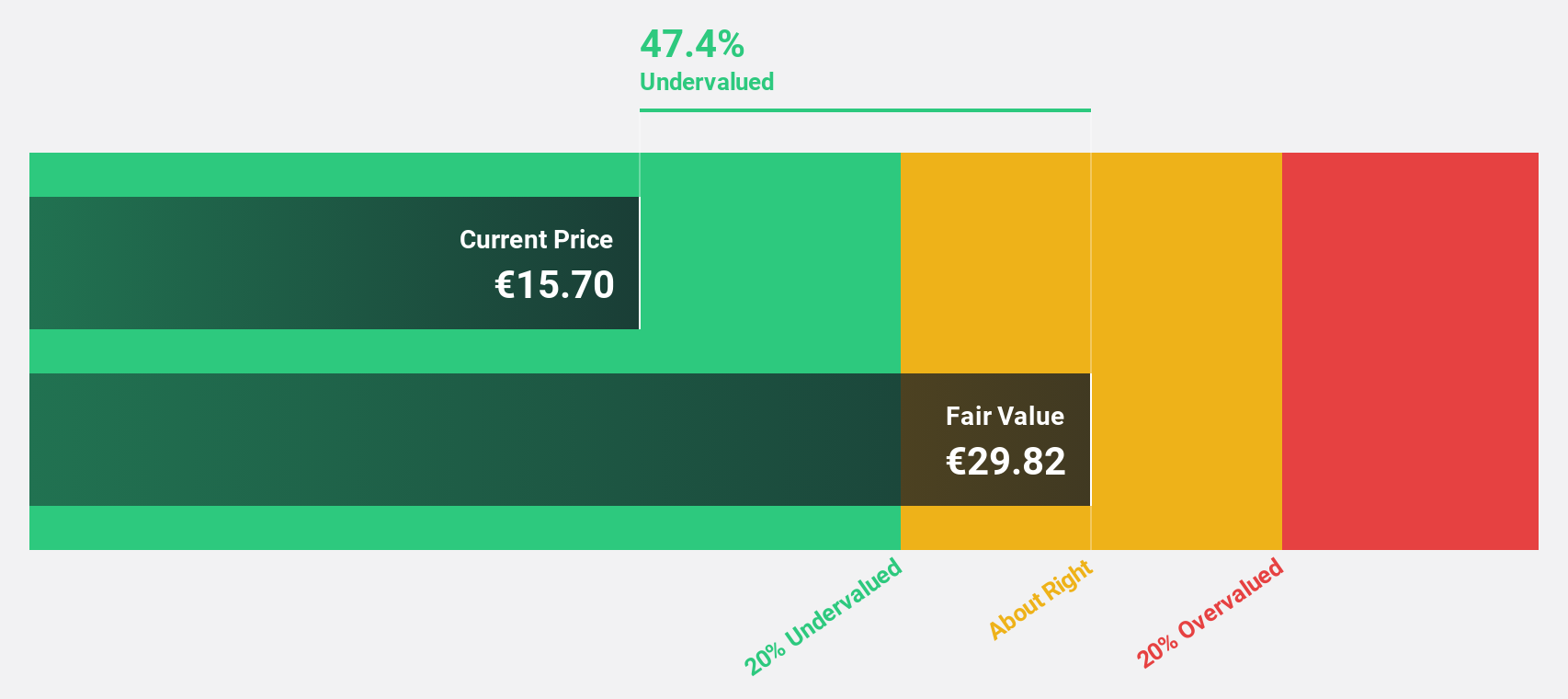

Verisure (OM:VSURE)

Overview: Verisure plc offers security services for families and small businesses across Europe and Latin America, with a market cap of €16.24 billion.

Operations: The company's revenue is generated from three main segments: Portfolio Services (€3.10 billion), Customer Acquisition (€366.09 million), and Adjacencies (€103.04 million).

Estimated Discount To Fair Value: 47.4%

Verisure plc is trading at €15.7, well below its estimated fair value of €29.82, highlighting its undervaluation based on cash flows. Recent inclusion in major indices like the FTSE All-World and S&P Global BMI post-IPO underscores growing market recognition. Despite a forecasted low return on equity of 8.3% in three years, revenue is expected to grow faster than the Swedish market at 8.8% annually, with profitability anticipated within three years.

- According our earnings growth report, there's an indication that Verisure might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Verisure.

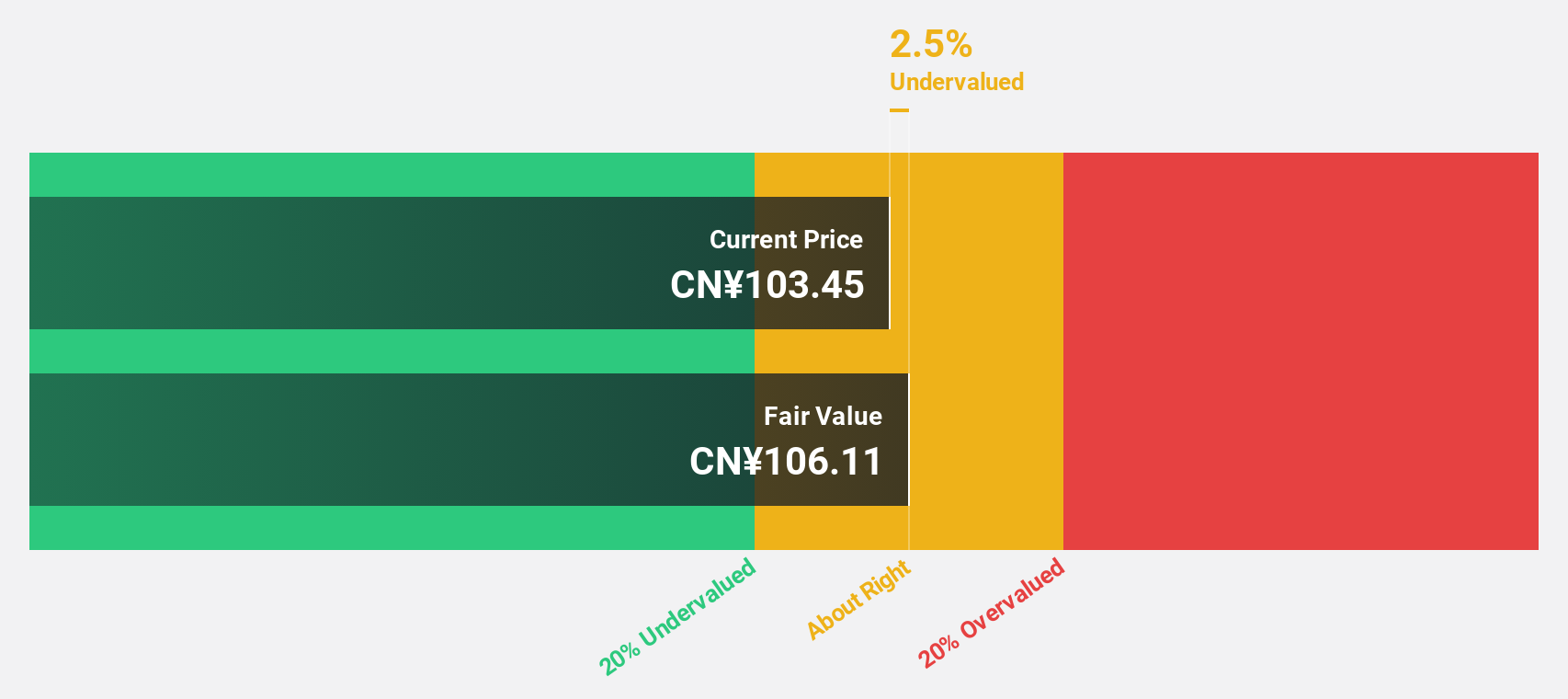

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. specializes in the design, R&D, production, and sales of optical communication transceiver modules and optical devices in China, with a market cap of CN¥532.96 billion.

Operations: Zhongji Innolight Co., Ltd. generates its revenue primarily through the design, research and development, production, and sales of optical communication transceiver modules and optical devices in China.

Estimated Discount To Fair Value: 47.5%

Zhongji Innolight is trading at CNY 543.22, significantly below its estimated fair value of CNY 1,034.63, indicating strong undervaluation based on cash flows. The company reported robust earnings growth of 84.7% over the past year with net income reaching CNY 7.13 billion for the first nine months of 2025. Despite recent share price volatility and plans to list in Hong Kong, revenue and earnings are forecast to grow significantly faster than the Chinese market average.

- Our earnings growth report unveils the potential for significant increases in Zhongji Innolight's future results.

- Navigate through the intricacies of Zhongji Innolight with our comprehensive financial health report here.

Summing It All Up

- Discover the full array of 514 Undervalued Global Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongji Innolight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300308

Zhongji Innolight

Engages in the design, research and development, production, and sales optical communication transceiver modules and optical devices in China.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success