- China

- /

- Communications

- /

- SZSE:300213

Beijing Jiaxun Feihong Electrical Co., Ltd.'s (SZSE:300213) 31% Price Boost Is Out Of Tune With Earnings

Those holding Beijing Jiaxun Feihong Electrical Co., Ltd. (SZSE:300213) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, despite the strong performance over the last month, the full year gain of 6.9% isn't as attractive.

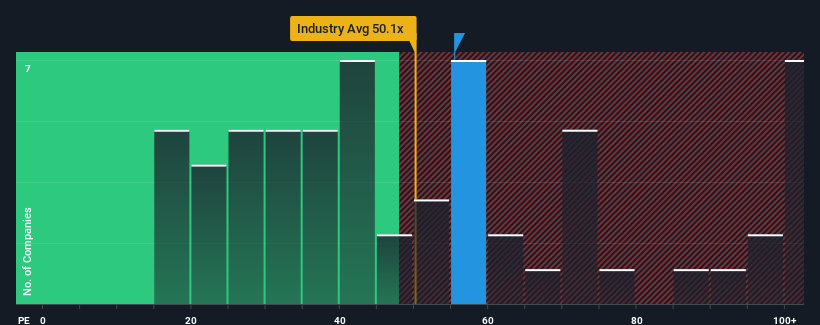

Following the firm bounce in price, Beijing Jiaxun Feihong Electrical's price-to-earnings (or "P/E") ratio of 55.4x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 30x and even P/E's below 18x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been pleasing for Beijing Jiaxun Feihong Electrical as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Beijing Jiaxun Feihong Electrical

What Are Growth Metrics Telling Us About The High P/E?

Beijing Jiaxun Feihong Electrical's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 55% decline in EPS over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 24% as estimated by the lone analyst watching the company. With the market predicted to deliver 42% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that Beijing Jiaxun Feihong Electrical is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

The strong share price surge has got Beijing Jiaxun Feihong Electrical's P/E rushing to great heights as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Beijing Jiaxun Feihong Electrical currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Beijing Jiaxun Feihong Electrical, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Beijing Jiaxun Feihong Electrical, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jiaxun Feihong Electrical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300213

Beijing Jiaxun Feihong Electrical

Beijing Jiaxun Feihong Electrical Co., Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives