- China

- /

- Electronic Equipment and Components

- /

- SZSE:002475

Cautious Investors Not Rewarding Luxshare Precision Industry Co., Ltd.'s (SZSE:002475) Performance Completely

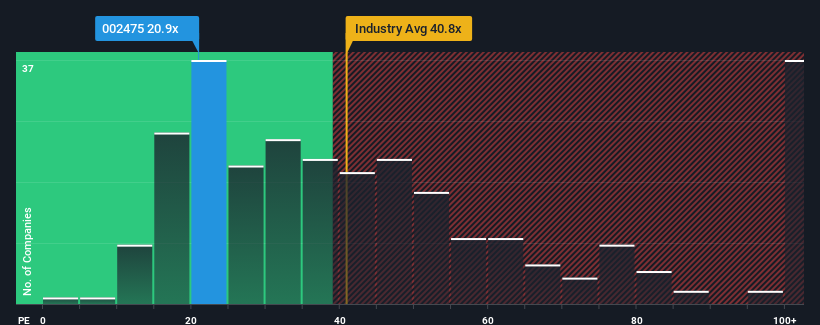

With a price-to-earnings (or "P/E") ratio of 20.9x Luxshare Precision Industry Co., Ltd. (SZSE:002475) may be sending bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 31x and even P/E's higher than 57x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, Luxshare Precision Industry has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Luxshare Precision Industry

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Luxshare Precision Industry's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 30%. The latest three year period has also seen an excellent 47% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 23% per annum during the coming three years according to the analysts following the company. With the market predicted to deliver 25% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Luxshare Precision Industry's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Luxshare Precision Industry's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Luxshare Precision Industry with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Luxshare Precision Industry. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002475

Luxshare Precision Industry

Designs, manufactures, and sells cable assembly and connector system solutions worldwide.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives