High Growth Tech Stocks in China Including Cetc Potevio Science&TechnologyLtd

Reviewed by Simply Wall St

Amid recent economic fluctuations and geopolitical tensions, Chinese stocks have shown resilience, with notable gains in key indices driven by optimism around government support measures. In this dynamic environment, identifying high-growth tech stocks such as Cetc Potevio Science & Technology Ltd requires a focus on companies that demonstrate strong innovation capabilities and adaptability to shifting market conditions.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 32.62% | 32.32% | ★★★★★★ |

| Zhongji Innolight | 32.46% | 31.38% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 24.24% | 38.87% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Eoptolink Technology | 43.31% | 44.06% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Cetc Potevio Science&TechnologyLtd (SZSE:002544)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cetc Potevio Science & Technology Co., Ltd. offers network communication solutions in China and has a market cap of CN¥15.47 billion.

Operations: Cetc Potevio Science & Technology Co., Ltd. generates revenue primarily from its Software and IT Services segment, which contributes CN¥5.30 billion. The company's focus on network communication solutions positions it within the technology sector in China.

Cetc Potevio Science&TechnologyLtd, amidst a challenging fiscal period with a revenue drop to CNY 2.44 billion from CNY 2.59 billion year-on-year and net income falling to CNY 39.32 million from CNY 65.32 million, still shows potential in the high-tech sector of China. Notably, its projected earnings growth stands at an impressive 59% annually, outpacing the broader Chinese market's expectation of 23.7%. This contrasts starkly with its recent performance where it saw earnings shrink by -95.4% over the past year due to significant one-off costs amounting to CN¥39.9M. Despite these hurdles, the company's revenue growth forecast at 16.4% annually could signify resilience and adaptability in navigating market fluctuations and internal challenges.

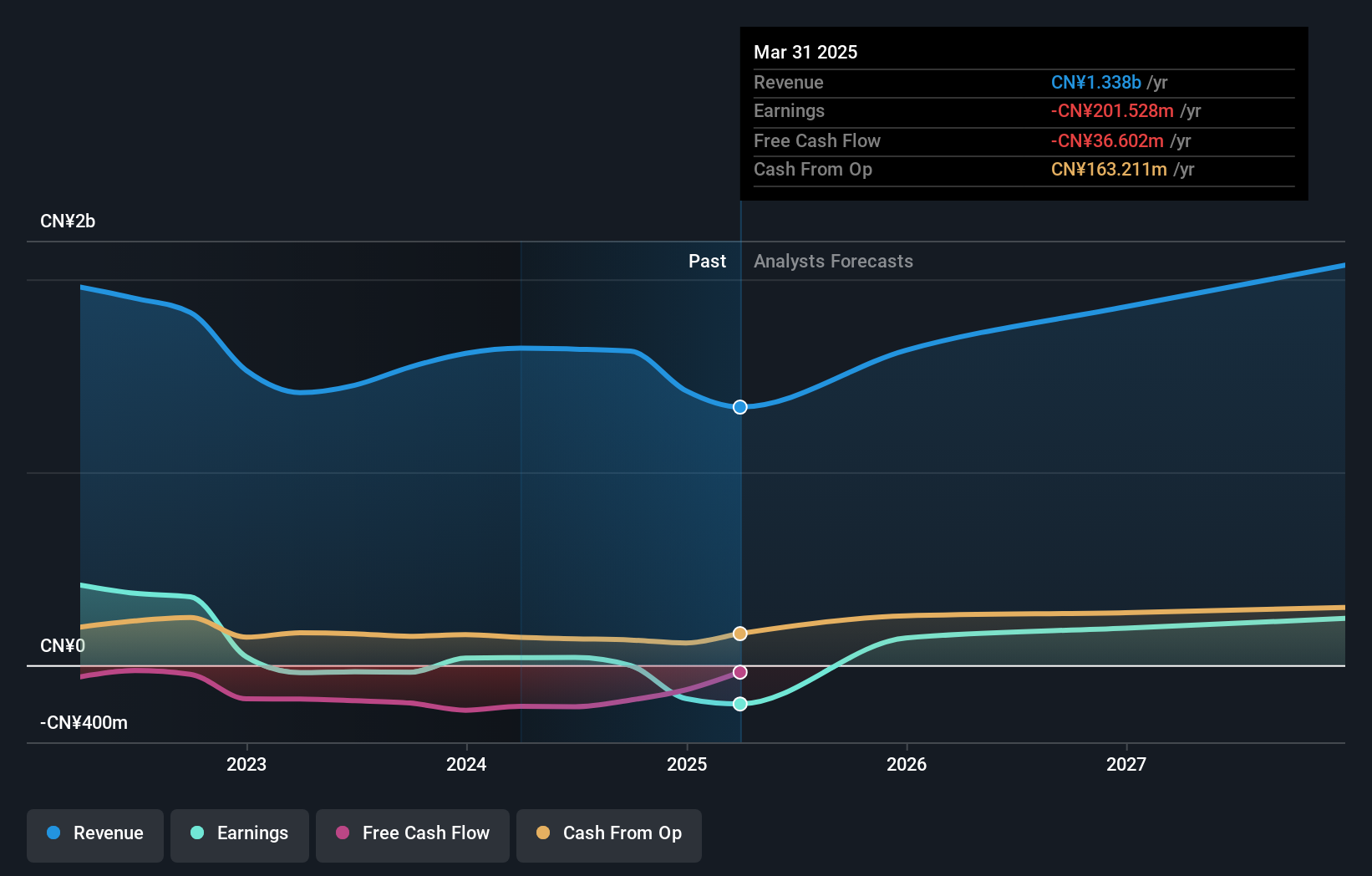

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. is a company engaged in the medical and health industry in China, with a market capitalization of CN¥8.70 billion.

Operations: B-SOFT Ltd. focuses on the medical and health sector in China, generating revenue primarily through its healthcare software solutions and services. The company’s operations are supported by a diverse range of products aimed at enhancing healthcare management and delivery systems.

B-SOFTLtd, navigating through a competitive landscape, reported a steady increase in revenue to CNY 726.74 million from CNY 704.39 million year-over-year as of June 2024, underlining its resilience in the tech sector. This growth is complemented by an R&D commitment that remains robust, with expenses aimed at fostering innovation and maintaining a competitive edge in software development—a crucial factor given the rapid technological advancements in China. Moreover, with an anticipated revenue growth rate of 17.4% per year and earnings expected to surge by 54.7% annually, B-SOFTLtd is positioning itself as a dynamic contender amidst China's tech evolution despite market challenges and high volatility in its share price over recent months.

- Navigate through the intricacies of B-SOFTLtd with our comprehensive health report here.

Evaluate B-SOFTLtd's historical performance by accessing our past performance report.

Brilliance Technology (SZSE:300542)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brilliance Technology Co., Ltd., along with its subsidiaries, offers information solutions and services in China, with a market cap of CN¥6.34 billion.

Operations: The company operates in the information solutions and services sector within China. It generates revenue primarily through its technology-driven offerings, which cater to a diverse range of clients seeking specialized information solutions.

Brilliance Technology, amidst a challenging fiscal period, reported a significant revenue drop to CNY 421.16 million from CNY 506.32 million year-over-year as of June 2024, reflecting broader market pressures yet underscoring the volatile nature of high-growth tech sectors in China. Despite these headwinds, the company's R&D expenditure remains a cornerstone of its strategy to rebound and innovate within the tech landscape; this commitment is critical as it seeks to navigate through rapid technological shifts and competitive dynamics. Notably, Brilliance Technology's forecasted earnings growth stands at an impressive 73.4% annually—outpacing the broader Chinese market projections—highlighting potential for recovery and growth despite current financial setbacks.

Where To Now?

- Click here to access our complete index of 256 Chinese High Growth Tech and AI Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brilliance Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300542

Brilliance Technology

Provides information solutions and services in China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives