- China

- /

- Electronic Equipment and Components

- /

- SZSE:002600

Lingyi iTech (Guangdong) Company's (SZSE:002600) P/E Is Still On The Mark Following 26% Share Price Bounce

The Lingyi iTech (Guangdong) Company (SZSE:002600) share price has done very well over the last month, posting an excellent gain of 26%. The last month tops off a massive increase of 102% in the last year.

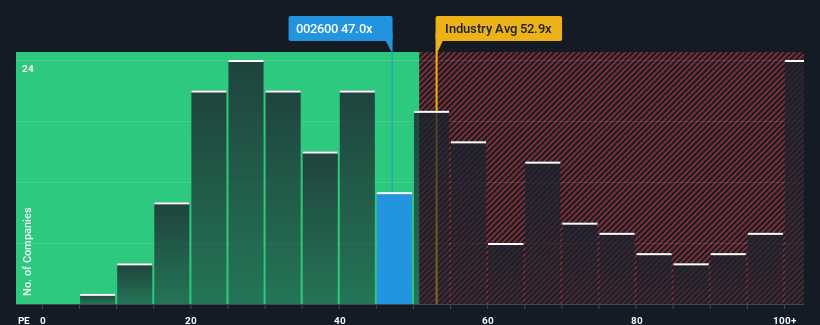

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 37x, you may consider Lingyi iTech (Guangdong) as a stock to potentially avoid with its 47x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Lingyi iTech (Guangdong) has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Lingyi iTech (Guangdong)

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Lingyi iTech (Guangdong)'s to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 33%. This means it has also seen a slide in earnings over the longer-term as EPS is down 24% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 48% per annum over the next three years. With the market only predicted to deliver 21% each year, the company is positioned for a stronger earnings result.

With this information, we can see why Lingyi iTech (Guangdong) is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Lingyi iTech (Guangdong)'s P/E?

The large bounce in Lingyi iTech (Guangdong)'s shares has lifted the company's P/E to a fairly high level. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Lingyi iTech (Guangdong) maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Lingyi iTech (Guangdong) has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Lingyi iTech (Guangdong)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002600

Lingyi iTech (Guangdong)

Provides smart manufacturing services and solutions in China and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives