- China

- /

- Electronic Equipment and Components

- /

- SZSE:300248

Newcapec Electronics (SZSE:300248) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Newcapec Electronics Co., Ltd. (SZSE:300248) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Newcapec Electronics

What Is Newcapec Electronics's Net Debt?

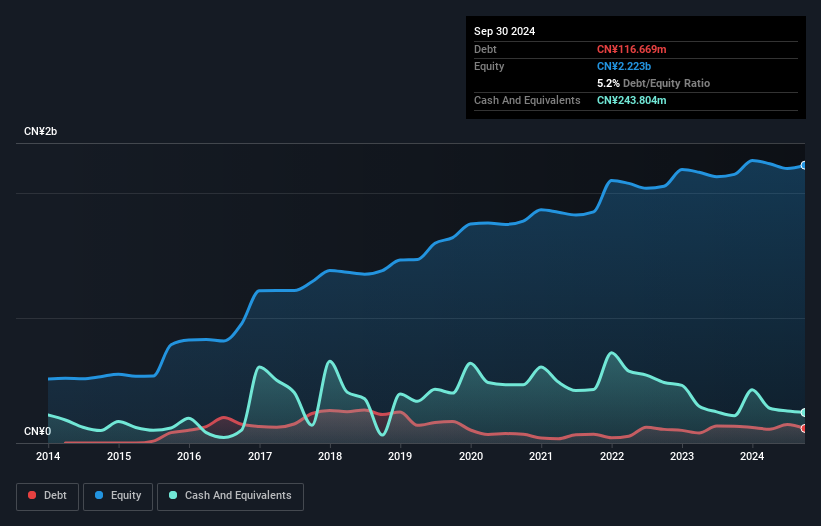

You can click the graphic below for the historical numbers, but it shows that Newcapec Electronics had CN¥116.7m of debt in September 2024, down from CN¥134.3m, one year before. However, it does have CN¥243.8m in cash offsetting this, leading to net cash of CN¥127.1m.

A Look At Newcapec Electronics' Liabilities

Zooming in on the latest balance sheet data, we can see that Newcapec Electronics had liabilities of CN¥349.6m due within 12 months and liabilities of CN¥56.9m due beyond that. Offsetting these obligations, it had cash of CN¥243.8m as well as receivables valued at CN¥776.9m due within 12 months. So it actually has CN¥614.2m more liquid assets than total liabilities.

This surplus suggests that Newcapec Electronics has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Newcapec Electronics boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Newcapec Electronics saw its EBIT drop by 5.7% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Newcapec Electronics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Newcapec Electronics has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Considering the last three years, Newcapec Electronics actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Newcapec Electronics has net cash of CN¥127.1m, as well as more liquid assets than liabilities. So we don't have any problem with Newcapec Electronics's use of debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Newcapec Electronics is showing 3 warning signs in our investment analysis , and 2 of those shouldn't be ignored...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Newcapec Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300248

Newcapec Electronics

Provides ICT solutions and services for smart campuses in the People’s Republic of China.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026