Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:002402

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

As rising U.S. Treasury yields exert pressure on global markets, the tech-heavy Nasdaq Composite Index has shown resilience, outperforming other indices amid a backdrop of moderated inflation and tepid economic growth. In this environment, identifying high-growth tech stocks that can capitalize on market dynamics such as innovation and adaptability becomes crucial for investors looking to navigate volatility and potential opportunities in the sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Pharma Mar | 20.17% | 55.11% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 29.32% | 70.79% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1247 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Megacable Holdings S. A. B. de C. V (BMV:MEGA CPO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Megacable Holdings S. A. B. de C. V., along with its subsidiaries, provides cable television, internet, and telephone services through the installation, operation, and maintenance of distribution systems, with a market capitalization of MX$36.39 billion.

Operations: Megacable Holdings S. A. B. de C. V generates revenue primarily from its cable television, internet, and telephone services by installing and operating distribution systems across various regions. The company has a market capitalization of MX$36.39 billion, reflecting its significant presence in the telecommunications sector in Mexico.

Megacable Holdings has demonstrated resilience with a reported 9.7% increase in sales to MXN 24.34 billion over nine months, despite a slight dip in net income to MXN 1.87 billion from last year's MXN 2.20 billion. This contrasts with its R&D strategy, which is critical as it navigates through competitive pressures in the tech sector; however, specific figures on R&D expenses were not disclosed, highlighting an area for potential investor scrutiny. The company's revenue growth forecast at 8.7% annually outpaces the broader Mexican market's 7.2%, suggesting robust strategic positioning despite short-term earnings volatility and challenges in covering interest payments effectively from earnings alone.

- Get an in-depth perspective on Megacable Holdings S. A. B. de C. V's performance by reading our health report here.

Understand Megacable Holdings S. A. B. de C. V's track record by examining our Past report.

Fujian Star-net Communication (SZSE:002396)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Star-net Communication Co., LTD. offers ICT infrastructure and AI application solutions in China, with a market cap of CN¥10 billion.

Operations: Star-net Communication generates revenue primarily from its communication equipment manufacturing segment, which accounted for CN¥16.74 billion. The company's focus on ICT infrastructure and AI applications positions it within a growing technological sector in China.

Fujian Star-net Communication has demonstrated significant growth potential, with its revenue increasing by 18.2% annually, outpacing the Chinese market's average of 13.7%. This growth is underpinned by a robust R&D investment strategy that not only fuels innovation but also aligns with industry shifts towards more integrated communication solutions. The company's earnings have also seen an impressive rise of 32.5% per year, suggesting a strong uptake of its offerings despite broader market fluctuations. Recent governance changes and strategic board re-elections could further steer the company towards harnessing emerging tech trends, enhancing its competitive edge in a rapidly evolving sector.

- Click to explore a detailed breakdown of our findings in Fujian Star-net Communication's health report.

Learn about Fujian Star-net Communication's historical performance.

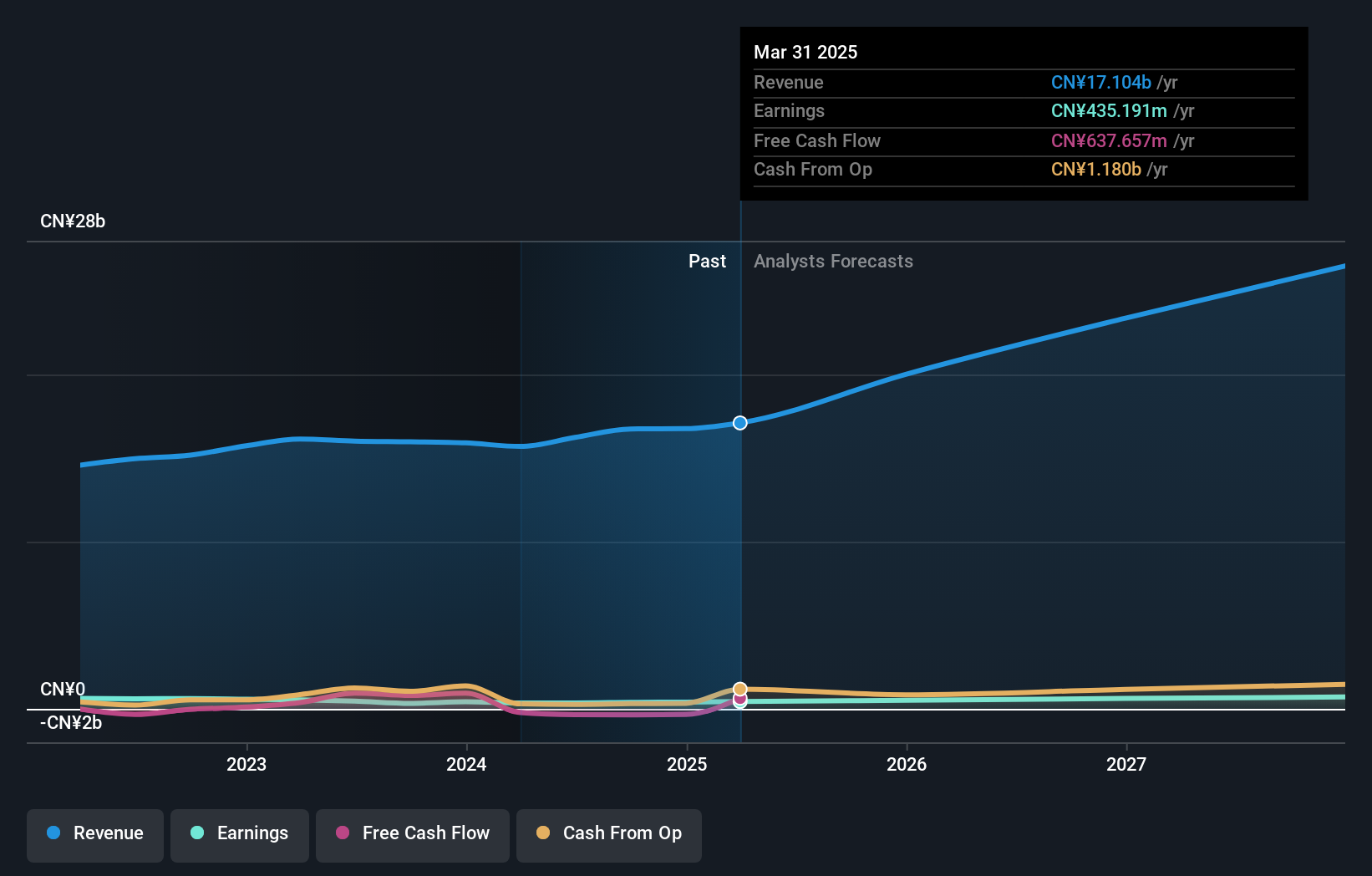

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen H&T Intelligent Control Co. Ltd, along with its subsidiaries, is engaged in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and internationally with a market cap of CN¥10.91 billion.

Operations: Shenzhen H&T Intelligent Control Co. Ltd focuses on the production and distribution of intelligent controller products, serving both domestic and international markets. The company leverages its R&D capabilities to innovate within the intelligent control sector, contributing to its market presence and growth potential.

Shenzhen H&T Intelligent Control Co.Ltd has shown a robust performance with a 28.2% increase in sales to CNY 7.04 billion over the past nine months, reflecting strong market acceptance of its products. This growth is supported by significant R&D investments which have enabled the company to stay ahead in innovation within the tech sector, particularly in intelligent control systems. Despite a challenging environment, where its net profit margins dipped slightly from last year's 6.3% to 3.9%, the company's earnings are projected to surge by an impressive 47.3% annually over the next three years, underscoring potential future profitability driven by their strategic initiatives including recent share buybacks amounting to CNY 104.99 million and adjustments in corporate governance aimed at enhancing operational efficiencies and market competitiveness.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1247 High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002402

Shenzhen H&T Intelligent ControlLtd

Researches and develops, manufactures, sells, and markets intelligent controller products in China and internationally.