- China

- /

- Electronic Equipment and Components

- /

- SZSE:002362

Further Upside For Hanwang Technology Co.,Ltd (SZSE:002362) Shares Could Introduce Price Risks After 38% Bounce

Hanwang Technology Co.,Ltd (SZSE:002362) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

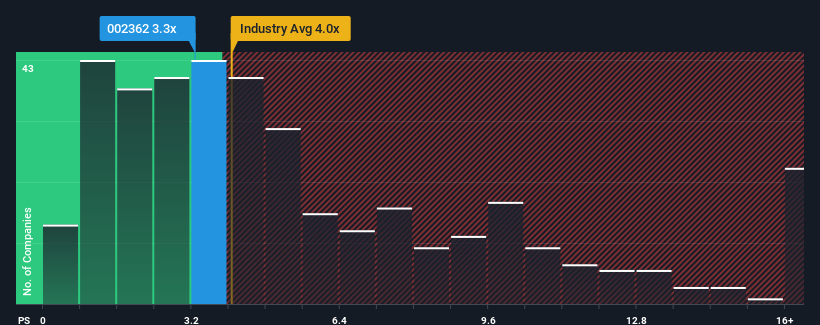

Although its price has surged higher, it's still not a stretch to say that Hanwang TechnologyLtd's price-to-sales (or "P/S") ratio of 3.3x right now seems quite "middle-of-the-road" compared to the Electronic industry in China, where the median P/S ratio is around 4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Hanwang TechnologyLtd

How Has Hanwang TechnologyLtd Performed Recently?

Recent times haven't been great for Hanwang TechnologyLtd as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Hanwang TechnologyLtd will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Hanwang TechnologyLtd?

Hanwang TechnologyLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.1% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 10% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the only analyst following the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Hanwang TechnologyLtd's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Hanwang TechnologyLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Hanwang TechnologyLtd's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Hanwang TechnologyLtd with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Hanwang TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hanwang TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002362

Hanwang TechnologyLtd

Provides handwriting recognition, optical character recognition, and handwriting input products in China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives