The Asian market has been navigating a complex landscape, with China's economy experiencing slower growth and Japan's technology sector facing valuation concerns amid global shifts in artificial intelligence spending. In this environment, identifying high-growth tech stocks requires careful consideration of companies that can adapt to changing market dynamics and leverage technological advancements to maintain competitive advantages.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.61% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 31.35% | 32.09% | ★★★★★★ |

| PharmaEssentia | 34.39% | 51.51% | ★★★★★★ |

| Fositek | 37.73% | 51.16% | ★★★★★★ |

| Gold Circuit Electronics | 25.30% | 31.13% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 58.79% | 72.48% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

CARsgen Therapeutics Holdings (SEHK:2171)

Simply Wall St Growth Rating: ★★★★★★

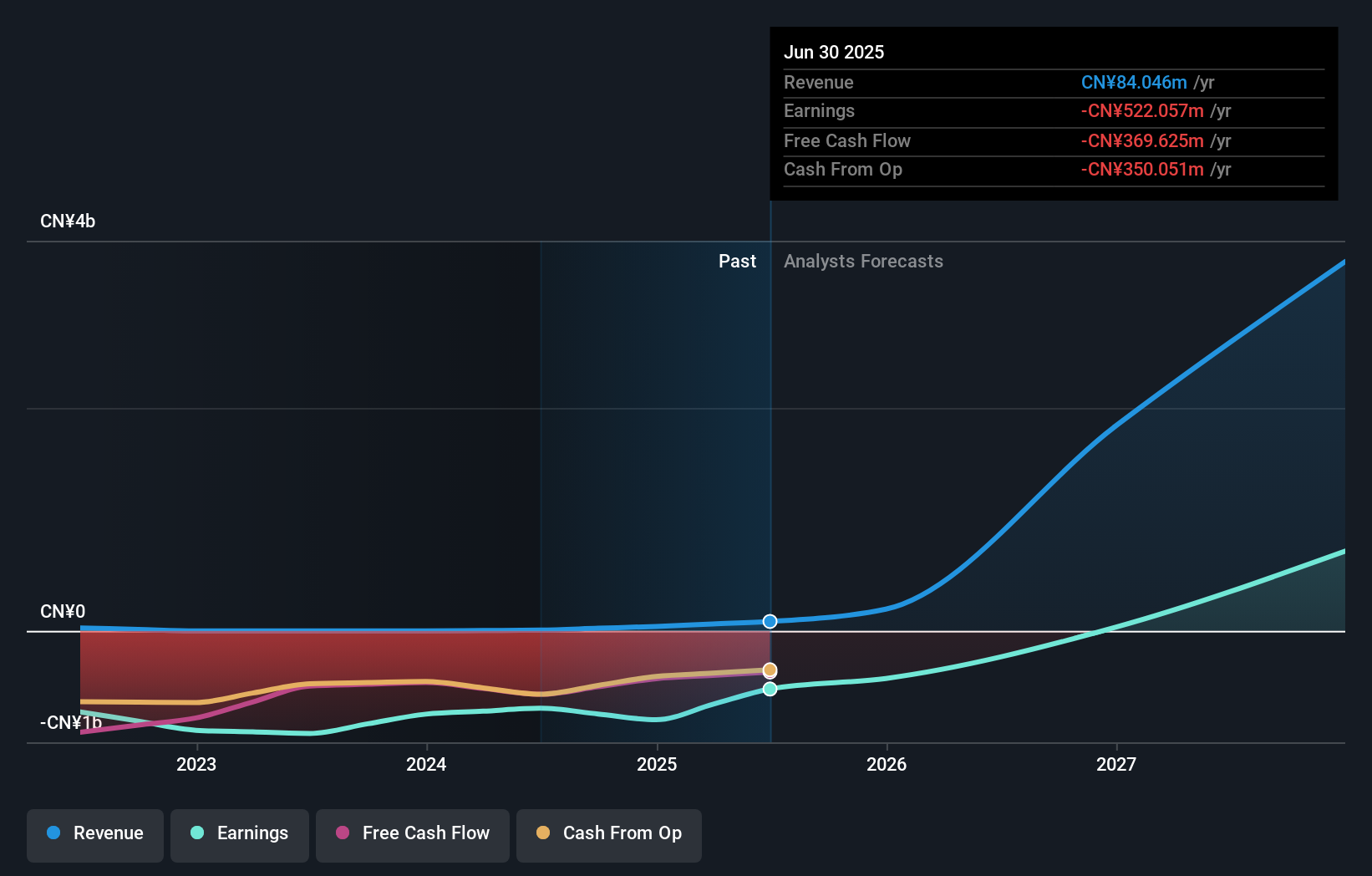

Overview: CARsgen Therapeutics Holdings Limited is an investment holding company focused on discovering, developing, and commercializing CAR-T cell therapies for hematological malignancies, solid tumors, and autoimmune diseases in China with a market cap of approximately HK$9.94 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, reporting CN¥84.05 million. It focuses on CAR-T cell therapies targeting hematological malignancies, solid tumors, and autoimmune diseases within China.

CARsgen Therapeutics Holdings, a trailblazer in the biotech industry, has demonstrated robust growth with its revenue surging by 100.4% annually. This impressive expansion is complemented by an anticipated earnings growth of 118.16% per year, signaling strong future prospects as the company moves towards profitability within three years. Recent clinical advancements further underscore its potential; notably, CARsgen announced encouraging preliminary results from trials of its innovative allogeneic CAR-T products for multiple myeloma and non-Hodgkin's lymphoma on November 3, 2025. These developments not only enhance its portfolio but also position CARsgen to capitalize on significant market opportunities in oncological treatments.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

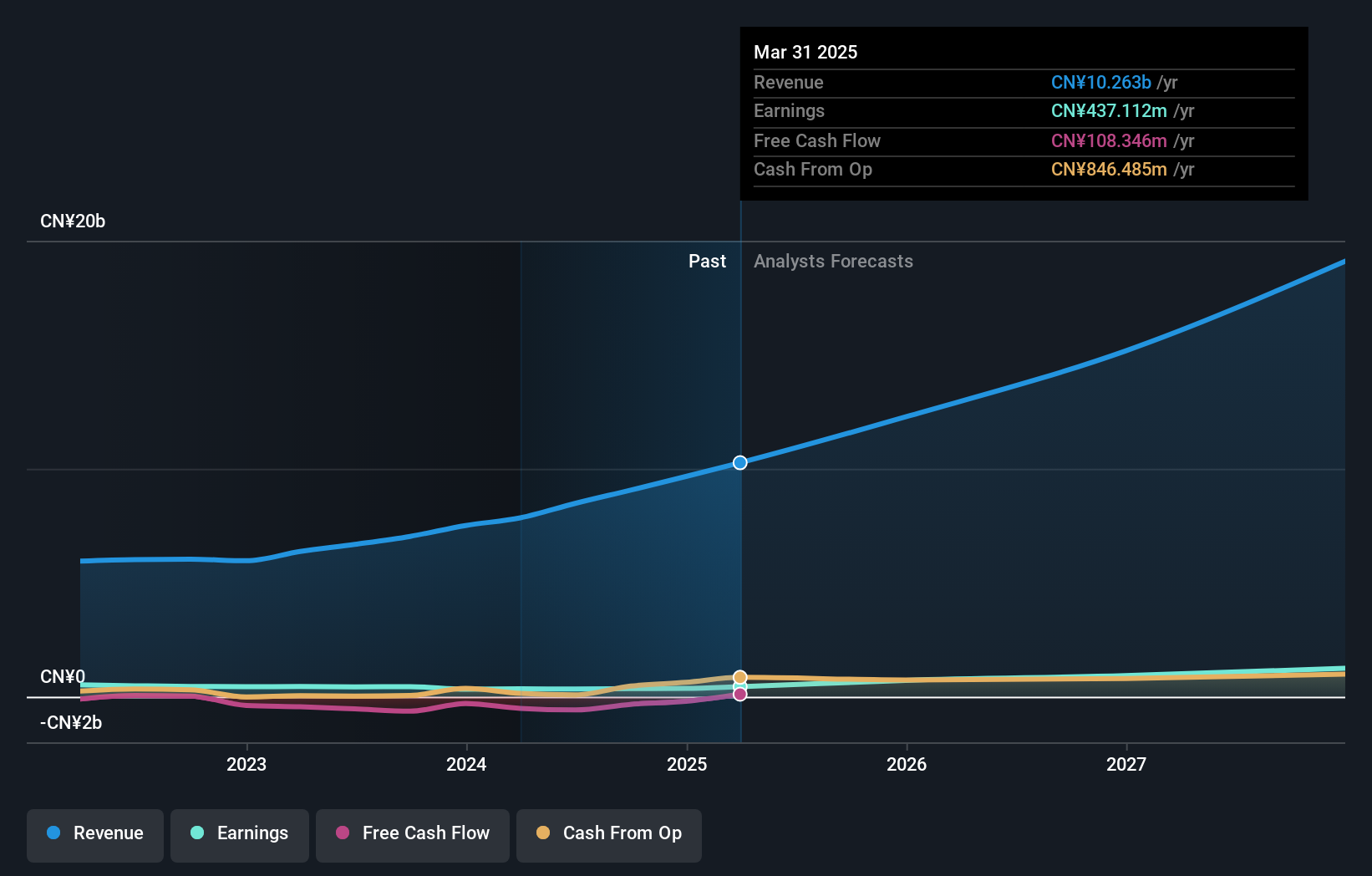

Overview: Shenzhen H&T Intelligent Control Co.Ltd, with a market cap of CN¥44.92 billion, engages in the research, development, manufacture, sale, and marketing of intelligent controller products both in China and internationally.

Operations: Shenzhen H&T Intelligent Control Co.Ltd focuses on intelligent controller products, serving both domestic and international markets.

Shenzhen H&T Intelligent Control Co. Ltd, an emerging force in Asia's tech landscape, has recently shown impressive financial performance with a revenue increase to CNY 8.27 billion, up from CNY 7.04 billion the previous year. This growth is supported by a substantial rise in net income to CNY 602.9 million, marking an annual earnings growth forecast of 30.5%. The company's commitment to innovation is evident from its R&D investments, aligning with industry trends towards enhanced control systems and smart technology integration in manufacturing processes. These strategic moves not only bolster its market position but also promise sustained growth amidst increasing demand for intelligent solutions.

Mamezo Digital Holdings (TSE:202A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mamezo Digital Holdings Co., Ltd. offers IT solutions in Japan with a market capitalization of ¥49.51 billion.

Operations: Mamezo Digital Holdings Co., Ltd. specializes in providing IT solutions across Japan, focusing on diverse revenue streams within the technology sector.

Mamezo Digital Holdings, with its strategic focus on innovative software solutions, has demonstrated robust growth metrics that underscore its potential within Asia's tech sector. The company's revenue and earnings have grown by 11.8% and 11.5% respectively, outpacing the Japanese market averages of 4.4% and 7.8%. This performance is bolstered by significant R&D investments, which have not only fueled product enhancements but also positioned Mamezo as a forward-thinking player in technology development. With a forecasted Return on Equity of an impressive 41.3%, the firm is well-poised for future advancements in high-demand tech segments.

Make It Happen

- Click this link to deep-dive into the 186 companies within our Asian High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:202A

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives