- China

- /

- Electronic Equipment and Components

- /

- SZSE:002849

There's Reason For Concern Over Zhejiang Viewshine Intelligent Meter Co.,Ltd's (SZSE:002849) Massive 30% Price Jump

Zhejiang Viewshine Intelligent Meter Co.,Ltd (SZSE:002849) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

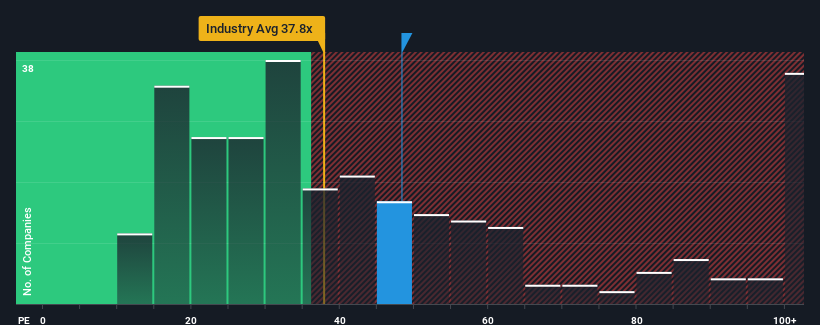

Since its price has surged higher, Zhejiang Viewshine Intelligent MeterLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 48.3x, since almost half of all companies in China have P/E ratios under 30x and even P/E's lower than 18x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Zhejiang Viewshine Intelligent MeterLtd has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Zhejiang Viewshine Intelligent MeterLtd

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Zhejiang Viewshine Intelligent MeterLtd's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 2.6%. However, this wasn't enough as the latest three year period has seen an unpleasant 24% overall drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 41% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Zhejiang Viewshine Intelligent MeterLtd is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Zhejiang Viewshine Intelligent MeterLtd's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Zhejiang Viewshine Intelligent MeterLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Zhejiang Viewshine Intelligent MeterLtd has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on Zhejiang Viewshine Intelligent MeterLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhejiang Viewshine Intelligent MeterLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002849

Zhejiang Viewshine Intelligent MeterLtd

Engages in the research, development, production, and sale of ultrasonic gas and water meters in China and internationally.

Excellent balance sheet with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion