- China

- /

- Electronic Equipment and Components

- /

- SZSE:002655

Undiscovered Gems in Asia to Explore This March 2025

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, including trade tensions and inflationary pressures, Asian markets present a unique landscape where small-cap stocks often remain under the radar. In this environment, identifying promising stocks involves looking for companies with robust fundamentals and growth potential that can navigate these complex conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.60% | 4.56% | 15.25% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 4.34% | 5.54% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Saha-Union | 0.99% | 0.02% | 12.48% | ★★★★★★ |

| Toukei Computer | NA | 5.67% | 12.77% | ★★★★★★ |

| HIMACS | NA | 3.47% | 10.31% | ★★★★★★ |

| Tibet Development | 51.47% | -1.07% | 56.62% | ★★★★★★ |

| Kondotec | 11.26% | 7.01% | 7.06% | ★★★★★☆ |

| Unitech Printed Circuit Board | 50.12% | -1.25% | 11.55% | ★★★★★☆ |

| GENOVA | 0.46% | 25.48% | 27.29% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Dong Feng Electronic TechnologyLtd (SHSE:600081)

Simply Wall St Value Rating: ★★★★★★

Overview: Dong Feng Electronic Technology Co., Ltd. focuses on manufacturing and selling automotive parts and accessories in China, with a market capitalization of CN¥7.73 billion.

Operations: The company generates revenue primarily from its automotive parts and accessories segment. It has a market capitalization of CN¥7.73 billion, reflecting its financial standing in the industry.

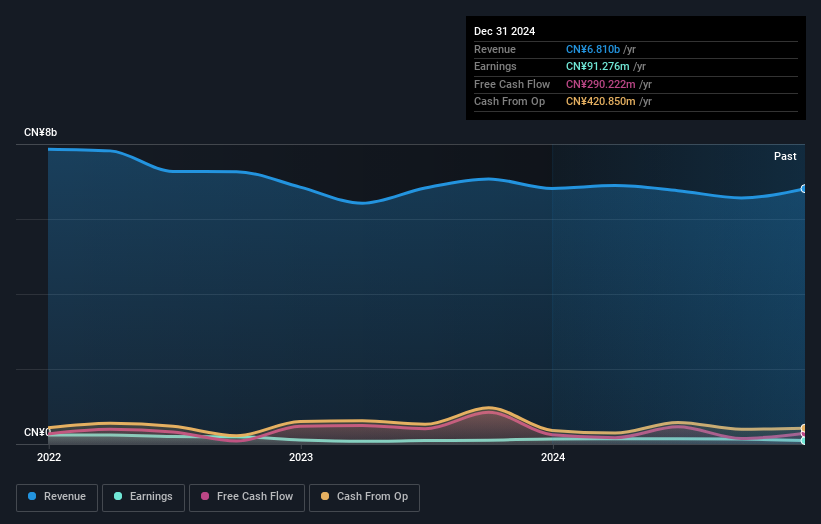

Dong Feng Electronic Technology Ltd., a small player in the auto components sector, has demonstrated notable earnings growth of 27.1% over the past year, outpacing the industry average of 11.6%. Despite this positive trajectory, earnings have seen a modest annual decline of 1.1% over five years. The company's financials were recently influenced by a significant one-off gain of CN¥75M, which could skew perceptions of its profitability quality. With more cash than total debt and a reduced debt-to-equity ratio from 13.6% to 8.1% over five years, Dong Feng seems financially robust despite recent share price volatility.

Gettop Acoustic (SZSE:002655)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gettop Acoustic Co., Ltd. specializes in the research, development, production, and sale of micro-precision electro-acoustic components and assemblies in China, with a market capitalization of CN¥5.59 billion.

Operations: The company's revenue is primarily derived from the sale of micro-precision electro-acoustic components and assemblies. It focuses on research and development to enhance its product offerings, impacting its cost structure.

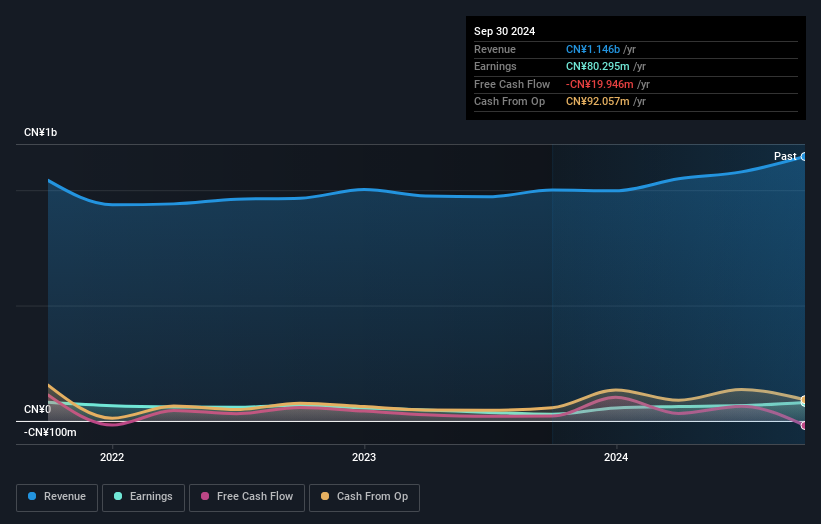

Gettop Acoustic, a promising player in the electronics sector, has shown impressive earnings growth of 180% over the past year, outpacing the industry's 4% average. The company's net debt to equity ratio stands at a satisfactory 24.8%, indicating prudent financial management. Interest payments are well covered by EBIT with a coverage of 19.5 times, showcasing robust operational efficiency. Despite these strengths, Gettop's free cash flow remains negative and its debt to equity ratio has risen from 46.6% to 50.2% over five years, suggesting room for improvement in financial leverage management as it navigates future opportunities and challenges within its industry landscape.

- Navigate through the intricacies of Gettop Acoustic with our comprehensive health report here.

Examine Gettop Acoustic's past performance report to understand how it has performed in the past.

Advanced Echem Materials (TPEX:4749)

Simply Wall St Value Rating: ★★★★★☆

Overview: Advanced Echem Materials Company Limited is a Taiwanese company that focuses on developing and manufacturing specialty chemical materials for semiconductor and display applications, with a market cap of NT$52.11 billion.

Operations: Advanced Echem Materials generates revenue primarily from its Electronic Components & Parts segment, which amounts to NT$3.32 billion.

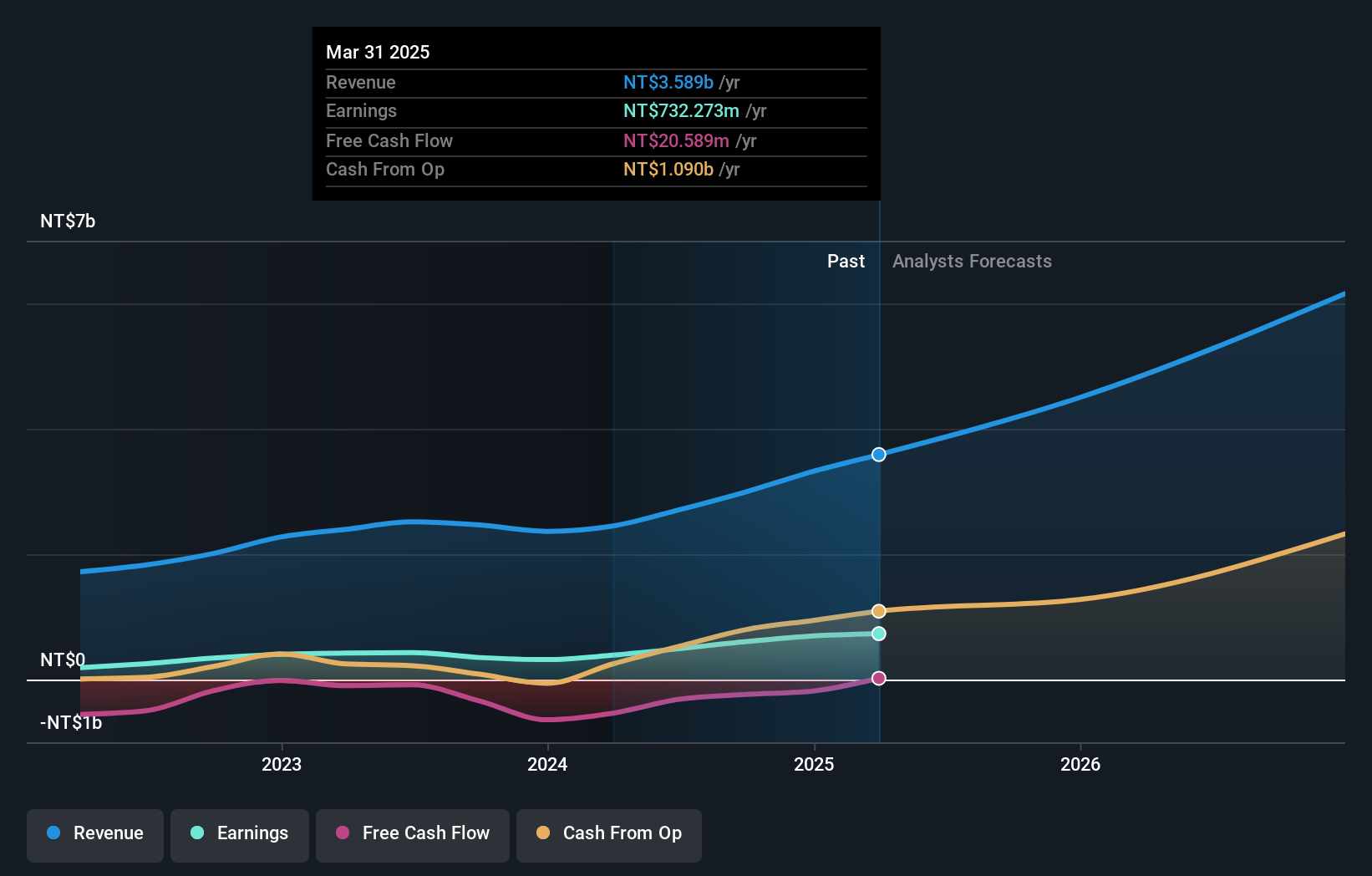

Advanced Echem Materials, a nimble player in Asia's semiconductor space, has shown impressive growth with net income soaring to TWD 697.54 million for 2024 from TWD 318.37 million the previous year. Their earnings per share jumped to TWD 8.5 from TWD 3.91, reflecting strong operational performance. Despite a rise in debt-to-equity ratio over five years to 52%, their interest payments remain comfortably covered by EBIT at a multiple of 36.6x, indicating robust financial health. The recent dividend approval of TWD 6 per share underscores their commitment to rewarding shareholders amidst expanding revenue streams and strategic equity offerings totalling TWD 4.94 billion.

- Click to explore a detailed breakdown of our findings in Advanced Echem Materials' health report.

Gain insights into Advanced Echem Materials' past trends and performance with our Past report.

Summing It All Up

- Investigate our full lineup of 2622 Asian Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002655

Gettop Acoustic

Engages in the research, development, production, and sale of micro-precision electro-acoustic components, and electroacoustic assemblies in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives