- China

- /

- Electronic Equipment and Components

- /

- SHSE:603528

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and a cautious Federal Reserve approach, small-cap stocks have faced increased pressure, with large-caps showing more resilience and growth stocks outperforming value counterparts. In this environment, identifying high-growth tech stocks requires careful consideration of their potential to thrive amid shifting economic indicators and broader market sentiment, making them intriguing options for investors looking to capitalize on technological advancements despite current challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

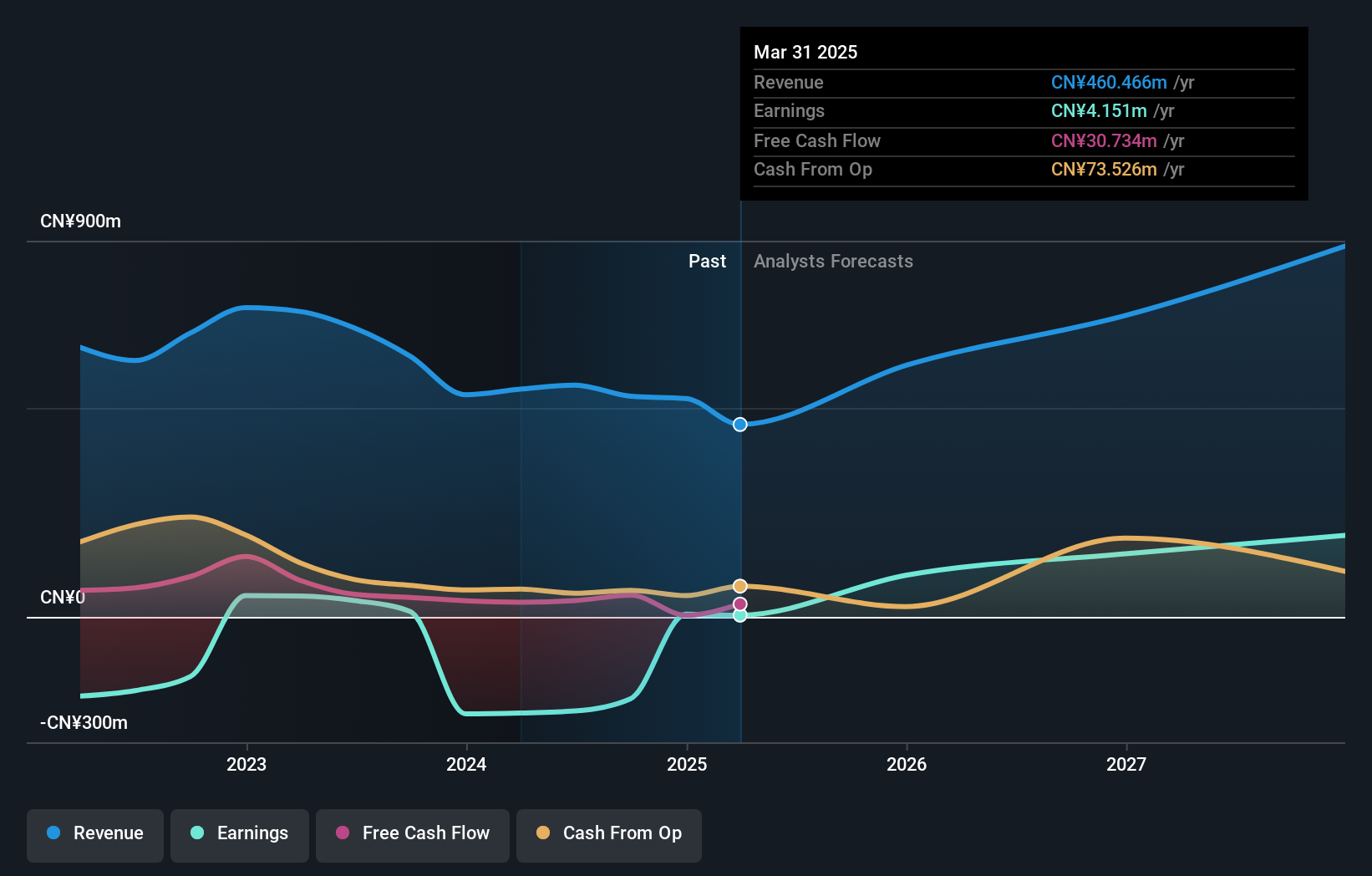

DuoLun Technology (SHSE:603528)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DuoLun Technology Corporation Ltd. specializes in the development of intelligent training, testing, and application systems for motor vehicle drivers in China, with a market capitalization of CN¥5.74 billion.

Operations: The company focuses on creating advanced systems for driver training and testing in China. These systems form the core of its revenue model, catering to a market with significant demand for motor vehicle driver education and assessment solutions.

DuoLun Technology, despite its unprofitability, has demonstrated a robust revenue growth rate of 18.3% annually, surpassing the CN market average of 13.7%. This momentum is underpinned by significant R&D investments which are crucial for maintaining technological competitiveness in the rapidly evolving tech landscape. The company's recent earnings report highlighted a substantial increase in net income to CNY 42 million from CNY 5.88 million year-over-year, reflecting effective cost management and operational efficiency. Additionally, DuoLun's strategic inclusion in the S&P Global BMI Index and its active share repurchase program, completing the buyback of nearly 5 million shares for CNY 30.49 million, signal strong confidence in its future prospects and commitment to shareholder value. This financial trajectory is further complemented by forecasts predicting an impressive earnings growth of approximately 89.2% per annum. Looking ahead, DuoLun is expected to reach profitability within three years—a testament to its potential in capitalizing on innovative technologies and expanding market presence.

- Take a closer look at DuoLun Technology's potential here in our health report.

Examine DuoLun Technology's past performance report to understand how it has performed in the past.

CICT Mobile Communication Technology (SHSE:688387)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CICT Mobile Communication Technology Co., Ltd. operates in the mobile communication technology sector and has a market capitalization of CN¥22.22 billion.

Operations: CICT Mobile Communication Technology Co., Ltd. generates revenue primarily from its mobile communication technology products and services. The company's financial performance is driven by its ability to innovate within the sector, impacting its gross profit margin trends over time.

CICT Mobile Communication Technology, despite a challenging fiscal year with a net loss reduction to CNY 169.83 million from CNY 202.63 million, shows resilience. The company’s inclusion in the S&P Global BMI Index underscores its potential relevance in the tech sector, while R&D spending remains pivotal for future competitiveness, especially given its revenue forecast to grow by 15.3% annually—outpacing the CN market average of 13.7%. Moreover, earnings are expected to surge by an impressive 116.5% per year, signaling strong future prospects as it edges towards profitability within three years and enhances shareholder value through strategic initiatives like share repurchases and sustained investment in innovation.

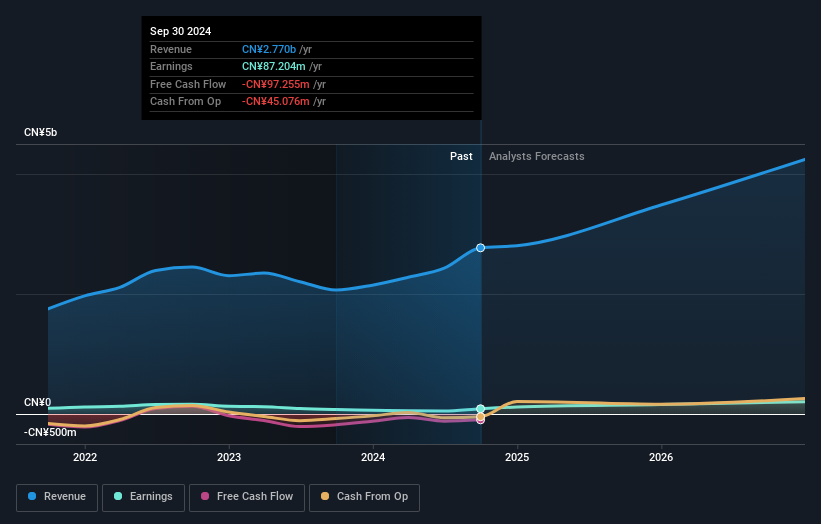

MeiG Smart Technology (SZSE:002881)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MeiG Smart Technology Co., Ltd. focuses on the research and development, production, and sale of Internet of Things terminals and wireless communication modules and solutions in China and internationally, with a market cap of CN¥6.65 billion.

Operations: The company generates revenue primarily from its wireless communication modules and solutions business, contributing CN¥2.29 billion. The focus on these products highlights the company's commitment to advancing connectivity technology both domestically and internationally.

MeiG Smart Technology has demonstrated robust growth with a notable 22.2% annual increase in revenue, outstripping the broader Chinese market's 13.7% expansion. This surge is supported by strategic R&D investments, which are not just substantial but pivotal, amounting to a significant portion of their revenue stream—ensuring MeiG stays at the forefront of innovation in communications technology. Moreover, the company's recent earnings report shows a rise in net income to CNY 91.36 million from CNY 68.66 million year-over-year, coupled with an aggressive share repurchase program that underscores confidence in its financial health and future prospects. These factors collectively highlight MeiG’s potential to maintain its trajectory amidst evolving tech landscapes.

- Click to explore a detailed breakdown of our findings in MeiG Smart Technology's health report.

Understand MeiG Smart Technology's track record by examining our Past report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1281 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603528

DuoLun Technology

Develops motor vehicle driver intelligent training, testing, and application systems in China.

Reasonable growth potential with adequate balance sheet.