- China

- /

- Communications

- /

- SZSE:300394

Exploring Three High Growth Tech Stocks with Global Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed performances, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 showing gains amidst a backdrop of economic uncertainty and trade tensions impacting larger tech stocks. As investors navigate these turbulent waters, identifying high growth tech stocks with robust fundamentals and global potential becomes crucial for those looking to capitalize on emerging opportunities in the ever-evolving technology sector.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Pharma Mar | 23.66% | 40.07% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 46.06% | 66.78% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Wus Printed Circuit (Kunshan) (SZSE:002463)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wus Printed Circuit (Kunshan) Co., Ltd. specializes in the research, development, design, manufacture, and sale of printed circuit boards in China with a market capitalization of approximately CN¥52.49 billion.

Operations: The company generates the majority of its revenue from the sale of printed circuit boards, amounting to CN¥12.84 billion. Additional income streams include house sale income at CN¥4.69 million and property fee income at CN¥0.32 million.

Wus Printed Circuit (Kunshan) has demonstrated robust financial performance with a notable annual revenue growth rate of 18.8% and earnings expansion at 21.9% per year, outpacing the broader Chinese market's average. In the past year alone, earnings surged by an impressive 71.1%, significantly exceeding the electronic industry's growth of 7.3%. This upward trajectory is supported by substantial R&D investments aimed at fostering innovation and maintaining competitive advantage in the fast-evolving tech landscape. The company’s strategic focus on enhancing its technological capabilities is evident from its latest full-year results, reporting a jump in sales to CNY 13.34 billion from CNY 8.94 billion and a surge in net income to CNY 2.59 billion up from CNY 1.51 billion previously, signaling strong operational efficiency and market demand for its offerings.

- Unlock comprehensive insights into our analysis of Wus Printed Circuit (Kunshan) stock in this health report.

Gain insights into Wus Printed Circuit (Kunshan)'s past trends and performance with our Past report.

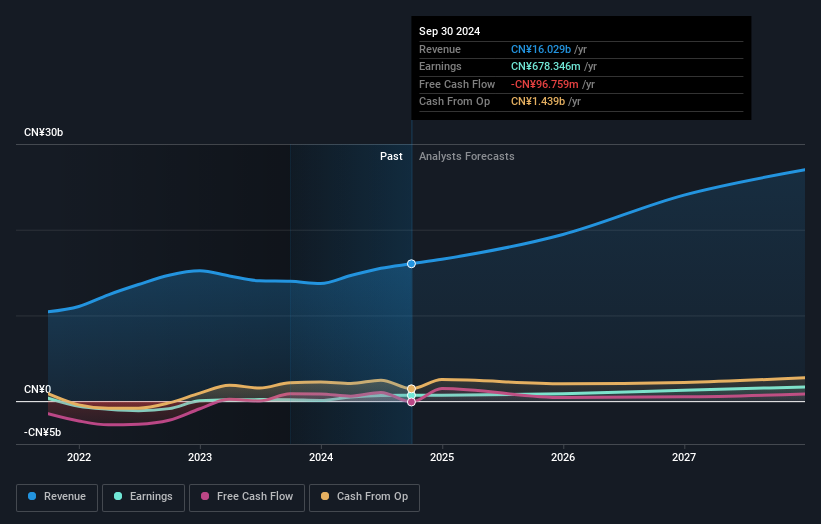

Shenzhen Everwin Precision Technology (SZSE:300115)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Everwin Precision Technology Co., Ltd. operates in the manufacturing sector, focusing on precision structural parts and modules for consumer electronics, new energy product components, and intelligent electronic product connectors, with a market cap of CN¥27.90 billion.

Operations: The company's primary revenue streams include precision structural parts and modules for consumer electronics, generating CN¥7.52 billion, and electronic connectors and precision small components for intelligent electronic products, contributing CN¥3.54 billion. Additionally, new energy product components and connectors add CN¥5.21 billion to the revenue mix.

Shenzhen Everwin Precision Technology has shown impressive growth, with its earnings skyrocketing by 800.2% over the past year, significantly outstripping the electronic industry's average of 7.3%. This surge is underpinned by a robust annual revenue increase of 15.1%, reflecting strong market demand and operational efficiency. The company's commitment to innovation is evident in its R&D investments, crucial for maintaining its competitive edge in a rapidly evolving sector. Additionally, recent announcements highlighted a substantial rise in yearly sales to CNY 16.92 billion and an eightfold increase in net income to CNY 768.74 million from just CNY 85.7 million previously, setting a positive tone for future prospects amidst high market expectations for continued profit growth at an annual rate of 27.5%.

- Get an in-depth perspective on Shenzhen Everwin Precision Technology's performance by reading our health report here.

Understand Shenzhen Everwin Precision Technology's track record by examining our Past report.

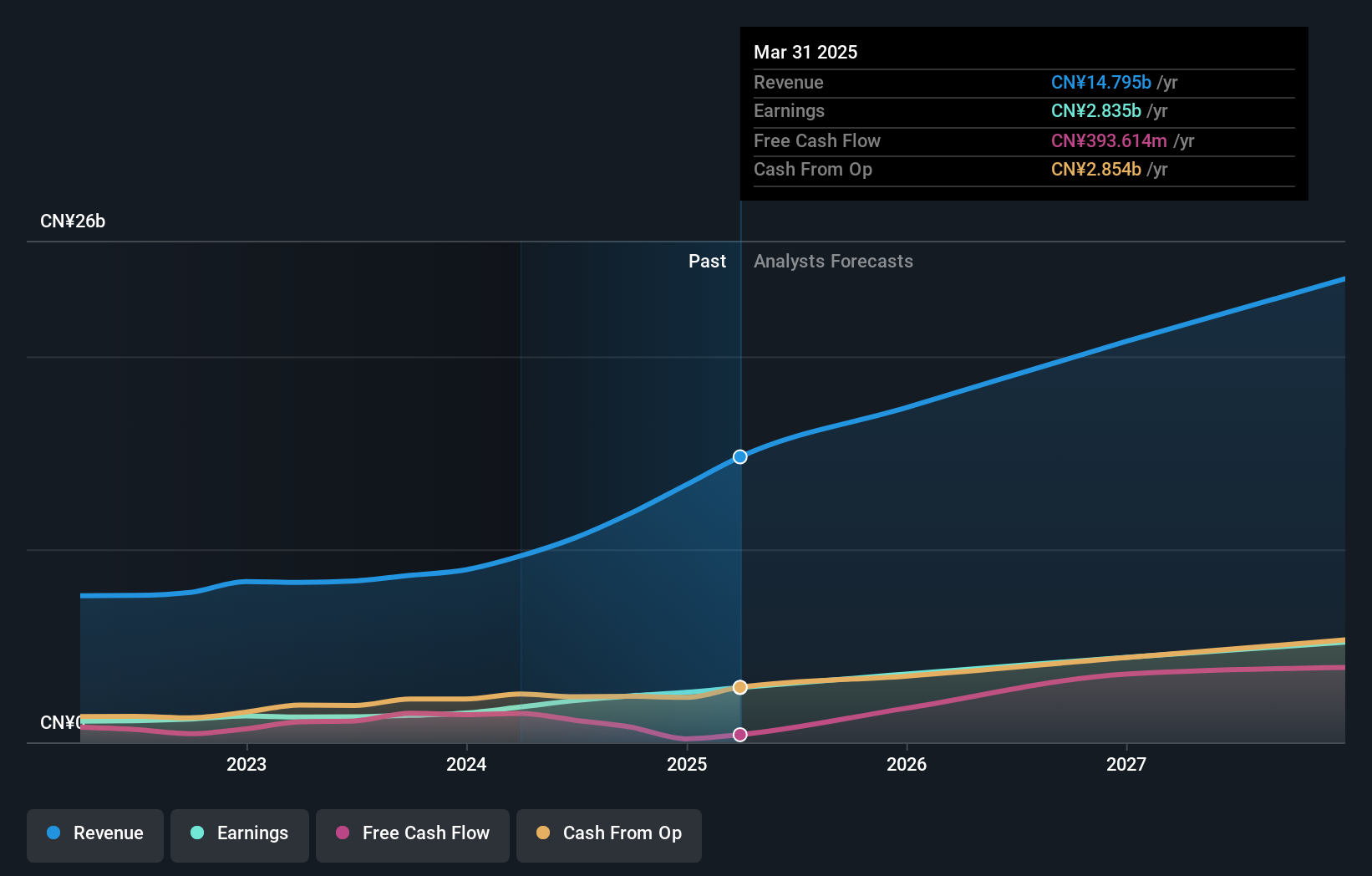

Suzhou TFC Optical Communication (SZSE:300394)

Simply Wall St Growth Rating: ★★★★★★

Overview: Suzhou TFC Optical Communication Co., Ltd. is a company with a market cap of CN¥37.39 billion, specializing in optical communication products and solutions.

Operations: The company generates revenue primarily from the sale of optical communication products and solutions. It focuses on delivering advanced technological offerings to meet the demands of its clientele.

Suzhou TFC Optical Communication has demonstrated robust growth, with a notable surge in sales from CNY 1.94 billion to CNY 3.25 billion and net income more than doubling to CNY 1.34 billion within the last fiscal year. This financial performance is complemented by strategic alliances, such as their recent partnership with OpenLight to enhance Silicon Photonics production—a move poised to bolster their position in the high-demand sectors of datacenter AI/ML and LiDAR sensing technologies. The company's commitment to R&D is evident, positioning them well for sustained innovation and market relevance in a rapidly evolving tech landscape.

Summing It All Up

- Gain an insight into the universe of 764 Global High Growth Tech and AI Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300394

Suzhou TFC Optical Communication

Provides optical communication devices in Mainland China and internationally.

Exceptional growth potential with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion