Stock Analysis

- Turkey

- /

- Industrials

- /

- IBSE:IHLAS

Ihlas Holding Leads The Pack Of 3 Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have experienced a tumultuous week, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating sharply. Amidst this backdrop of fluctuating market conditions, investors often look to smaller or newer companies for potential opportunities. Penny stocks, despite their somewhat outdated name, continue to offer intriguing possibilities for growth at lower price points. In this article, we explore several penny stocks that stand out due to their financial strength and potential for long-term success in today's complex economic landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.22 | THB1.8B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.60 | A$70.33M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.815 | £207.57M | ★★★★★★ |

Click here to see the full list of 5,775 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Ihlas Holding (IBSE:IHLAS)

Simply Wall St Financial Health Rating: ★★★★☆☆

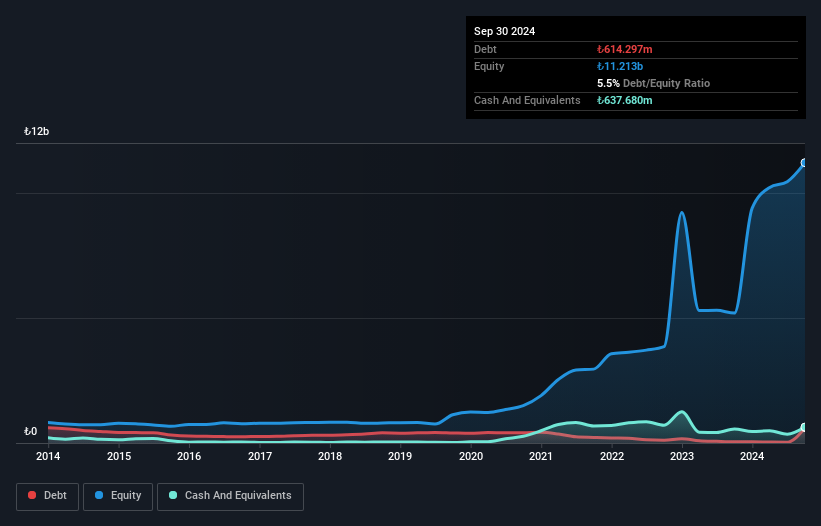

Overview: Ihlas Holding A.S. operates in construction and real estate, media, manufacturing and trading, and healthcare and education sectors both in Turkey and internationally, with a market cap of TRY1.72 billion.

Operations: The company's revenue is primarily derived from its construction segment at TRY2.88 billion, followed by marketing at TRY2.58 billion, and media at TRY1.67 billion.

Market Cap: TRY1.72B

Ihlas Holding A.S. recently reported a net loss for the second quarter of 2024, despite sales growth to TRY1.87 billion. The company has experienced significant volatility due to one-off losses and shareholder dilution, with total shares outstanding increasing by 6%. Although Ihlas's short-term assets comfortably cover both its short- and long-term liabilities, its negative operating cash flow indicates debt is not well covered. Despite these challenges, the company's price-to-earnings ratio suggests it may be undervalued compared to the broader Turkish market. Management stability is notable with an average tenure of 12.8 years.

- Click to explore a detailed breakdown of our findings in Ihlas Holding's financial health report.

- Examine Ihlas Holding's past performance report to understand how it has performed in prior years.

Shenzhen Success Electronics (SZSE:002289)

Simply Wall St Financial Health Rating: ★★★★☆☆

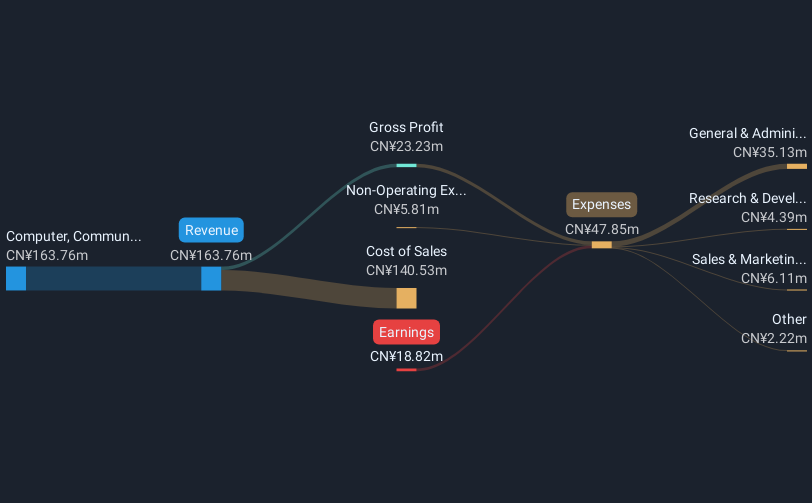

Overview: Shenzhen Success Electronics Co., Ltd focuses on the R&D, production, and sale of LCD screens, touch screens, and integrated display modules in China with a market cap of CN¥1.08 billion.

Operations: No specific revenue segments are reported for Shenzhen Success Electronics Co., Ltd.

Market Cap: CN¥1.08B

Shenzhen Success Electronics Co., Ltd has recently reported a net loss for the nine months ending September 2024, despite an increase in sales to CN¥134.71 million. The company faces financial challenges with less than a year of cash runway if its free cash flow continues to decline. However, it maintains a satisfactory net debt to equity ratio of 2% and has reduced its debt significantly over the past five years. Short-term assets exceed both short- and long-term liabilities, providing some financial stability. The board's average tenure is relatively short at 1.7 years, indicating limited experience in leadership roles.

- Take a closer look at Shenzhen Success Electronics' potential here in our financial health report.

- Gain insights into Shenzhen Success Electronics' historical outcomes by reviewing our past performance report.

Exasol (XTRA:EXL)

Simply Wall St Financial Health Rating: ★★★★★★

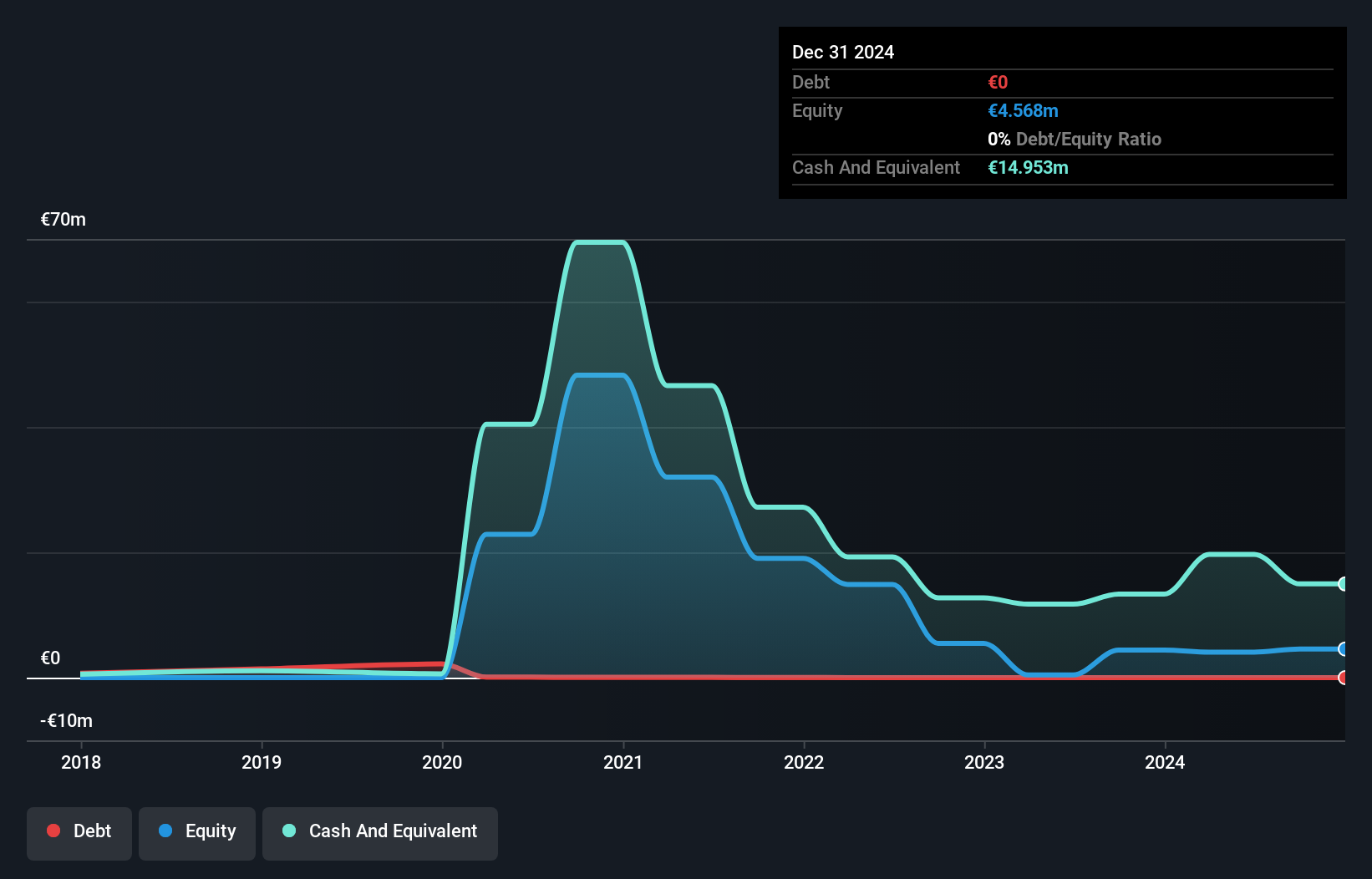

Overview: Exasol AG develops databases for analytics and data warehousing across Germany, Austria, Switzerland, Great Britain, North America, and internationally with a market cap of €54.23 million.

Operations: The company's revenue is primarily derived from the DACH region (€24.64 million), followed by North America (€6.06 million), the Rest of the World (€3.72 million), and Great Britain (€2.42 million).

Market Cap: €54.23M

Exasol AG, with a market cap of €54.23 million, has shown resilience despite being unprofitable by reducing its net loss significantly from €4.98 million to €0.26 million year-over-year for the half ending June 2024, while increasing sales to €19.44 million. The company benefits from a strong cash runway exceeding three years due to positive free cash flow and is debt-free, which provides financial flexibility. Although its share price has been volatile recently, Exasol's management team is experienced and the company's short-term assets comfortably cover both short- and long-term liabilities, indicating stable financial health amidst industry challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Exasol.

- Learn about Exasol's future growth trajectory here.

Make It Happen

- Take a closer look at our Penny Stocks list of 5,775 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IHLAS

Ihlas Holding

Engages in the construction and real estate, media, manufacturing and trading, and healthcare and education businesses in Turkey and internationally.