- China

- /

- Communications

- /

- SZSE:002544

Cetc Potevio Science&Technology Co.,Ltd. (SZSE:002544) Stocks Shoot Up 32% But Its P/E Still Looks Reasonable

Cetc Potevio Science&Technology Co.,Ltd. (SZSE:002544) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

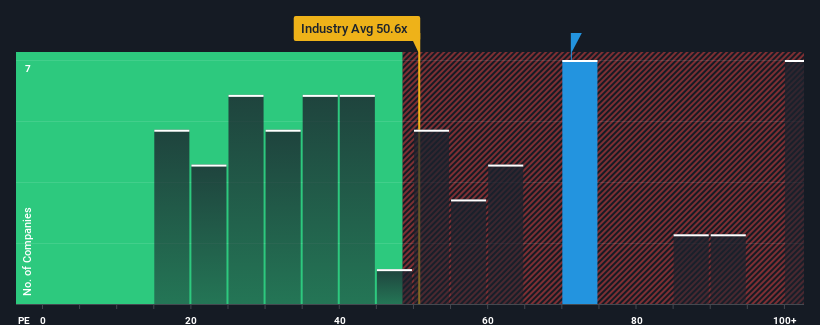

After such a large jump in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Cetc Potevio Science&TechnologyLtd as a stock to avoid entirely with its 71.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been pleasing for Cetc Potevio Science&TechnologyLtd as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Cetc Potevio Science&TechnologyLtd

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Cetc Potevio Science&TechnologyLtd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 16% last year. Pleasingly, EPS has also lifted 151% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 65% during the coming year according to the one analyst following the company. With the market only predicted to deliver 41%, the company is positioned for a stronger earnings result.

With this information, we can see why Cetc Potevio Science&TechnologyLtd is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Cetc Potevio Science&TechnologyLtd's P/E

The strong share price surge has got Cetc Potevio Science&TechnologyLtd's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Cetc Potevio Science&TechnologyLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Cetc Potevio Science&TechnologyLtd.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002544

Cetc Potevio Science&TechnologyLtd

Provides network communication solutions in China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives