- China

- /

- Electronic Equipment and Components

- /

- SZSE:002819

Not Many Are Piling Into Beijing Oriental Jicheng Co., Ltd. (SZSE:002819) Stock Yet As It Plummets 28%

Beijing Oriental Jicheng Co., Ltd. (SZSE:002819) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 17% in that time.

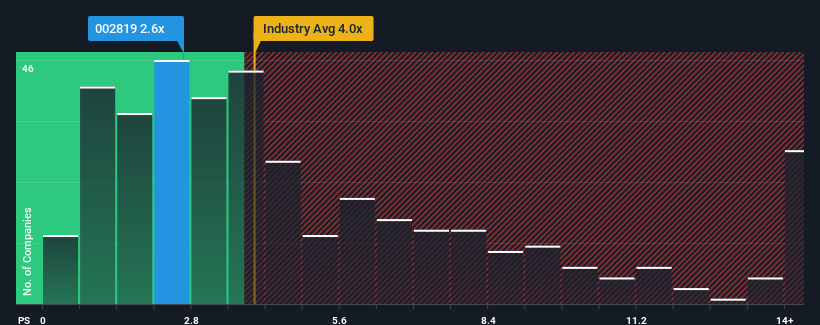

After such a large drop in price, Beijing Oriental Jicheng may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.6x, since almost half of all companies in the Electronic industry in China have P/S ratios greater than 4x and even P/S higher than 8x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing Oriental Jicheng

How Beijing Oriental Jicheng Has Been Performing

As an illustration, revenue has deteriorated at Beijing Oriental Jicheng over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Beijing Oriental Jicheng will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beijing Oriental Jicheng's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Beijing Oriental Jicheng would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 103% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 26% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that Beijing Oriental Jicheng's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What Does Beijing Oriental Jicheng's P/S Mean For Investors?

Beijing Oriental Jicheng's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Beijing Oriental Jicheng revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. medium-term

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Beijing Oriental Jicheng with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Oriental Jicheng might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002819

Beijing Oriental Jicheng

Engages in the testing technology and service-related businesses in China.

Excellent balance sheet and good value.

Market Insights

Community Narratives