- China

- /

- Electronic Equipment and Components

- /

- SZSE:002402

It's A Story Of Risk Vs Reward With Shenzhen H&T Intelligent Control Co.Ltd (SZSE:002402)

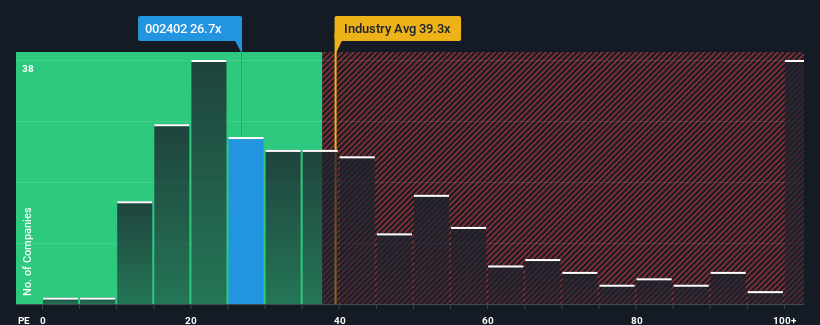

It's not a stretch to say that Shenzhen H&T Intelligent Control Co.Ltd's (SZSE:002402) price-to-earnings (or "P/E") ratio of 26.7x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 28x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Shenzhen H&T Intelligent ControlLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Shenzhen H&T Intelligent ControlLtd

What Are Growth Metrics Telling Us About The P/E?

Shenzhen H&T Intelligent ControlLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 23% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 40% per annum during the coming three years according to the five analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 25% each year, which is noticeably less attractive.

In light of this, it's curious that Shenzhen H&T Intelligent ControlLtd's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Shenzhen H&T Intelligent ControlLtd's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Shenzhen H&T Intelligent ControlLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shenzhen H&T Intelligent ControlLtd that you need to be mindful of.

If you're unsure about the strength of Shenzhen H&T Intelligent ControlLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002402

Shenzhen H&T Intelligent ControlLtd

Researches and develops, manufactures, sells, and markets intelligent controller products in China and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives