- China

- /

- Electronic Equipment and Components

- /

- SHSE:688322

Exploring Global High Growth Tech Stocks with Promising Potential

Reviewed by Simply Wall St

Amid escalating tensions in the Middle East and fluctuating trade dynamics, global markets have experienced a turbulent week, with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 facing notable declines. In this environment of uncertainty, identifying high-growth tech stocks with robust fundamentals and innovative potential can offer investors opportunities to navigate market volatility effectively.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Rakovina Therapeutics | 40.75% | 16.49% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orbbec Inc. is a company that designs, manufactures, and sells 3D vision sensors with a market capitalization of CN¥20.18 billion.

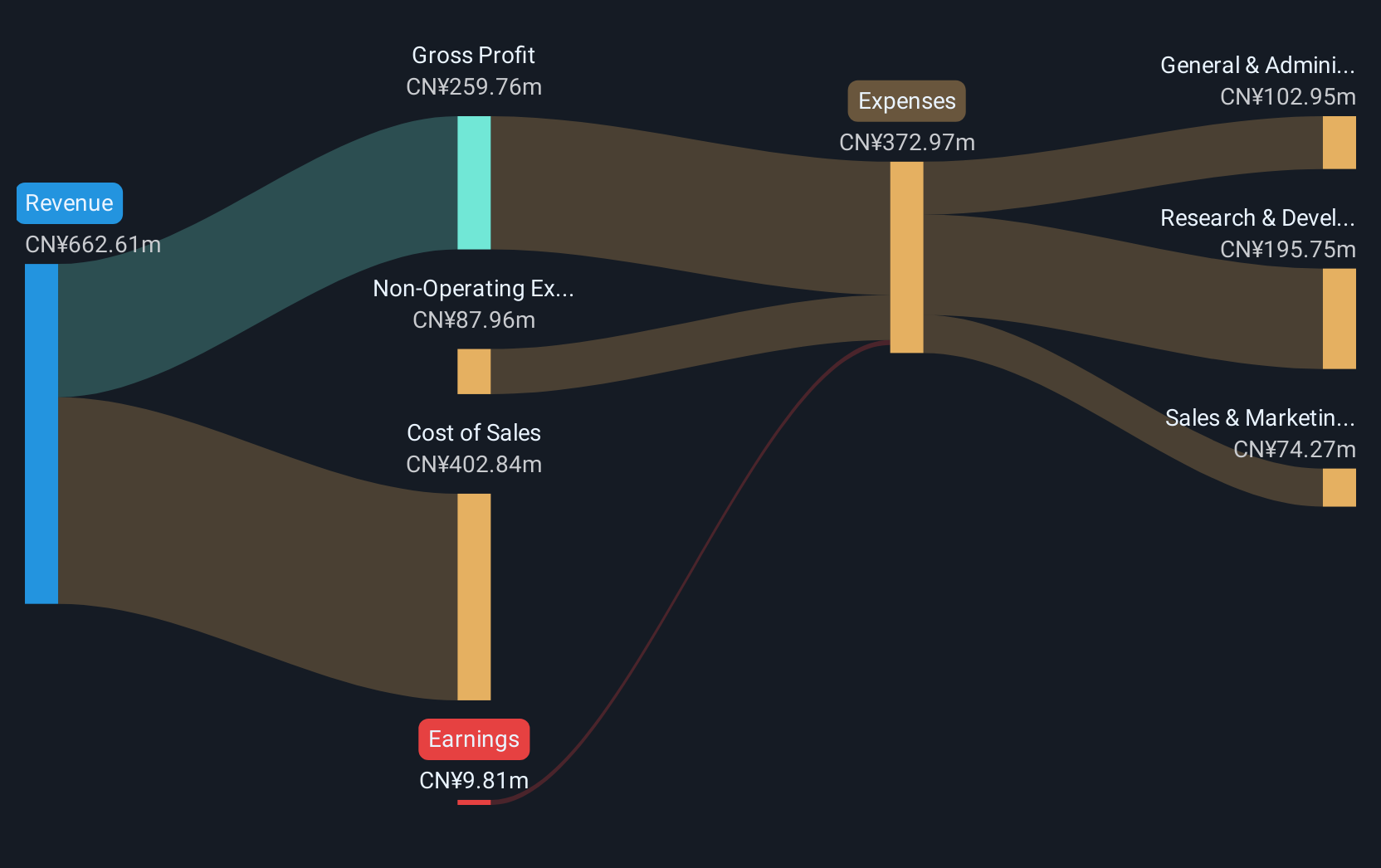

Operations: Orbbec generates revenue primarily through the sale of 3D vision sensors. The company's cost structure involves expenses related to design and manufacturing processes.

Orbbec, amidst a dynamic tech landscape, has demonstrated robust financial and operational growth. With an impressive annual revenue increase of 32.3%, the company significantly outpaces the Chinese market's average of 12.3%. This surge is supported by a recent earnings report highlighting a shift from a net loss to a profit of CNY 24.32 million, underscoring effective management and innovative strategies. Furthermore, Orbbec's commitment to R&D is evident in its strategic investments and recent private placement aimed at fueling further innovations, ensuring it remains at the forefront of technology advancements despite its current unprofitability and market challenges.

- Click to explore a detailed breakdown of our findings in Orbbec's health report.

Examine Orbbec's past performance report to understand how it has performed in the past.

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen H&T Intelligent Control Co.Ltd, along with its subsidiaries, engages in the research, development, manufacturing, sales, and marketing of intelligent controller products both domestically and internationally, with a market cap of CN¥17.20 billion.

Operations: H&T Intelligent Control focuses on the development and production of intelligent controller products, serving both domestic and international markets. The company operates with a market capitalization of CN¥17.20 billion, leveraging its expertise in research and manufacturing to drive sales globally.

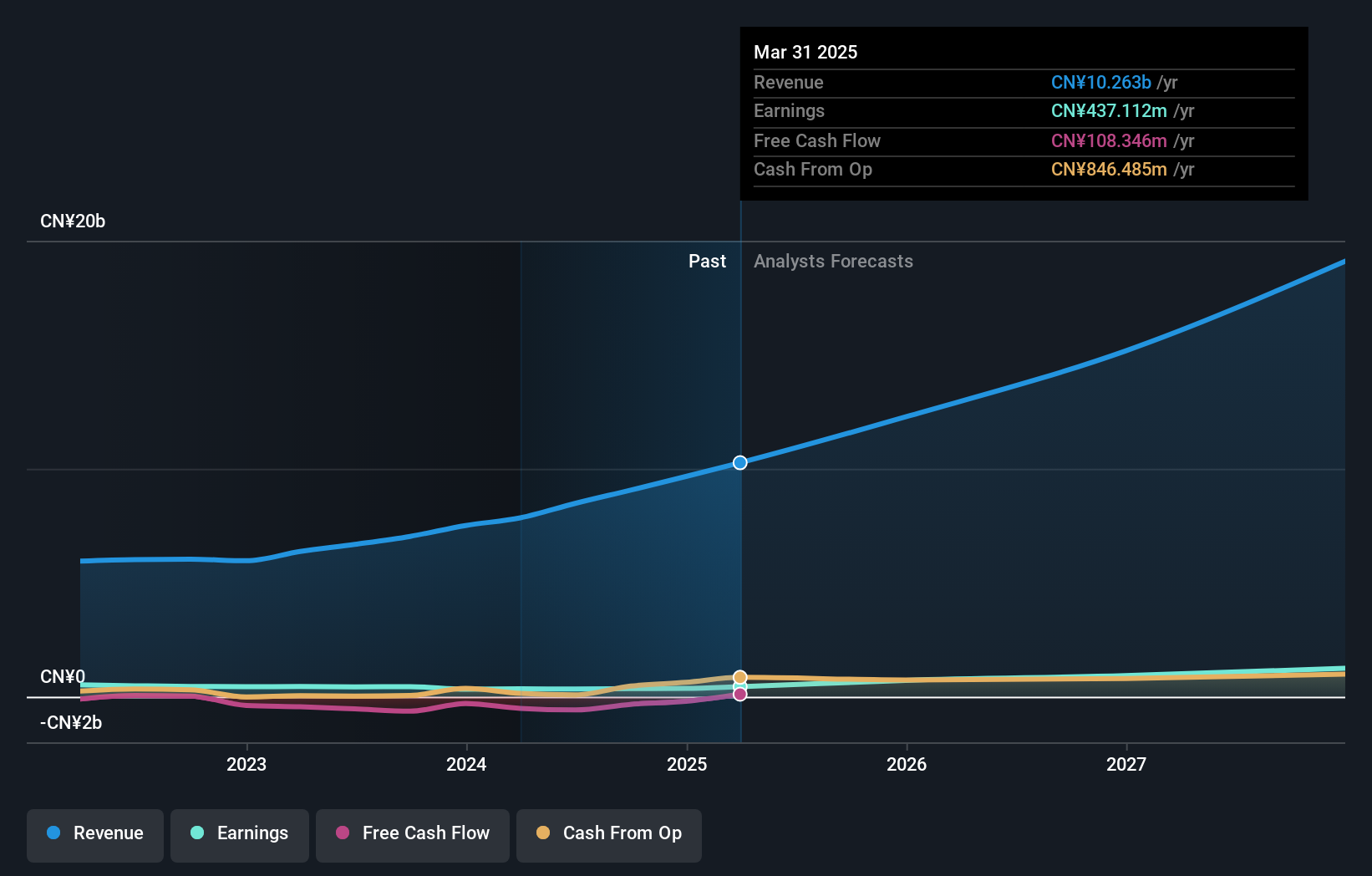

Shenzhen H&T Intelligent Control Co. Ltd has shown a commendable trajectory in its financial performance, with a 22% annual revenue growth outstripping the broader Chinese market's 12.3%. This growth is complemented by an impressive forecast of earnings expansion at 33.9% annually, signaling robust operational efficiency and market adaptability. The company's commitment to innovation is underscored by substantial investments in R&D, ensuring it stays relevant in the competitive tech landscape despite recent adjustments like dividend decreases and corporate restructuring as per its latest AGM decisions. These strategic moves reflect a proactive approach to governance and fiscal management that could shape its future in high-growth tech sectors.

Shanghai Huace Navigation Technology (SZSE:300627)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai Huace Navigation Technology Ltd. specializes in providing navigation and positioning solutions, with a market capitalization of CN¥25.06 billion.

Operations: Huace Navigation Technology generates revenue primarily through its navigation and positioning solutions. The company has a market capitalization of CN¥25.06 billion, reflecting its significant presence in the industry.

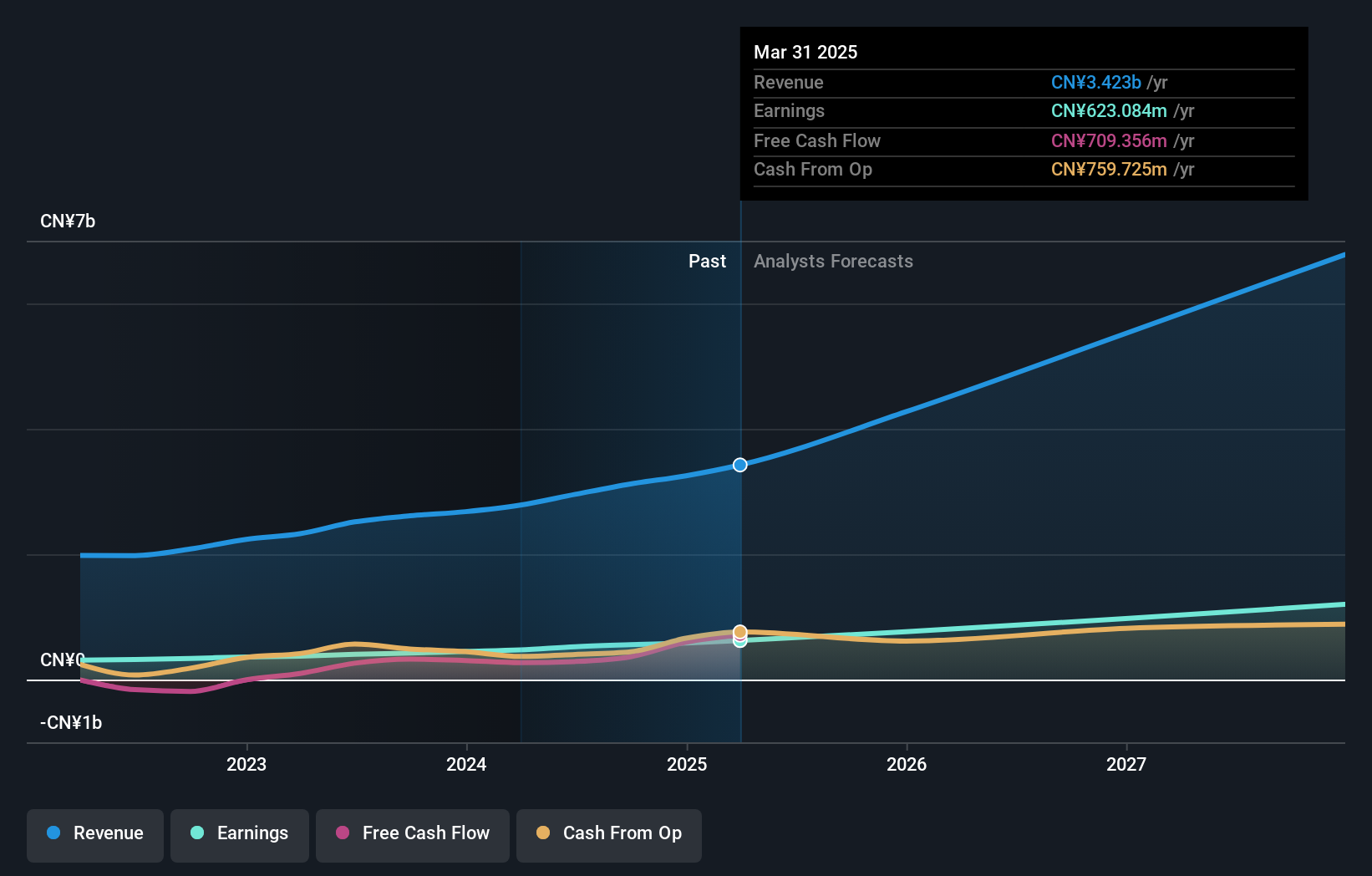

Shanghai Huace Navigation Technology has demonstrated robust financial health with a significant 24.4% annual revenue growth and 23.5% earnings growth, surpassing the broader Chinese market trends. The firm's strategic amendments to its bylaws and a consistent dividend payout, as approved in its recent AGM, reflect a proactive stance in corporate governance. With R&D expenses aligning closely with these growth metrics, the company is well-positioned to maintain its competitive edge in the tech industry, leveraging innovation to drive future expansions.

Next Steps

- Embark on your investment journey to our 744 Global High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688322

High growth potential with excellent balance sheet.

Market Insights

Community Narratives