- China

- /

- Electronic Equipment and Components

- /

- SZSE:002975

Revenues Not Telling The Story For Zhuhai Bojay Electronics Co.,Ltd. (SZSE:002975) After Shares Rise 28%

Zhuhai Bojay Electronics Co.,Ltd. (SZSE:002975) shares have had a really impressive month, gaining 28% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.7% in the last twelve months.

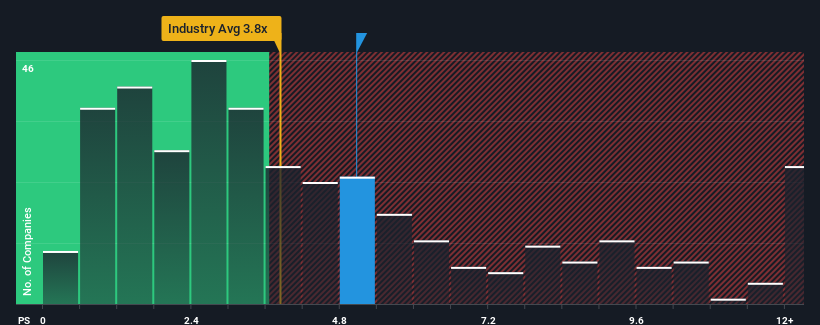

After such a large jump in price, when almost half of the companies in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.8x, you may consider Zhuhai Bojay ElectronicsLtd as a stock probably not worth researching with its 5.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Zhuhai Bojay ElectronicsLtd

How Zhuhai Bojay ElectronicsLtd Has Been Performing

As an illustration, revenue has deteriorated at Zhuhai Bojay ElectronicsLtd over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Zhuhai Bojay ElectronicsLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Zhuhai Bojay ElectronicsLtd?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Zhuhai Bojay ElectronicsLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 18% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Zhuhai Bojay ElectronicsLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Zhuhai Bojay ElectronicsLtd's P/S

Zhuhai Bojay ElectronicsLtd's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Zhuhai Bojay ElectronicsLtd currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 4 warning signs for Zhuhai Bojay ElectronicsLtd (2 don't sit too well with us!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Zhuhai Bojay ElectronicsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhuhai Bojay ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002975

Zhuhai Bojay ElectronicsLtd

Engages in the research and development, production, sale, and technical services of industrial automation, intelligent equipment, and system solutions in China and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives