- Hong Kong

- /

- Real Estate

- /

- SEHK:28

3 Asian Penny Stocks With Market Caps Under US$900M

Reviewed by Simply Wall St

As global markets grapple with mixed performances and economic uncertainties, investors are increasingly turning their attention to smaller-cap opportunities in Asia. Penny stocks, despite their somewhat outdated moniker, continue to attract interest due to their potential for significant growth when backed by strong financials. This article will explore several Asian penny stocks that may offer hidden value and stability through solid balance sheets and long-term potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.89 | HK$2.35B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.50 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.08 | SGD437.71M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.90 | THB2.94B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.42 | SGD13.46B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$0.99 | HK$2.65B | ✅ 3 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.04 | NZ$148.04M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.86 | NZ$237.89M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 934 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Tian An China Investments (SEHK:28)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, and the United Kingdom with a market capitalization of approximately HK$6.74 billion.

Operations: The company's revenue is primarily derived from Property Development at HK$7.61 billion, followed by Healthcare at HK$1.54 billion, Property Investment at HK$573.86 million, and Other Operations at HK$414.87 million.

Market Cap: HK$6.74B

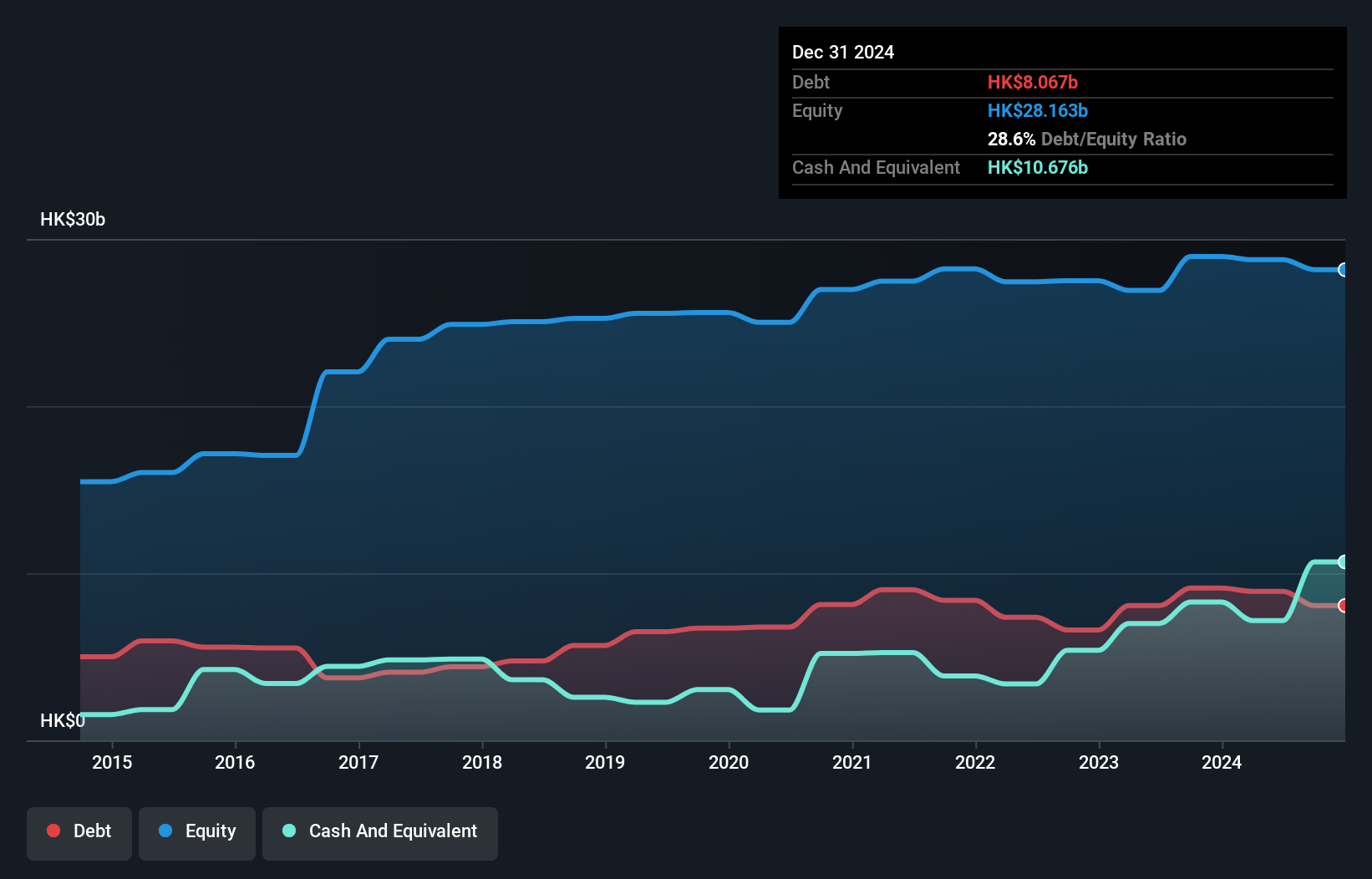

Tian An China Investments has demonstrated significant earnings growth, with a remarkable increase of 186.8% over the past year, outpacing the broader Real Estate industry. The company's financial health is robust, with short-term assets exceeding both short and long-term liabilities and more cash than total debt. Its interest payments are well-covered by EBIT, indicating strong debt management. Recent earnings results show substantial revenue growth to HK$8.67 billion for the first half of 2025, reflecting improved profitability despite lower net profit margins compared to last year. The experienced management team supports its strategic operations across key markets.

- Navigate through the intricacies of Tian An China Investments with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Tian An China Investments' track record.

Hour Glass (SGX:AGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Hour Glass Limited is an investment holding company involved in the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD1.41 billion.

Operations: No specific revenue segments are reported for Hour Glass Limited.

Market Cap: SGD1.41B

Hour Glass Limited, with a market cap of SGD1.41 billion, shows solid financial health in the penny stock space. The company has more cash than total debt and its short-term assets cover both short and long-term liabilities, indicating strong liquidity. Despite earnings growth slowing to 6.5% over the past year from an average of 8.4% over five years, profit margins remain stable at 12.1%. The management team is seasoned with an average tenure of 5.1 years, supporting strategic operations across multiple countries in Asia-Pacific markets where it distributes luxury products like watches and jewelry.

- Click to explore a detailed breakdown of our findings in Hour Glass' financial health report.

- Examine Hour Glass' past performance report to understand how it has performed in prior years.

Jiangsu Yinhe ElectronicsLtd (SZSE:002519)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Jiangsu Yinhe Electronics Co., Ltd. manufactures and sells computer, communication, and other electronic equipment both in China and internationally, with a market cap of CN¥5.56 billion.

Operations: Jiangsu Yinhe Electronics Co., Ltd. has not reported any specific revenue segments, but it operates in the computer, communication, and electronic equipment sectors both domestically and abroad.

Market Cap: CN¥5.56B

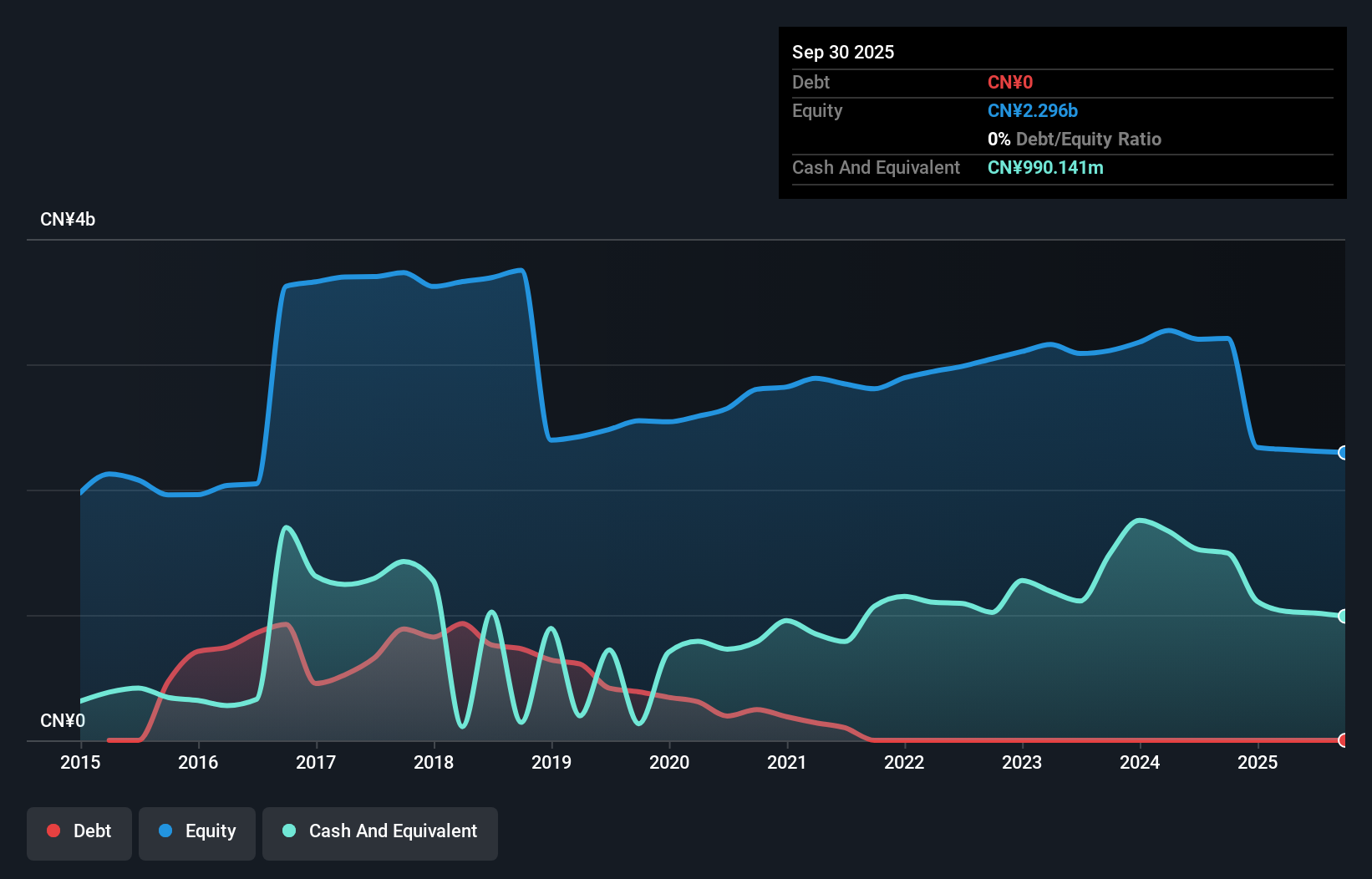

Jiangsu Yinhe Electronics Co., Ltd., with a market cap of CN¥5.56 billion, operates in the electronics sector and is currently unprofitable, reporting a net loss of CN¥40.16 million for the first nine months of 2025. The company has seen its revenue decline significantly to CN¥332.42 million from CN¥813.08 million year-on-year, reflecting challenges in maintaining sales momentum. Despite these setbacks, Jiangsu Yinhe remains debt-free and its short-term assets (CN¥2.5 billion) comfortably exceed both short-term and long-term liabilities, suggesting reasonable liquidity management amidst ongoing financial pressures.

- Unlock comprehensive insights into our analysis of Jiangsu Yinhe ElectronicsLtd stock in this financial health report.

- Gain insights into Jiangsu Yinhe ElectronicsLtd's historical outcomes by reviewing our past performance report.

Where To Now?

- Click here to access our complete index of 934 Asian Penny Stocks.

- Ready To Venture Into Other Investment Styles? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tian An China Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:28

Tian An China Investments

An investment holding company, invests in, develops, and manages properties in the People's Republic of China, Hong Kong, and the United Kingdom.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives