- China

- /

- Electronic Equipment and Components

- /

- SZSE:002902

Take Care Before Diving Into The Deep End On Dongguan Mentech Optical & Magnetic Co., Ltd. (SZSE:002902)

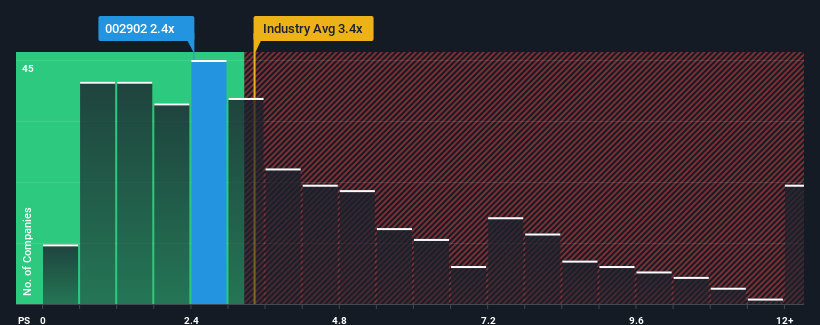

You may think that with a price-to-sales (or "P/S") ratio of 2.4x Dongguan Mentech Optical & Magnetic Co., Ltd. (SZSE:002902) is a stock worth checking out, seeing as almost half of all the Electronic companies in China have P/S ratios greater than 3.4x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Dongguan Mentech Optical & Magnetic

What Does Dongguan Mentech Optical & Magnetic's Recent Performance Look Like?

Dongguan Mentech Optical & Magnetic hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Dongguan Mentech Optical & Magnetic will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Dongguan Mentech Optical & Magnetic's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. This means it has also seen a slide in revenue over the longer-term as revenue is down 6.4% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 40% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Dongguan Mentech Optical & Magnetic's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Dongguan Mentech Optical & Magnetic's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Dongguan Mentech Optical & Magnetic that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002902

Dongguan Mentech Optical & Magnetic

Dongguan Mentech Optical & Magnetic Co., Ltd.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives