- China

- /

- Communications

- /

- SZSE:300098

There's Reason For Concern Over Gosuncn Technology Group Co., Ltd.'s (SZSE:300098) Massive 34% Price Jump

Gosuncn Technology Group Co., Ltd. (SZSE:300098) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

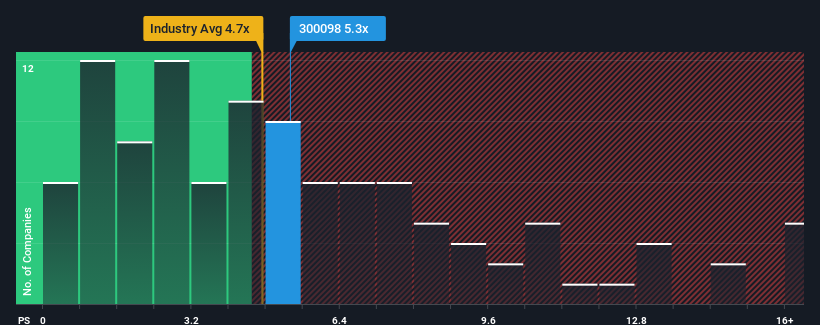

In spite of the firm bounce in price, there still wouldn't be many who think Gosuncn Technology Group's price-to-sales (or "P/S") ratio of 5.3x is worth a mention when the median P/S in China's Communications industry is similar at about 4.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Gosuncn Technology Group

What Does Gosuncn Technology Group's Recent Performance Look Like?

Gosuncn Technology Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Gosuncn Technology Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

Gosuncn Technology Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 19%. This means it has also seen a slide in revenue over the longer-term as revenue is down 33% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 31% during the coming year according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 42%, which is noticeably more attractive.

With this information, we find it interesting that Gosuncn Technology Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Gosuncn Technology Group's P/S

Gosuncn Technology Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that Gosuncn Technology Group's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Having said that, be aware Gosuncn Technology Group is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300098

Gosuncn Technology Group

Provides IoT products and services in China and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives