- China

- /

- Electronic Equipment and Components

- /

- SZSE:002281

Accelink Technologies CoLtd And 2 Other High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and inflation trends, Asian tech stocks are drawing attention for their potential to thrive in a dynamic economic landscape. In this environment, high growth tech companies like Accelink Technologies CoLtd stand out due to their ability to innovate and adapt, making them intriguing considerations for those monitoring developments within the sector.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.68% | 30.37% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Auras Technology | 21.79% | 25.47% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.40% | 23.42% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.38% | 25.85% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Accelink Technologies Co., Ltd. is engaged in the research, development, manufacturing, sales, and provision of technical services for optoelectronic chips, devices, modules, and subsystem products primarily in China with a market capitalization of approximately CN¥35.20 billion.

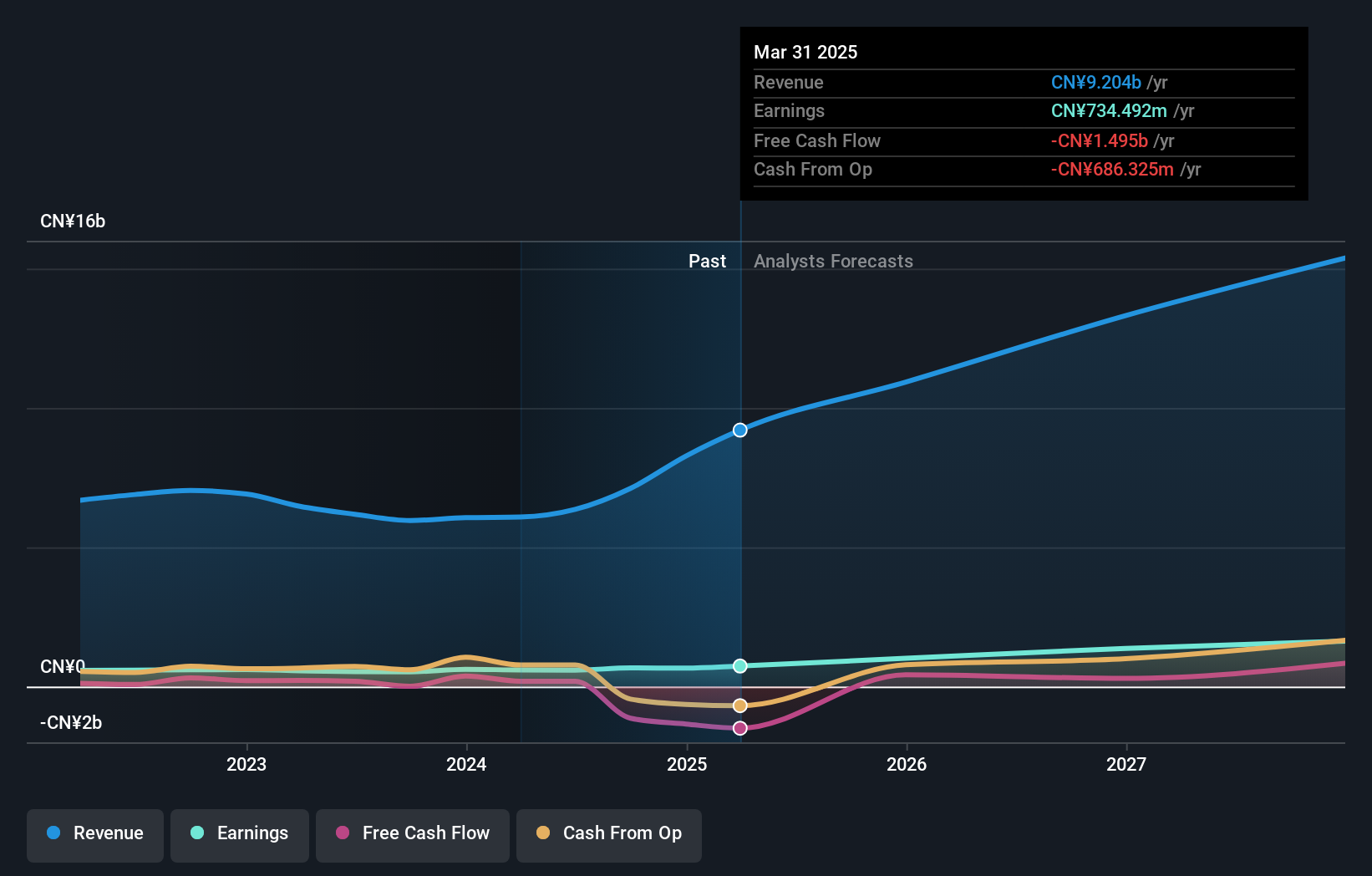

Operations: Accelink focuses on the communication equipment manufacturing sector, generating revenue of approximately CN¥9.16 billion.

Accelink Technologies CoLtd's recent performance and strategic moves underscore its potential in the high-tech sector in Asia. With a robust annual revenue growth of 18.9% and an impressive earnings increase of 28.1% over the past year, the company is outpacing many in its industry. Recent developments, such as their presentation at international tech conferences and substantial dividend increases, reflect a commitment to growth and shareholder value. Furthermore, R&D investments are pivotal to their strategy, ensuring that Accelink remains at the forefront of technological advancements in optical communication systems. These factors combined suggest that Accelink is well-positioned for sustained growth amidst evolving market demands.

- Navigate through the intricacies of Accelink Technologies CoLtd with our comprehensive health report here.

Gain insights into Accelink Technologies CoLtd's past trends and performance with our Past report.

Aerospace CH UAVLtd (SZSE:002389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aerospace CH UAV Co., Ltd specializes in the research, design, manufacturing, testing, sales, and servicing of drones and their onboard mission equipment with a market capitalization of CN¥22.49 billion.

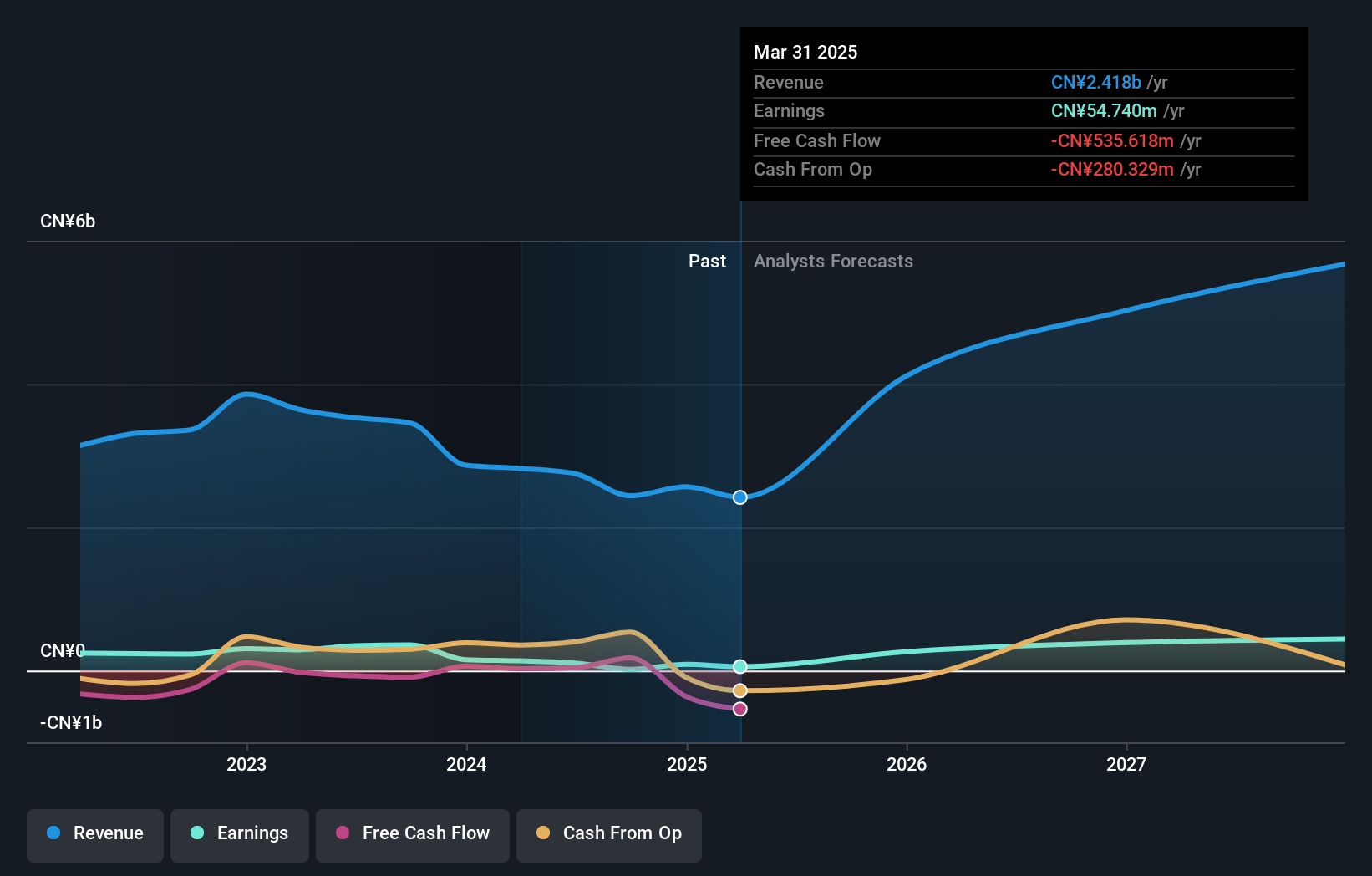

Operations: Aerospace CH UAV Co., Ltd focuses on developing and producing drones along with their mission equipment. The company engages in various stages of the drone lifecycle, including research, design, manufacturing, testing, sales, and servicing.

Despite a challenging year with a net loss reported in Q1 2025, Aerospace CH UAVLtd's strategic focus on aerospace and emerging tech sectors indicates potential resilience. The company's revenue growth forecast at 28.8% annually outstrips the Chinese market average of 12.4%, highlighting its robust market position. Additionally, an impressive anticipated annual earnings growth of 55.6% underscores its recovery potential amidst industry shifts. With R&D expenses aligned to foster innovations in UAV technology, Aerospace CH UAVLtd is poised to capitalize on evolving aerospace demands, ensuring it remains a significant player in high-growth tech sectors across Asia.

- Dive into the specifics of Aerospace CH UAVLtd here with our thorough health report.

Evaluate Aerospace CH UAVLtd's historical performance by accessing our past performance report.

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Broadex Technologies Co., Ltd. is engaged in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥15.65 billion.

Operations: Broadex Technologies focuses on the development and sale of integrated optoelectronic devices for optical communications, catering to both domestic and international markets. The company operates in a niche sector with a significant market presence, as indicated by its market capitalization of CN¥15.65 billion.

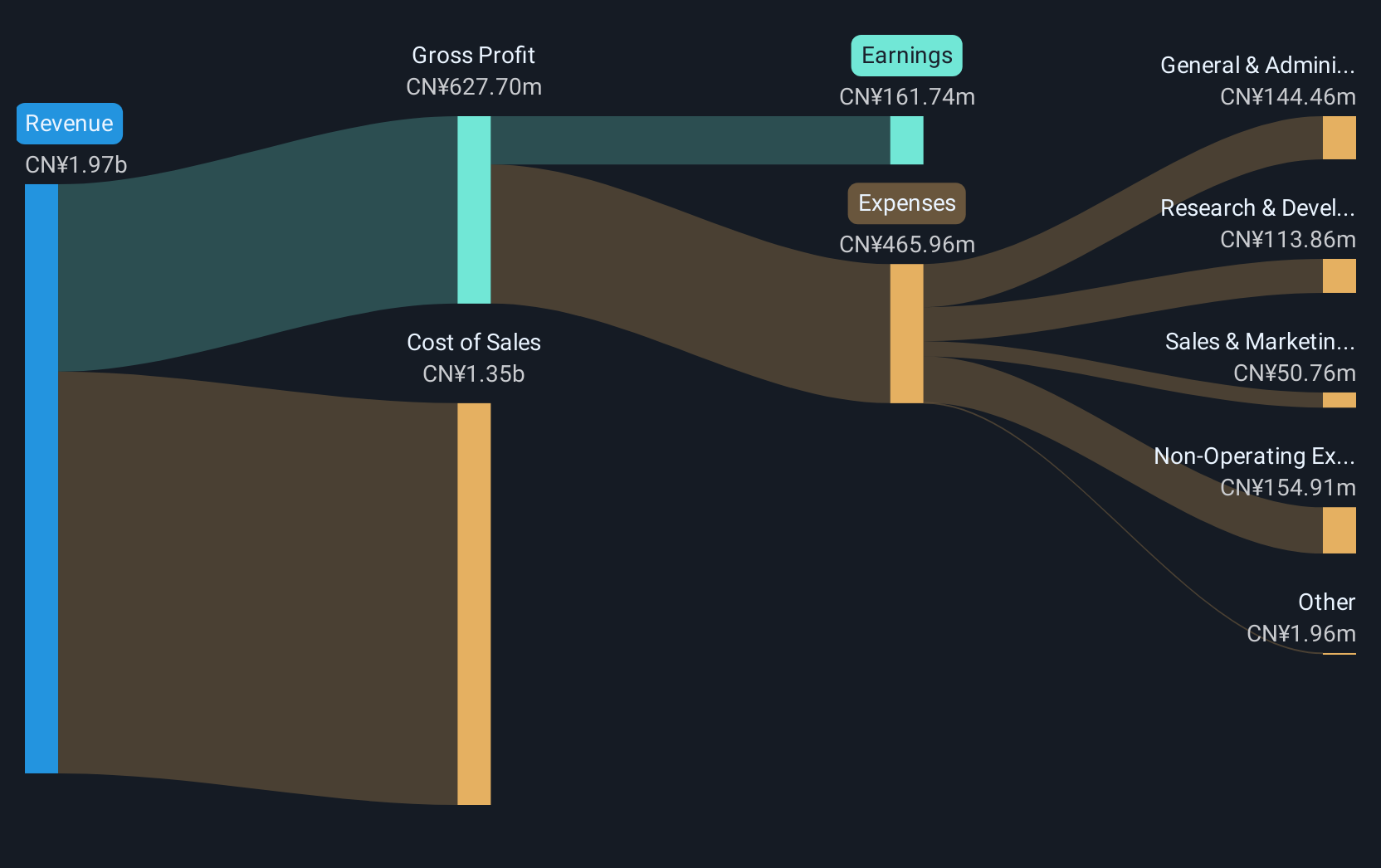

Broadex Technologies has demonstrated robust growth dynamics, with a notable 20.7% annual revenue increase and an impressive 24.4% rise in earnings per year, surpassing the broader Chinese market's growth rates of 12.4% and 23.4%, respectively. This performance is underpinned by substantial R&D investments that fuel innovation, evidenced by their recent significant earnings leap of 309.9% over the past year, far outstripping the communications industry's average of 8.8%. Recent corporate activities including amendments to its bylaws and a consistent dividend payout further reflect Broadex’s strategic adaptability and shareholder commitment amidst rapid technological evolutions in Asia’s tech landscape.

Next Steps

- Access the full spectrum of 488 Asian High Growth Tech and AI Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002281

Accelink Technologies CoLtd

Researches, develops, manufactures, sells, and technical services for optoelectronic chips, devices, modules, and subsystem products primarily in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion