- China

- /

- Electronic Equipment and Components

- /

- SZSE:002449

Foshan NationStar Optoelectronics Co.,Ltd (SZSE:002449) Is About To Go Ex-Dividend, And It Pays A 0.9% Yield

It looks like Foshan NationStar Optoelectronics Co.,Ltd (SZSE:002449) is about to go ex-dividend in the next three days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. This means that investors who purchase Foshan NationStar OptoelectronicsLtd's shares on or after the 14th of June will not receive the dividend, which will be paid on the 14th of June.

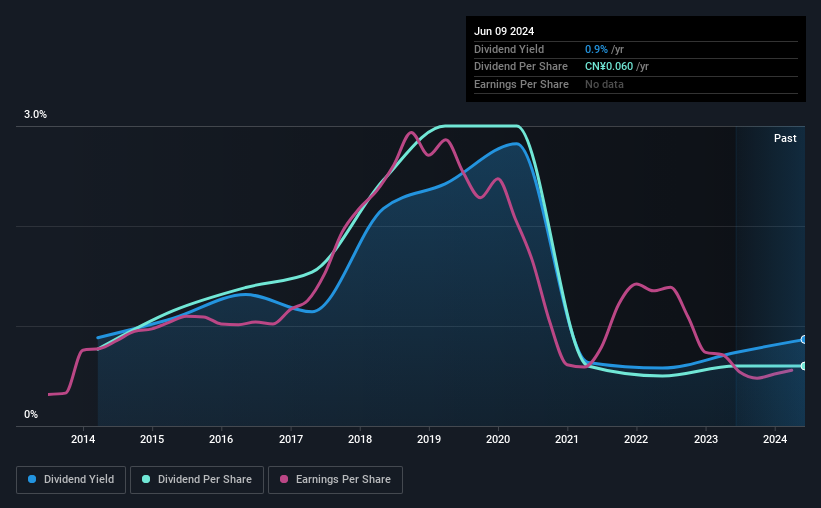

The company's next dividend payment will be CN¥0.06 per share, and in the last 12 months, the company paid a total of CN¥0.06 per share. Calculating the last year's worth of payments shows that Foshan NationStar OptoelectronicsLtd has a trailing yield of 0.9% on the current share price of CN¥6.93. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether Foshan NationStar OptoelectronicsLtd has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Foshan NationStar OptoelectronicsLtd

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Foshan NationStar OptoelectronicsLtd paid out a comfortable 40% of its profit last year. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It distributed 27% of its free cash flow as dividends, a comfortable payout level for most companies.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're discomforted by Foshan NationStar OptoelectronicsLtd's 27% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Foshan NationStar OptoelectronicsLtd has seen its dividend decline 2.5% per annum on average over the past 10 years, which is not great to see. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

Final Takeaway

Has Foshan NationStar OptoelectronicsLtd got what it takes to maintain its dividend payments? Foshan NationStar OptoelectronicsLtd has comfortably low cash and profit payout ratios, which may mean the dividend is sustainable even in the face of a sharp decline in earnings per share. Still, we consider declining earnings to be a warning sign. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

In light of that, while Foshan NationStar OptoelectronicsLtd has an appealing dividend, it's worth knowing the risks involved with this stock. Every company has risks, and we've spotted 3 warning signs for Foshan NationStar OptoelectronicsLtd (of which 1 doesn't sit too well with us!) you should know about.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002449

Foshan NationStar OptoelectronicsLtd

Engages in the research, development, production, and sale of LED components and its application products in the People’s Republic of China and internationally.

Excellent balance sheet second-rate dividend payer.