- China

- /

- Communications

- /

- SZSE:002583

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

As global markets continue to navigate a dynamic landscape, recent developments have seen the S&P 500 Index advance with notable strength in utilities and real estate, while small-cap indices like the Russell 2000 and S&P MidCap 400 have outperformed. In this context of shifting economic indicators and market sentiment, identifying high growth tech stocks requires an understanding of their potential to capitalize on trends such as artificial intelligence advancements and robust consumer spending patterns.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 23.85% | 44.09% | ★★★★★★ |

| TG Therapeutics | 28.54% | 41.50% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| KebNi | 32.82% | 87.24% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Pharma Mar | 20.17% | 55.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.24% | 70.77% | ★★★★★★ |

Click here to see the full list of 1273 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Hengdian Group DMEGC Magnetics Ltd (SZSE:002056)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hengdian Group DMEGC Magnetics Co., Ltd engages in the production of magnetic materials, components, PV solar products, and lithium-ion batteries for both domestic and international markets, with a market cap of CN¥22.64 billion.

Operations: DMEGC Magnetics generates revenue primarily through the sale of magnetic materials, components, PV solar products, and lithium-ion batteries across domestic and international markets. The company operates with a market capitalization of CN¥22.64 billion.

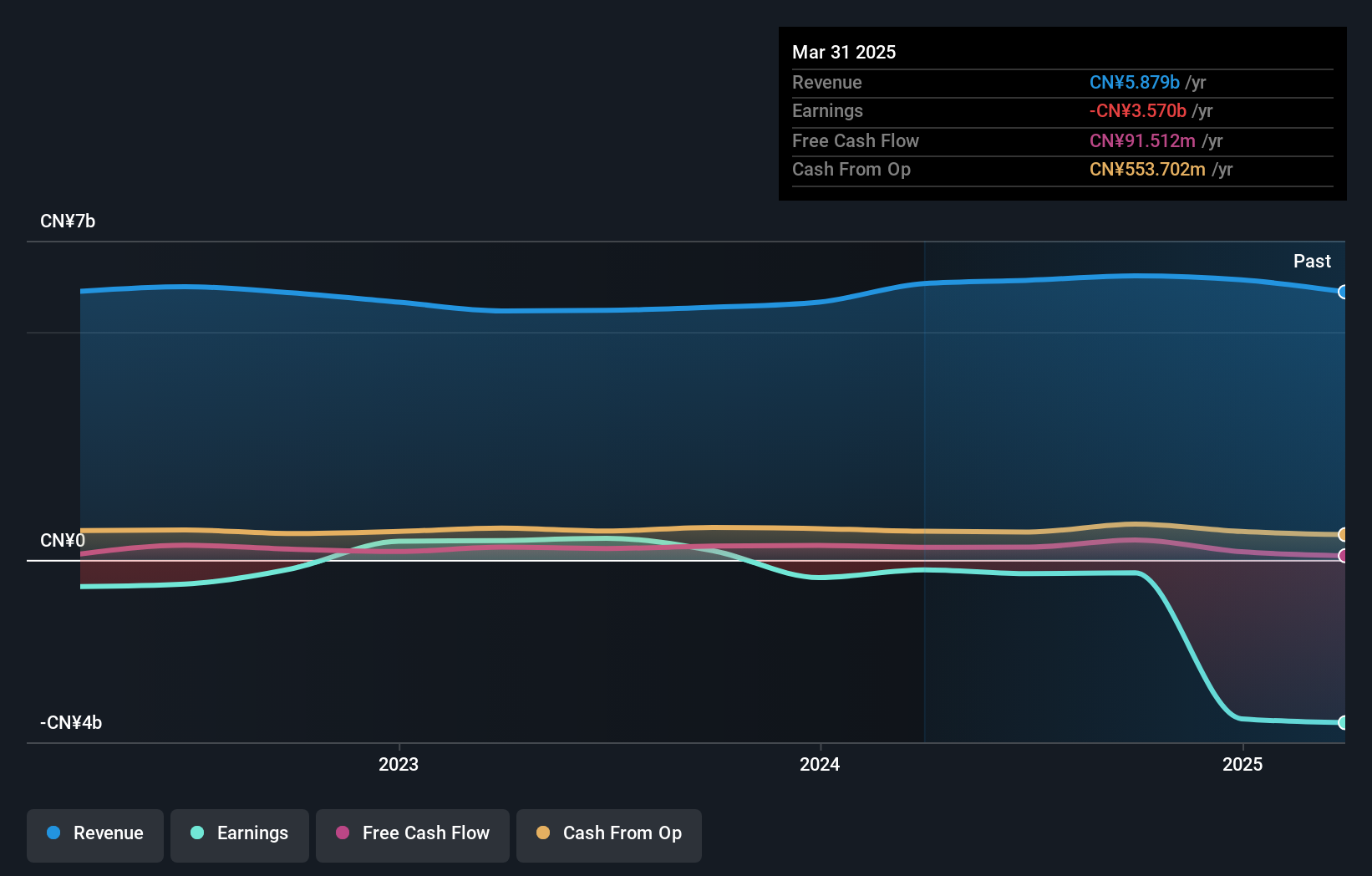

Despite a challenging year with a 14% drop in sales to CNY 13.58 billion and net income sliding to CNY 926.32 million, Hengdian Group DMEGC Magnetics has been proactive, repurchasing shares worth CNY 259.98 million and launching innovative products like the M01 Home Battery. This move into energy storage, coupled with their sustainable energy project in Jiangsu expected to generate significant annual electricity while reducing carbon emissions notably, underscores their strategic pivot towards green technology. These initiatives align with broader industry trends towards sustainability and efficiency enhancement, positioning them well for future growth despite current financial headwinds.

Hytera Communications (SZSE:002583)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hytera Communications Corporation Limited offers communications technologies and solutions under the Hytera brand both in China and globally, with a market cap of CN¥31.84 billion.

Operations: Hytera Communications generates revenue primarily through the sale of communications technologies and solutions. The company's operations span both domestic and international markets, contributing to its financial performance.

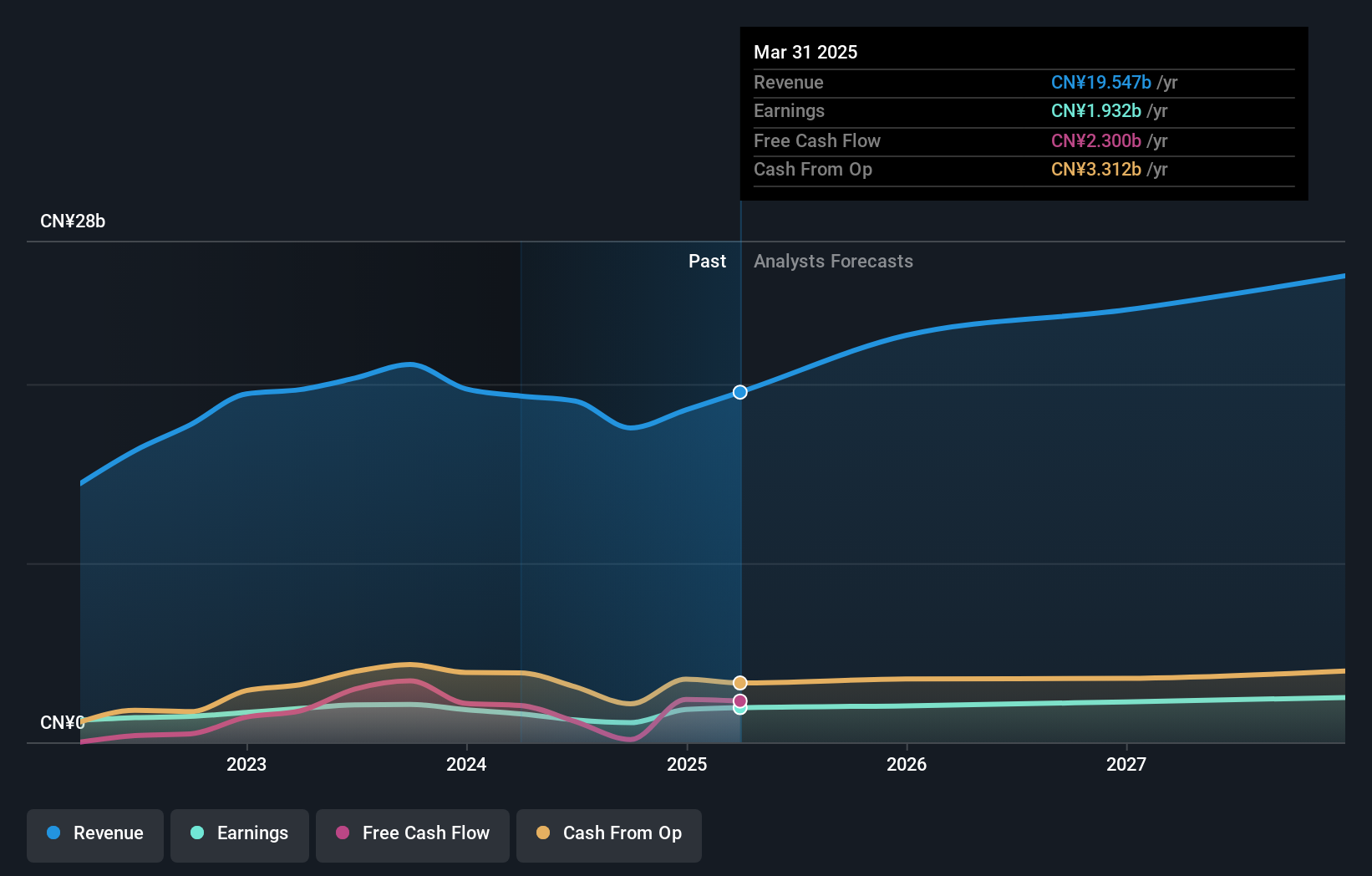

Hytera Communications has demonstrated a robust growth trajectory, with recent reports showing a significant uplift in sales to CNY 4.17 billion, up from CNY 3.6 billion year-over-year, and a net income increase to CNY 251.48 million from CNY 147.5 million. This financial uptick is supported by an aggressive R&D focus, where the company allocates substantial resources—evident from its latest Push-to-Talk over Cellular (PoC) radios release, the P5 Series. These innovations not only enhance Hytera's product line but also solidify its position in critical communication solutions across various sectors. With earnings expected to surge by 86.7% annually and revenue growth projected at 13.9%, which outpaces the broader CN market forecast of 13.4%, Hytera is strategically positioned for sustained advancement despite market volatilities.

- Click here and access our complete health analysis report to understand the dynamics of Hytera Communications.

Understand Hytera Communications' track record by examining our Past report.

Hangzhou DPtech TechnologiesLtd (SZSE:300768)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou DPtech Technologies Co., Ltd. focuses on the research and development, production, and sale of network security and application delivery products both in China and internationally, with a market cap of CN¥10.96 billion.

Operations: DPtech generates revenue primarily from network security and application delivery products, catering to both domestic and international markets. The company's operations emphasize research and development, aiming to innovate within its product offerings.

Hangzhou DPtech Technologies has been navigating a promising path in the tech sector, evidenced by a 13.7% increase in sales to CNY 819.3 million over the past nine months, alongside a notable rise in net income to CNY 92.38 million from CNY 67.08 million previously reported. This financial health is underpinned by strategic R&D investments, which have been pivotal in driving innovation and maintaining competitive advantage—R&D expenses surged by 19.5%, reflecting the company's commitment to evolving its technological capabilities. Moreover, with earnings expected to climb at an annual rate of 29.3%, DPtech is poised for robust growth, outstripping broader market projections and signaling potential for sustained upward trajectories amidst industry shifts towards more integrated tech solutions.

Where To Now?

- Click this link to deep-dive into the 1273 companies within our High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hytera Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002583

Hytera Communications

Provides communications technologies and solutions under the Hytera brand name in China and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives