As global markets navigate the early days of 2025, U.S. stocks are reaching new heights, buoyed by optimism surrounding potential trade negotiations and a burgeoning interest in artificial intelligence investments. Amid this backdrop of political developments and economic shifts, identifying high-growth tech stocks requires a focus on companies with strong innovation capabilities and exposure to emerging technologies that align with current market enthusiasm.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.13% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Megacable Holdings S. A. B. de C. V (BMV:MEGA CPO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Megacable Holdings S. A. B. de C. V., along with its subsidiaries, focuses on the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems and has a market cap of MX$32 billion.

Operations: Megacable Holdings generates revenue primarily through its cable television, internet, and telephone services. The company operates within the telecommunications sector, focusing on providing comprehensive signal distribution systems.

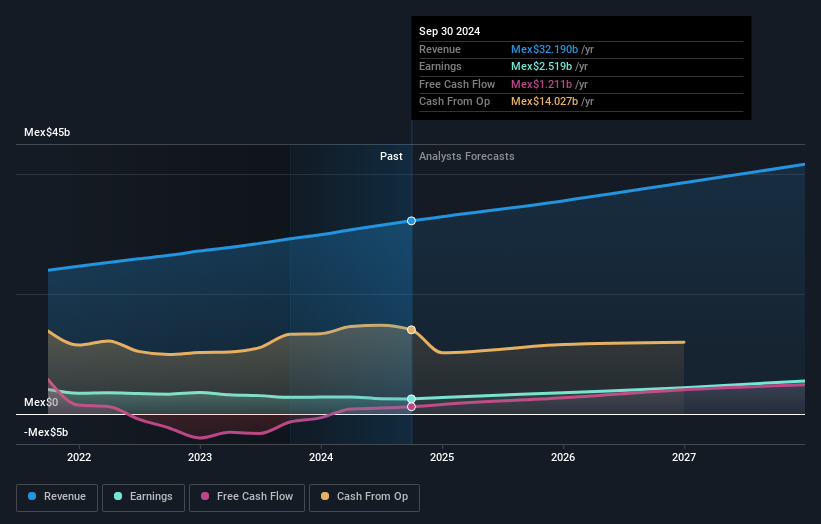

Megacable Holdings, a player in the telecommunications sector, is navigating a challenging landscape with mixed financial indicators. Despite a revenue growth forecast of 8% per year outpacing the Mexican market average of 7.2%, the company has faced a recent downturn with earnings decreasing by 9.1% last year compared to the industry's decline of 3.7%. However, looking ahead, MEGA CPO shows promise with an expected earnings growth rate of 25% annually, significantly above Mexico's market projection of 12%. This growth is underpinned by substantial R&D investments aimed at innovation and staying competitive in a rapidly evolving tech landscape. Yet, challenges remain as interest payments are not well covered by earnings, hinting at potential financial strain.

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CanSino Biologics Inc. is engaged in the development, manufacturing, and commercialization of vaccines in China with a market capitalization of approximately HK$11.06 billion.

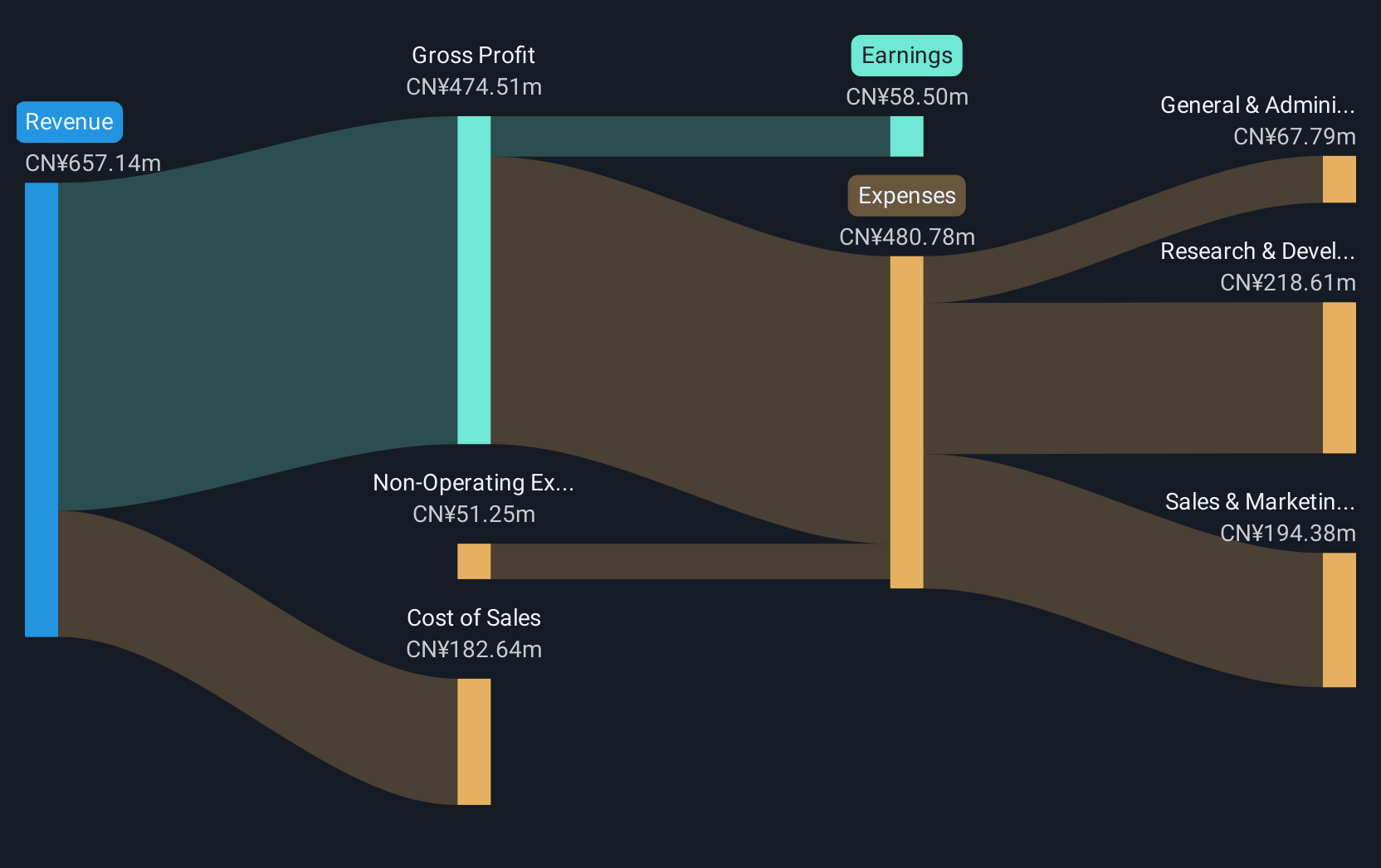

Operations: The company focuses on the research and development of vaccine products for human use, generating revenue from this segment amounting to CN¥748.53 million.

CanSino Biologics, amid a challenging yet opportunistic landscape, is steering towards enhancing its vaccine portfolio with significant strides in R&D and commercialization. Recently, the company projected a revenue between RMB 825 million and RMB 865 million for 2024, despite anticipating a net loss of up to RMB 385 million. These figures underscore CanSino's aggressive expansion in vaccine development, particularly highlighted by its exclusive Menhycia® vaccine gaining market traction. Notably, their strategic international registrations and clinical advancements signify robust efforts to capture global markets. This approach not only diversifies their revenue streams but also solidifies their standing in the high-stakes biotech sector.

- Click here to discover the nuances of CanSino Biologics with our detailed analytical health report.

Gain insights into CanSino Biologics' past trends and performance with our Past report.

Shenzhen Sinovatio Technology (SZSE:002912)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sinovatio Technology Co., Ltd. specializes in network visualization, data and network security, big data analysis and application, with a market capitalization of CN¥4.36 billion.

Operations: Sinovatio focuses on providing solutions in network visualization, data and network security, and big data analysis. The company generates revenue primarily from these technological services.

Shenzhen Sinovatio Technology has demonstrated resilience despite recent challenges, including its removal from the S&P Global BMI Index. The company's revenue growth forecast at 23.9% annually outpaces the Chinese market average of 13.4%, signaling robust potential in its tech segment. Although currently unprofitable with a notable net loss of CNY 46.96 million for the nine months ending September 2024, Sinovatio is expected to turn profitable within three years, supported by a strong revenue base and strategic initiatives aimed at reversing recent downturns. This turnaround is underpinned by an aggressive R&D focus, which continues to fuel innovations essential for future growth in competitive tech landscapes.

- Dive into the specifics of Shenzhen Sinovatio Technology here with our thorough health report.

Learn about Shenzhen Sinovatio Technology's historical performance.

Next Steps

- Get an in-depth perspective on all 1226 High Growth Tech and AI Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:MEGA CPO

Megacable Holdings S. A. B. de C. V

Engages in the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion