- China

- /

- Electronic Equipment and Components

- /

- SZSE:300127

Chengdu Galaxy Magnets Co.,Ltd. (SZSE:300127) Not Lagging Market On Growth Or Pricing

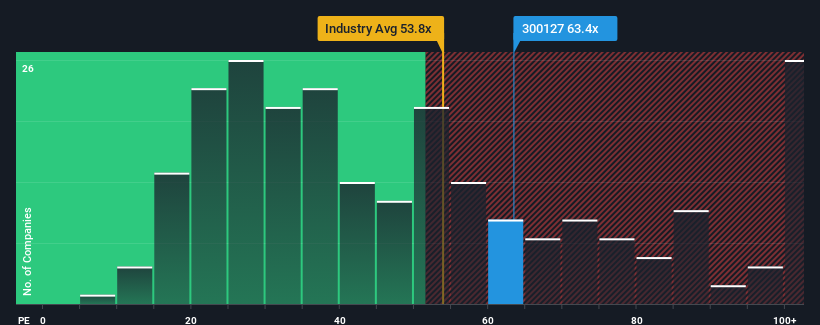

Chengdu Galaxy Magnets Co.,Ltd.'s (SZSE:300127) price-to-earnings (or "P/E") ratio of 63.4x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 38x and even P/E's below 21x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Chengdu Galaxy MagnetsLtd has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Chengdu Galaxy MagnetsLtd

How Is Chengdu Galaxy MagnetsLtd's Growth Trending?

In order to justify its P/E ratio, Chengdu Galaxy MagnetsLtd would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 26%. As a result, earnings from three years ago have also fallen 31% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 40% over the next year. That's shaping up to be materially higher than the 36% growth forecast for the broader market.

In light of this, it's understandable that Chengdu Galaxy MagnetsLtd's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Chengdu Galaxy MagnetsLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Chengdu Galaxy MagnetsLtd that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300127

Chengdu Galaxy MagnetsLtd

Engages in the research, development, production, and sales of a new generation of rare earth permanent magnets - bonded NdFeB rare earth magnet elements worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives