- China

- /

- Electronic Equipment and Components

- /

- SHSE:688112

High Growth Tech Stocks In Asia With Promising Potential

Reviewed by Simply Wall St

Amidst a backdrop of rising indices and economic shifts, the Asian tech sector has shown resilience, particularly as mainland Chinese markets experienced notable gains driven by technology-focused shares. In this dynamic environment, identifying high growth potential in tech stocks involves assessing factors such as innovation capacity and alignment with regional economic policies aimed at enhancing technological self-reliance.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 24.08% | 28.54% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 36.03% | 47.77% | ★★★★★★ |

| Eoptolink Technology | 38.08% | 35.42% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi TechnologyLtd | 20.20% | 31.67% | ★★★★★★ |

| Shengyi Electronics | 23.62% | 31.31% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

DuoLun Technology (SHSE:603528)

Simply Wall St Growth Rating: ★★★★★☆

Overview: DuoLun Technology Corporation Ltd. specializes in developing intelligent training, testing, and application systems for motor vehicle drivers in China, with a market cap of CN¥6.14 billion.

Operations: The company generates revenue primarily from its electronic security devices segment, contributing CN¥410.06 million.

DuoLun Technology, amidst a challenging landscape, reported a significant revenue drop to CNY 200.35 million from last year’s CNY 312.93 million, reflecting broader market conditions rather than isolated incidents. Despite current unprofitability, the company is poised for a robust turnaround with expected annual profit growth of 66.3% and revenue acceleration at 27% per year, outpacing the Chinese market average of 14.1%. This growth trajectory is supported by substantial R&D investments aimed at driving innovation and securing competitive advantages in high-growth tech sectors in Asia. With earnings calls indicating strategic adjustments and an optimistic outlook for profitability within three years, DuoLun's focus on expanding its technological capabilities could well redefine its market standing.

- Unlock comprehensive insights into our analysis of DuoLun Technology stock in this health report.

Understand DuoLun Technology's track record by examining our Past report.

Siglent TechnologiesLtd (SHSE:688112)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Siglent Technologies Co., Ltd. is engaged in the research, development, production, sales, and servicing of electronic test and measurement equipment both in China and internationally, with a market cap of CN¥6.21 billion.

Operations: Siglent Technologies Co., Ltd. generates revenue through the sale and servicing of electronic test and measurement equipment, catering to both domestic and international markets. The company's financial performance is characterized by its focus on innovation in product development within the electronics sector.

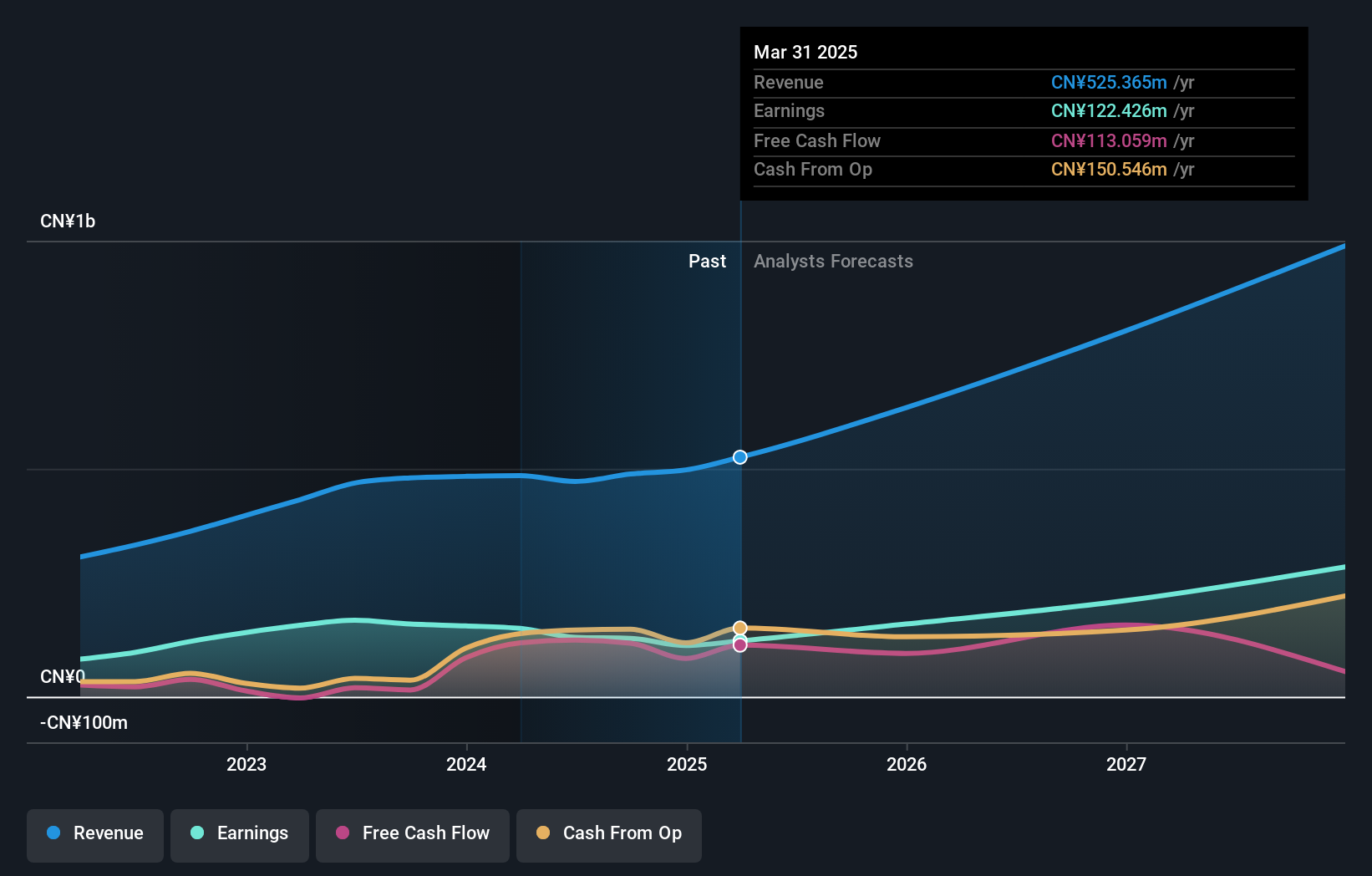

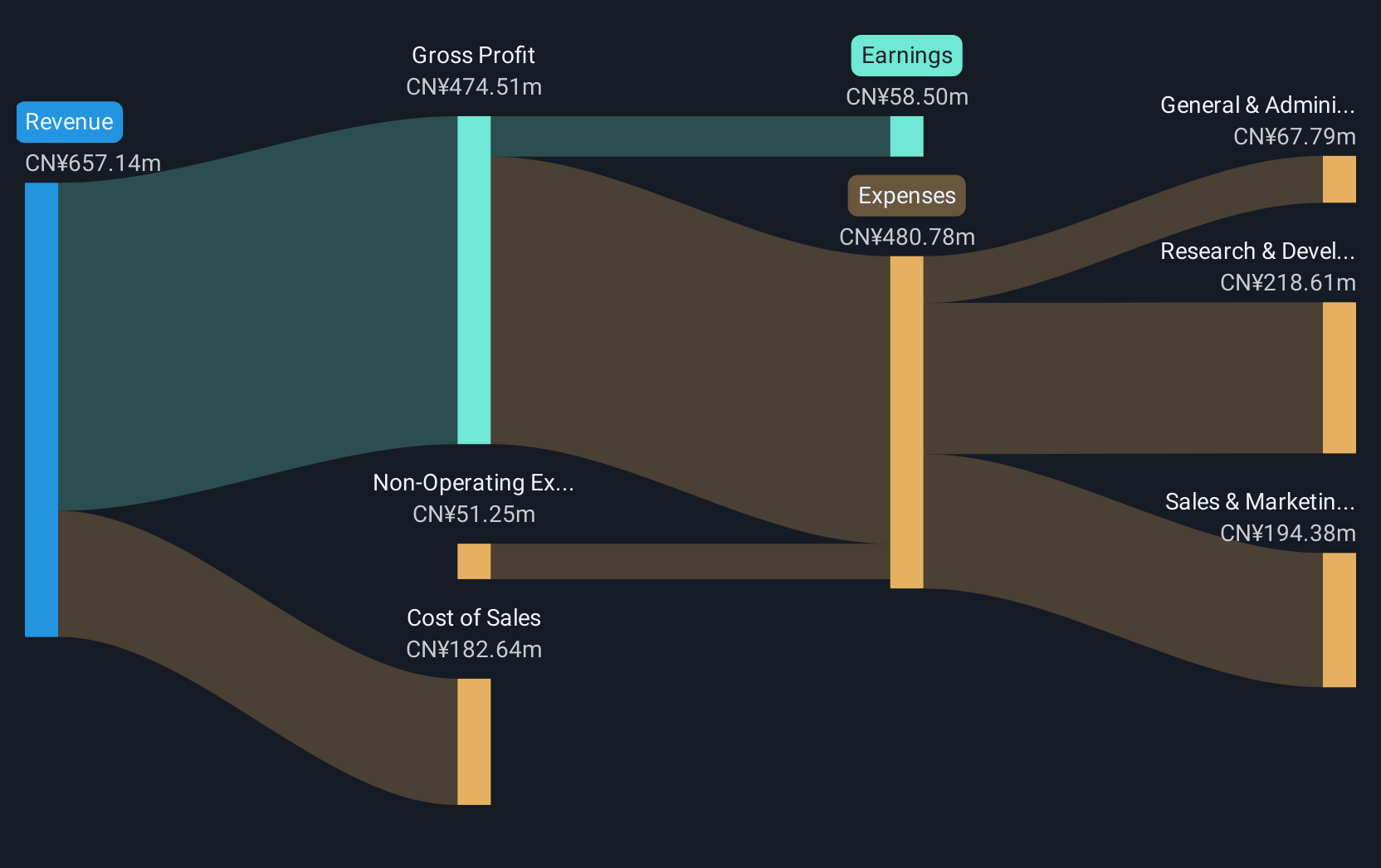

Siglent Technologies, a key player in Asia's tech sector, has demonstrated robust financial growth with a 22.4% annual increase in revenue and an impressive 28.8% rise in earnings per year. This performance is underpinned by significant R&D investments, which have been crucial for maintaining its competitive edge in the rapidly evolving tech landscape. The company recently reported first-half sales of CNY 274.19 million, up from CNY 219.73 million the previous year, with net income also rising to CNY 76.88 million from CNY 58.44 million, indicating strong operational efficiency and market adaptation strategies despite global economic uncertainties.

Shenzhen Sinovatio Technology (SZSE:002912)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sinovatio Technology Co., Ltd. specializes in network visualization, data and network security, and big data analysis, with a market cap of CN¥5.22 billion.

Operations: Sinovatio Technology focuses on network visualization, data security, and big data applications. The company's revenue streams are primarily derived from these specialized technological services.

Shenzhen Sinovatio Technology has pivoted towards profitability this year, with a notable 16.2% annual revenue growth outpacing the Chinese market's 14.1%. This growth is complemented by a projected earnings increase of 40.5% annually, significantly above the market average of 26.4%. Recent restructuring efforts and amendments to company bylaws underscore its adaptability in a competitive tech landscape. Moreover, its commitment to R&D is evident from recent financial reports, positioning it well for sustained innovation and market relevance in Asia’s tech sector.

Summing It All Up

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 182 more companies for you to explore.Click here to unveil our expertly curated list of 185 Asian High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688112

Siglent TechnologiesLtd

Researches, develops, produces, sells, and services electronic test and measurement equipment in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives