- China

- /

- Electronic Equipment and Components

- /

- SZSE:002876

Exploring High Growth Tech Stocks In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are experiencing a mixed bag of economic indicators, with U.S. consumer confidence seeing a decline and major stock indexes showing moderate gains despite some mid-week pullbacks. In this environment, high growth tech stocks continue to capture investor interest due to their potential for innovation and market disruption, making them attractive considerations for those seeking opportunities in sectors that may thrive amid changing economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

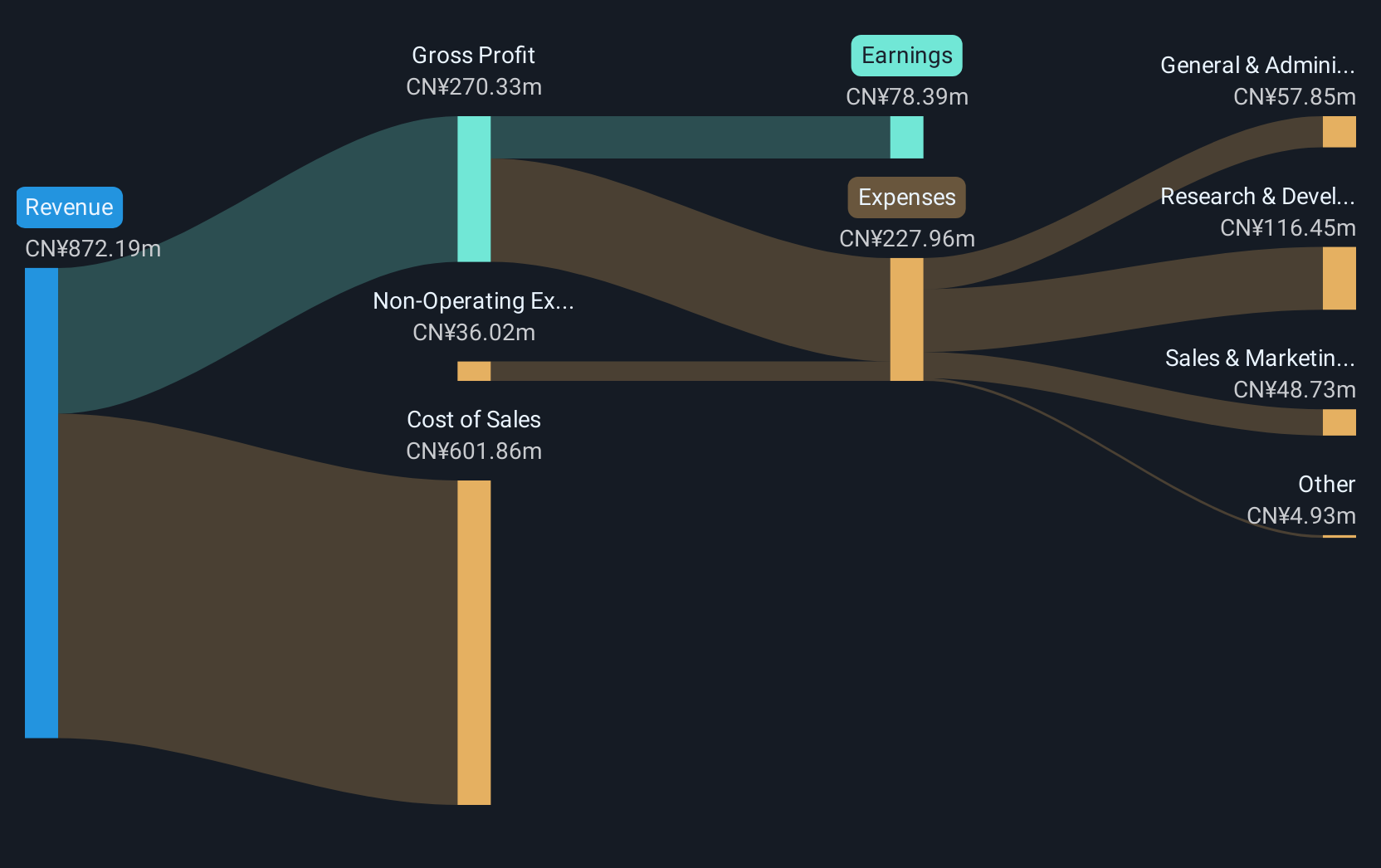

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen SEICHI Technologies Co., Ltd. specializes in the research, development, production, and sale of new display device testing equipment in China with a market capitalization of CN¥7.22 billion.

Operations: SEICHI Technologies focuses on the development and sale of innovative testing equipment for display devices in China. The company's revenue is derived primarily from its specialized products tailored to the display technology sector.

Shenzhen SEICHI Technologies, amidst a volatile market, reports a promising revenue growth rate of 29.1% annually, outpacing the Chinese market's average of 13.7%. This surge is shadowed by an impressive forecast in earnings growth at 42.6% per year, significantly higher than the market expectation of 25.4%. However, it's important to note a recent dip in profit margins from 20% to 13.3%, reflecting some operational challenges despite high revenue upticks and strategic share repurchases totaling CNY 44.76 million this year. The firm's commitment to innovation and expansion is evident from its recent extraordinary shareholders meeting and continuous earnings calls that keep stakeholders informed and engaged with its financial strategies and outlook.

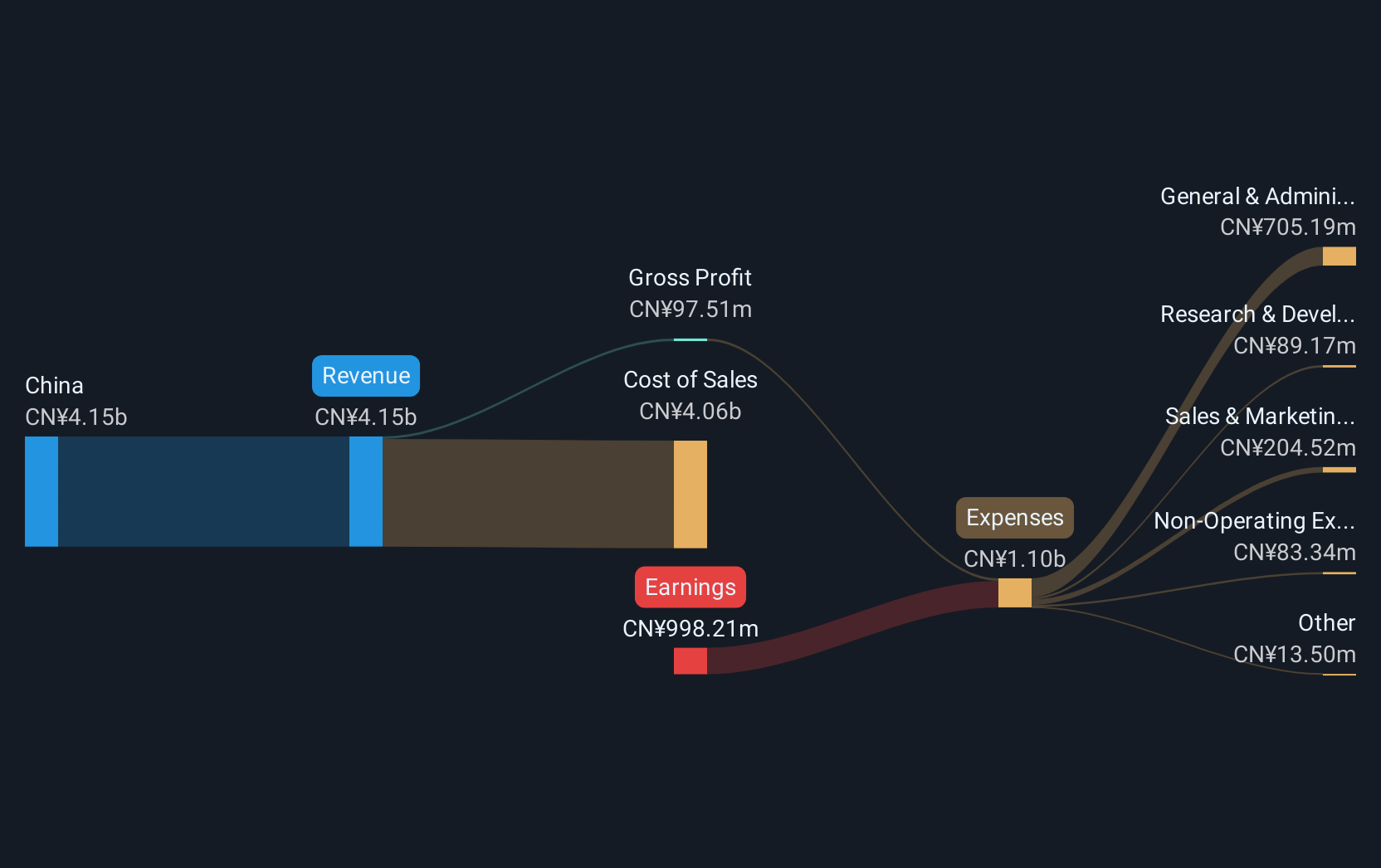

Foshan Yowant TechnologyLtd (SZSE:002291)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foshan Yowant Technology Co., Ltd operates in the digital marketing sector in China with a market capitalization of CN¥6.13 billion.

Operations: Foshan Yowant Technology Co., Ltd focuses on digital marketing services within China. The company generates revenue primarily through its digital marketing operations, which are central to its business model.

Foshan Yowant TechnologyLtd's trajectory in the tech landscape is marked by a robust annual revenue growth of 14.0%, slightly outpacing the broader Chinese market. Despite current unprofitability, projections indicate a significant turnaround with earnings expected to surge by 171.7% annually, positioning it for potential future profitability. This growth narrative is supported by substantial R&D investments, reflective of its commitment to innovation amidst operational challenges evidenced by a net loss reduction from CNY 449.61 million to CNY 408.29 million year-over-year. The company's strategic focus was also highlighted in their recent extraordinary shareholders meeting aimed at reinforcing financial strategies and audit processes, underscoring its proactive approach in governance and fiscal management.

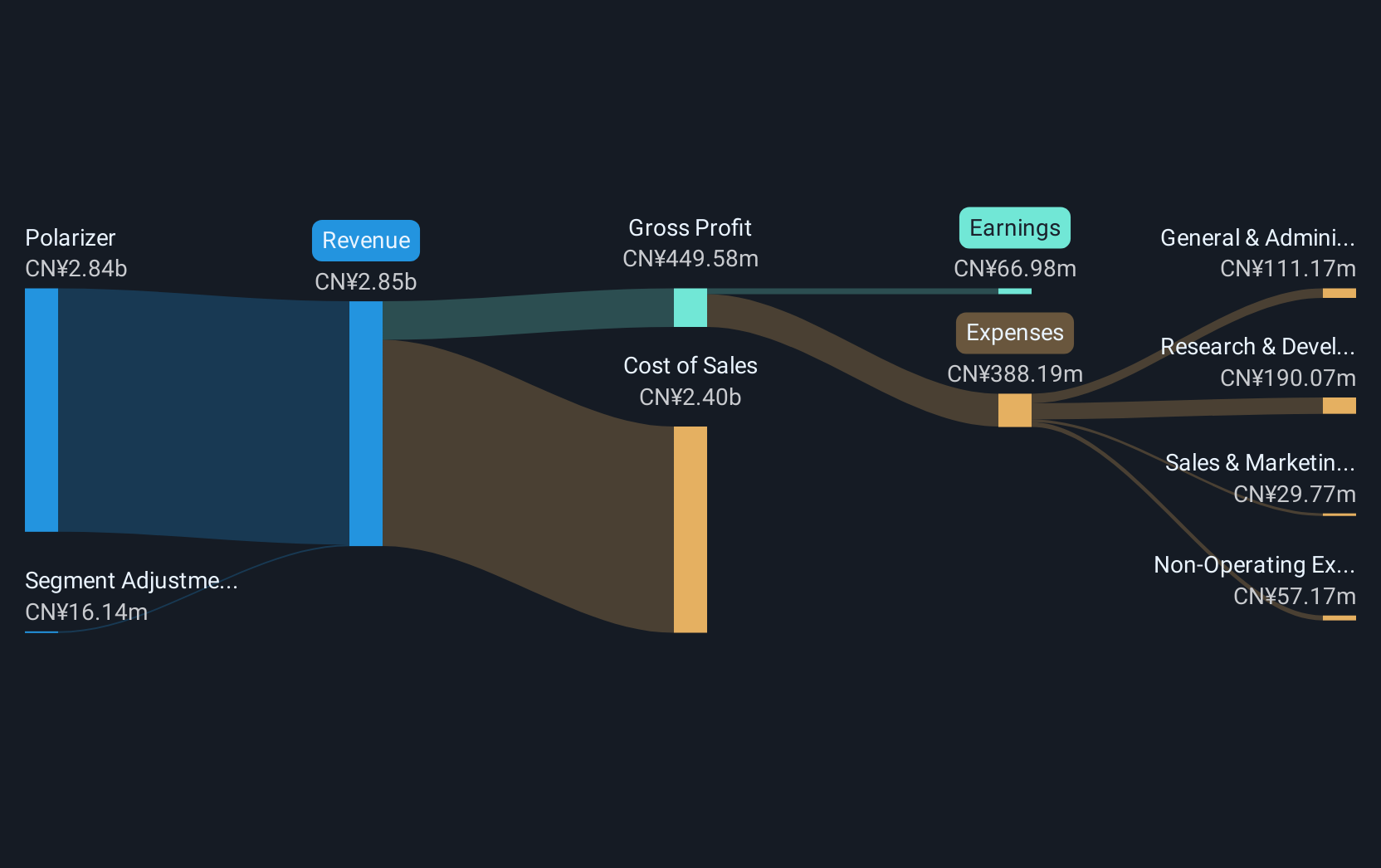

Shenzhen Sunnypol OptoelectronicsLtd (SZSE:002876)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Sunnypol Optoelectronics Co., Ltd. focuses on the production and sale of optoelectronic components, with a market capitalization of CN¥4.60 billion.

Operations: Sunnypol Optoelectronics derives its revenue primarily from the sale of polarizers, contributing approximately CN¥2.39 billion.

Shenzhen Sunnypol Optoelectronics has demonstrated robust growth with a 32.6% annual increase in revenue, outpacing the Chinese market average of 13.7%. This financial vitality is further underscored by an earnings surge of 60% annually, reflecting significant operational efficiency and market demand. Notably, the company's commitment to innovation is evident from its R&D spending which aligns closely with its revenue uptick, ensuring sustained advancements in optoelectronic technologies. Recent earnings reports highlight a jump in net income to CNY 64.74 million from CNY 58.39 million year-over-year, signaling strong profitability amidst competitive pressures.

Make It Happen

- Discover the full array of 1267 High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002876

Shenzhen Sunnypol OptoelectronicsLtd

Shenzhen Sunnypol Optoelectronics Co.,Ltd.

Reasonable growth potential with low risk.

Market Insights

Community Narratives