- Philippines

- /

- Food

- /

- PSE:FB

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a turbulent start to 2025, with U.S. stocks experiencing volatility due to AI competition concerns and mixed economic signals from major economies, investors are seeking stability amidst the uncertainty. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to balance risk while capitalizing on steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.09% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

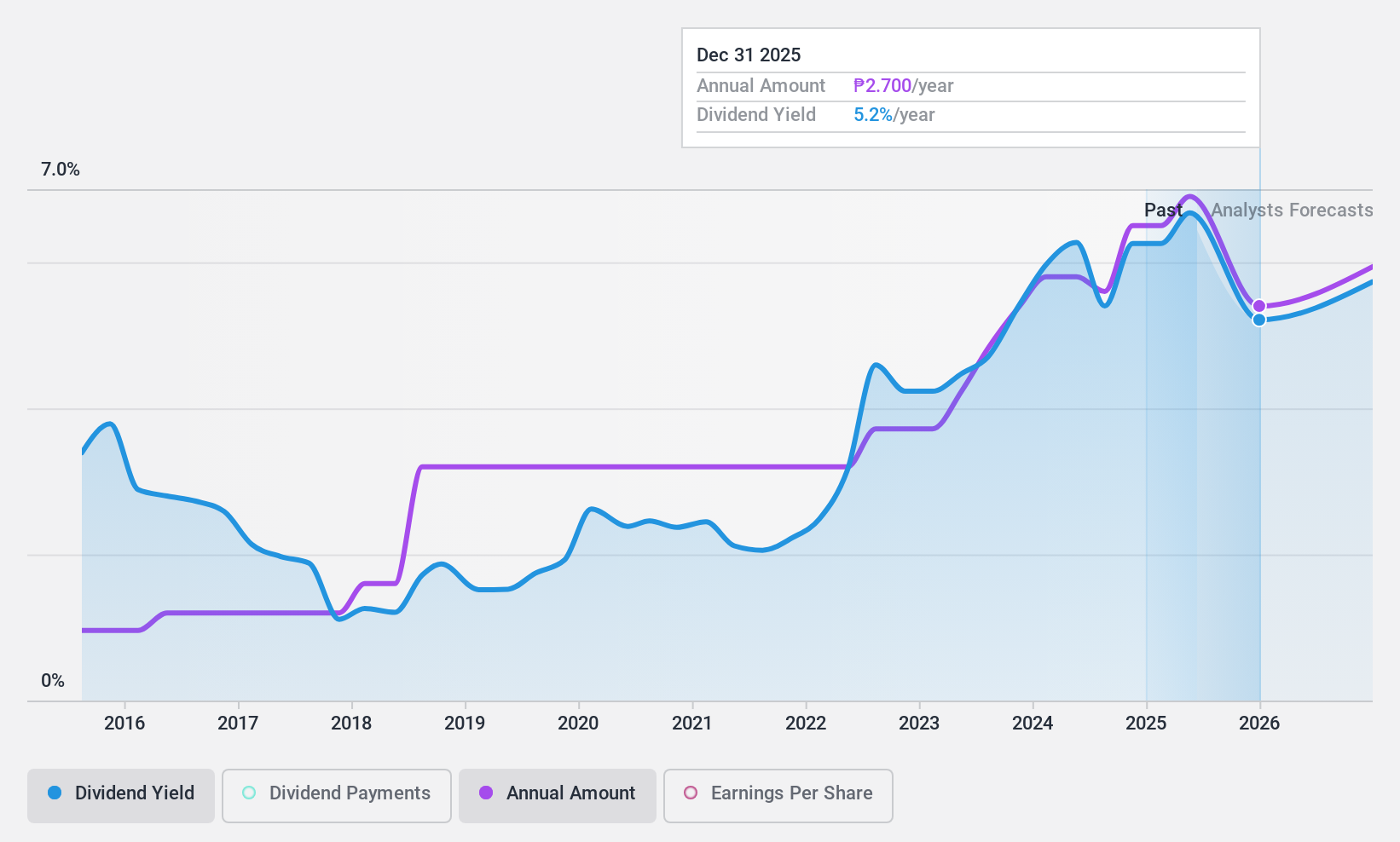

San Miguel Food and Beverage (PSE:FB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: San Miguel Food and Beverage, Inc. operates in the processed meat products sector with a market capitalization of approximately ₱302.55 billion.

Operations: San Miguel Food and Beverage, Inc.'s revenue is primarily derived from its Food segment at ₱183.76 billion, Spirits at ₱60.29 billion, and Beer and Non-Alcoholic Beverage at ₱150.23 billion.

Dividend Yield: 6.3%

San Miguel Food and Beverage offers a stable dividend yield of 6.35%, though slightly below the top 25% in the Philippine market. Its dividends are well-covered by earnings and cash flows, with payout ratios of 40.3% and 60.2%, respectively, ensuring sustainability. Recent management changes include new appointments for COO and CFO roles amid ongoing reorganization efforts, which may impact strategic direction but do not currently affect dividend stability or reliability.

- Take a closer look at San Miguel Food and Beverage's potential here in our dividend report.

- Upon reviewing our latest valuation report, San Miguel Food and Beverage's share price might be too pessimistic.

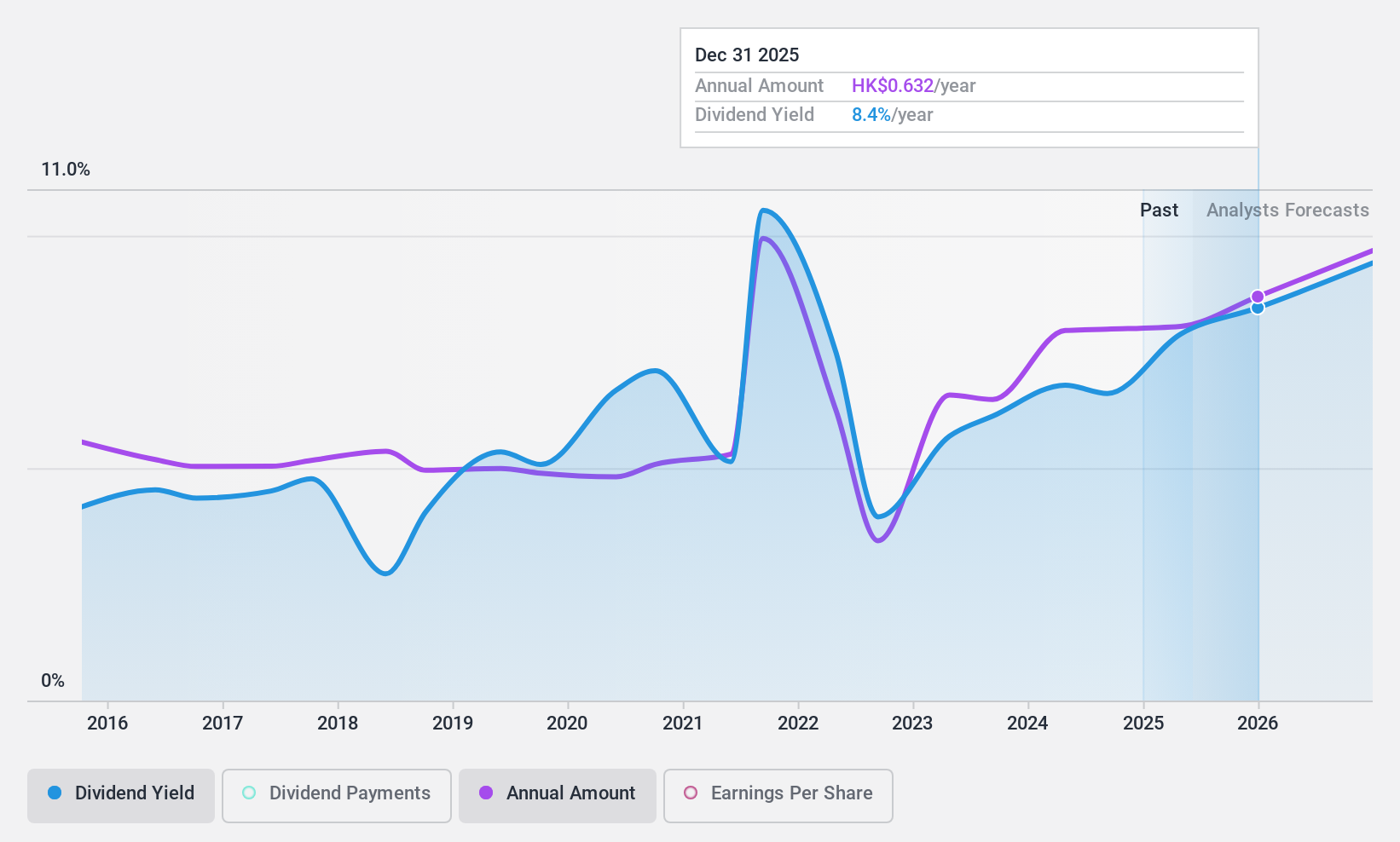

China Shineway Pharmaceutical Group (SEHK:2877)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Shineway Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and trade of Chinese medicines in the People’s Republic of China and Hong Kong, with a market cap of HK$6.32 billion.

Operations: The company's revenue is primarily derived from its Chinese Pharmaceutical Products segment, which generated CN¥4.20 billion.

Dividend Yield: 6.5%

China Shineway Pharmaceutical Group's dividend yield of 6.47% is below the top 25% in Hong Kong, but dividends are well-covered by earnings and cash flows with a payout ratio of 36.9%. Despite a history of volatile and unreliable dividend payments, dividends have grown over the past decade. The company trades at a significant discount to its estimated fair value, suggesting potential for capital appreciation alongside its dividend offerings.

- Dive into the specifics of China Shineway Pharmaceutical Group here with our thorough dividend report.

- Our valuation report unveils the possibility China Shineway Pharmaceutical Group's shares may be trading at a discount.

Shenzhen Aisidi (SZSE:002416)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shenzhen Aisidi Co., Ltd. operates in digital distribution and retail services both in China and internationally, with a market cap of CN¥15.83 billion.

Operations: Shenzhen Aisidi Co., Ltd. generates its revenue through digital distribution and retail services across domestic and international markets.

Dividend Yield: 3%

Shenzhen Aisidi's dividend yield of 3.04% ranks in the top 25% of the Chinese market, with dividends covered by both earnings (74.7%) and cash flows (39.3%). Despite a history of volatility and unreliability in dividend payments over the past decade, recent growth trends are promising. The company's Price-To-Earnings ratio of 24.6x indicates good value relative to the broader CN market, though its share price remains highly volatile short-term.

- Delve into the full analysis dividend report here for a deeper understanding of Shenzhen Aisidi.

- The valuation report we've compiled suggests that Shenzhen Aisidi's current price could be quite moderate.

Turning Ideas Into Actions

- Explore the 1960 names from our Top Dividend Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:FB

San Miguel Food and Beverage

Manufactures and markets processed meat products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives