- China

- /

- Electronic Equipment and Components

- /

- SZSE:002819

Even With A 32% Surge, Cautious Investors Are Not Rewarding Beijing Oriental Jicheng Co., Ltd.'s (SZSE:002819) Performance Completely

Beijing Oriental Jicheng Co., Ltd. (SZSE:002819) shares have had a really impressive month, gaining 32% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.8% in the last twelve months.

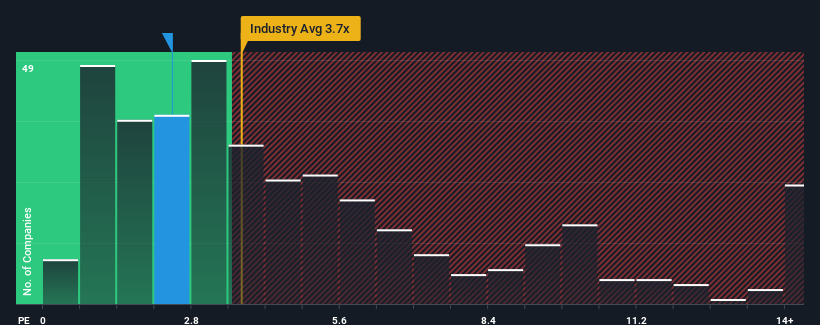

In spite of the firm bounce in price, Beijing Oriental Jicheng may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.4x, since almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.7x and even P/S higher than 7x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Beijing Oriental Jicheng

What Does Beijing Oriental Jicheng's Recent Performance Look Like?

Recent times have been quite advantageous for Beijing Oriental Jicheng as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Beijing Oriental Jicheng will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Beijing Oriental Jicheng will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Beijing Oriental Jicheng?

In order to justify its P/S ratio, Beijing Oriental Jicheng would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. The latest three year period has also seen an excellent 222% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 25%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Beijing Oriental Jicheng's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Beijing Oriental Jicheng's P/S

Despite Beijing Oriental Jicheng's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Beijing Oriental Jicheng currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 2 warning signs for Beijing Oriental Jicheng that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Oriental Jicheng might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002819

Beijing Oriental Jicheng

Engages in the testing technology and service-related businesses in China.

Excellent balance sheet and good value.

Market Insights

Community Narratives