- China

- /

- Electronic Equipment and Components

- /

- SZSE:002426

Suzhou Victory Precision Manufacture Co., Ltd.'s (SZSE:002426) Share Price Is Matching Sentiment Around Its Revenues

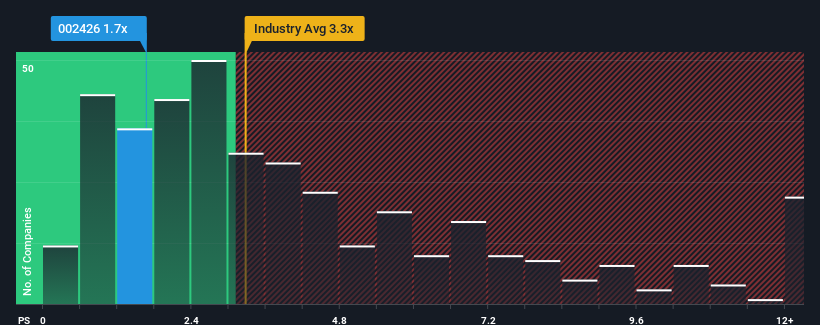

With a price-to-sales (or "P/S") ratio of 1.7x Suzhou Victory Precision Manufacture Co., Ltd. (SZSE:002426) may be sending bullish signals at the moment, given that almost half of all the Electronic companies in China have P/S ratios greater than 3.3x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Suzhou Victory Precision Manufacture

What Does Suzhou Victory Precision Manufacture's P/S Mean For Shareholders?

For instance, Suzhou Victory Precision Manufacture's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Suzhou Victory Precision Manufacture's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Suzhou Victory Precision Manufacture's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. The last three years don't look nice either as the company has shrunk revenue by 60% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 25% shows it's an unpleasant look.

With this information, we are not surprised that Suzhou Victory Precision Manufacture is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Suzhou Victory Precision Manufacture confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Suzhou Victory Precision Manufacture with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Suzhou Victory Precision Manufacture, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002426

Suzhou Victory Precision Manufacture

Suzhou Victory Precision Manufacture Co., Ltd.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives