Exploring None High Growth Tech Stocks with Promising Potential

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have put pressure on equities and led to a mixed performance across major indices. As the broader market navigates these dynamics, identifying high-growth tech stocks with promising potential involves looking for companies that can adapt to changing economic conditions and leverage technological advancements effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. operates in the high-tech sector with a market cap of CN¥12.13 billion.

Operations: Beijing Zhong Ke San Huan High-Tech Co., Ltd. focuses on the high-tech sector, primarily engaging in the production and sale of advanced materials and technologies. The company's revenue streams are diversified across various segments, contributing to its substantial market presence.

Despite a challenging year with a net loss reported in the recent earnings, Beijing Zhong Ke San Huan High-Tech remains committed to growth, as evidenced by its aggressive R&D spending. The company's R&D expenses have been substantial, aligning with its strategic focus on innovation in the high-tech sector. This investment is critical as it navigates through a 16.4% annual revenue growth forecast, slightly below the industry's rapid pace but still ahead of the broader Chinese market's 13.9% growth expectation. Moreover, an impressive projected annual profit surge of 82.8% underscores potential recovery and adaptation strategies that could redefine its market stance. Additionally, the recent completion of a share buyback program reflects confidence in its financial strategy and future prospects despite current setbacks.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market capitalization of CN¥20.85 billion.

Operations: The company generates revenue through its network security products, trusted security management platforms, and specialized security services. Its market capitalization is CN¥20.85 billion.

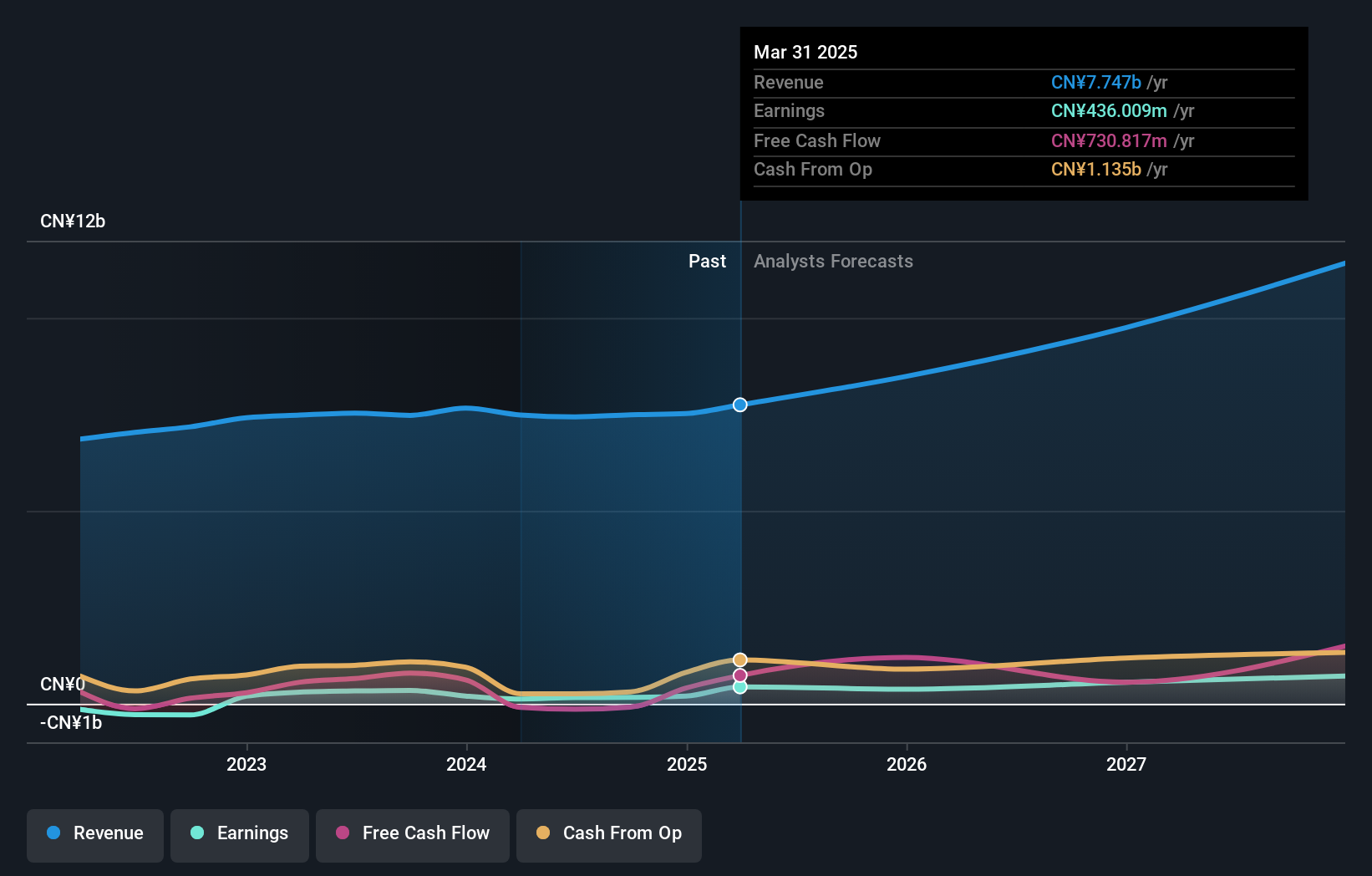

Despite recent setbacks, Venustech Group's commitment to innovation is evident in its R&D spending, which remains robust at 37.3% of revenue. This investment underscores a strategic focus on developing cutting-edge technologies despite a challenging financial period marked by a net loss of CNY 210.07 million for the nine months ending September 2024. Looking ahead, with revenue growth projected at 18.4% annually—outpacing the broader Chinese market—the company is poised for recovery, leveraging its technological advancements and market responsiveness to navigate future challenges effectively.

- Get an in-depth perspective on Venustech Group's performance by reading our health report here.

Examine Venustech Group's past performance report to understand how it has performed in the past.

Sangfor Technologies (SZSE:300454)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sangfor Technologies Inc. offers IT infrastructure solutions both in China and internationally, with a market cap of CN¥27.21 billion.

Operations: The company generates revenue through its IT infrastructure solutions, focusing on cybersecurity, cloud computing, and network optimization. It operates in both domestic and international markets.

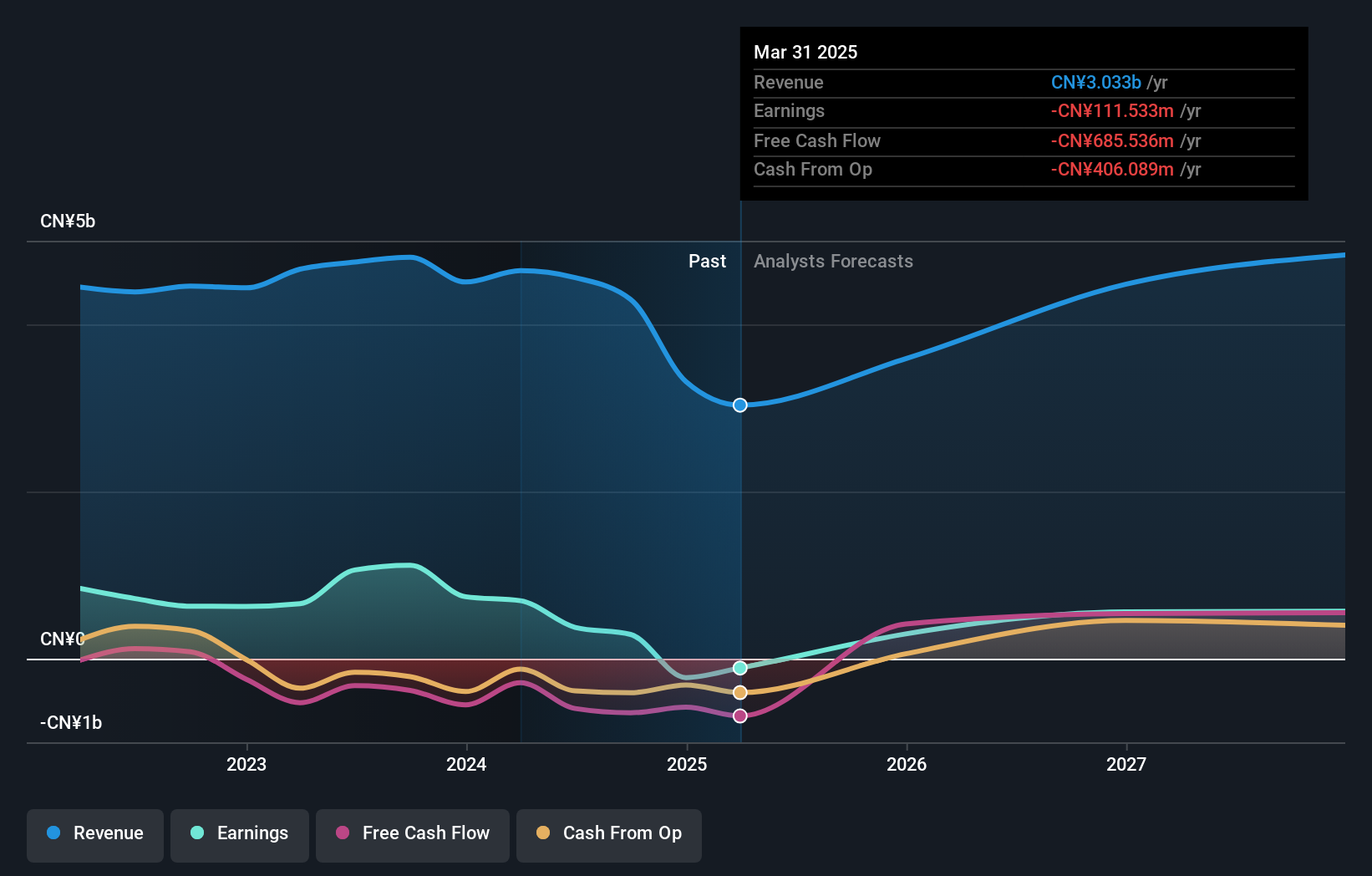

Sangfor Technologies has been navigating a challenging financial landscape, evident from its recent earnings reports showing a net loss increase to CNY 579.66 million from CNY 545.58 million year-over-year for the nine months ending September 2024. Despite these setbacks, the company's commitment to innovation remains strong, with R&D expenses accounting for a significant portion of revenue at 15.1%. This investment is critical as it supports Sangfor's growth trajectory in the competitive tech sector, where it aims to leverage its advancements in software and AI technologies to reverse current trends and capitalize on projected annual earnings growth of 33.7%.

Turning Ideas Into Actions

- Gain an insight into the universe of 1279 High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300454

Sangfor Technologies

Provides IT infrastructure solutions in China and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives