As of October 2025, Asian markets have shown resilience amid global economic fluctuations, with mainland Chinese stock markets experiencing notable gains driven by technology-focused shares despite lingering concerns about domestic demand. In this context, identifying high-growth tech stocks involves looking for companies that are not only innovating but also adapting to evolving market conditions and demonstrating strong fundamentals in a dynamic economic environment.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| PharmaEssentia | 34.00% | 50.89% | ★★★★★★ |

| Fositek | 36.03% | 47.77% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| ASROCK Incorporation | 30.39% | 32.50% | ★★★★★★ |

| Shengyi TechnologyLtd | 20.20% | 31.67% | ★★★★★★ |

| Shengyi Electronics | 23.62% | 31.31% | ★★★★★★ |

| Zhongji Innolight | 28.99% | 31.11% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

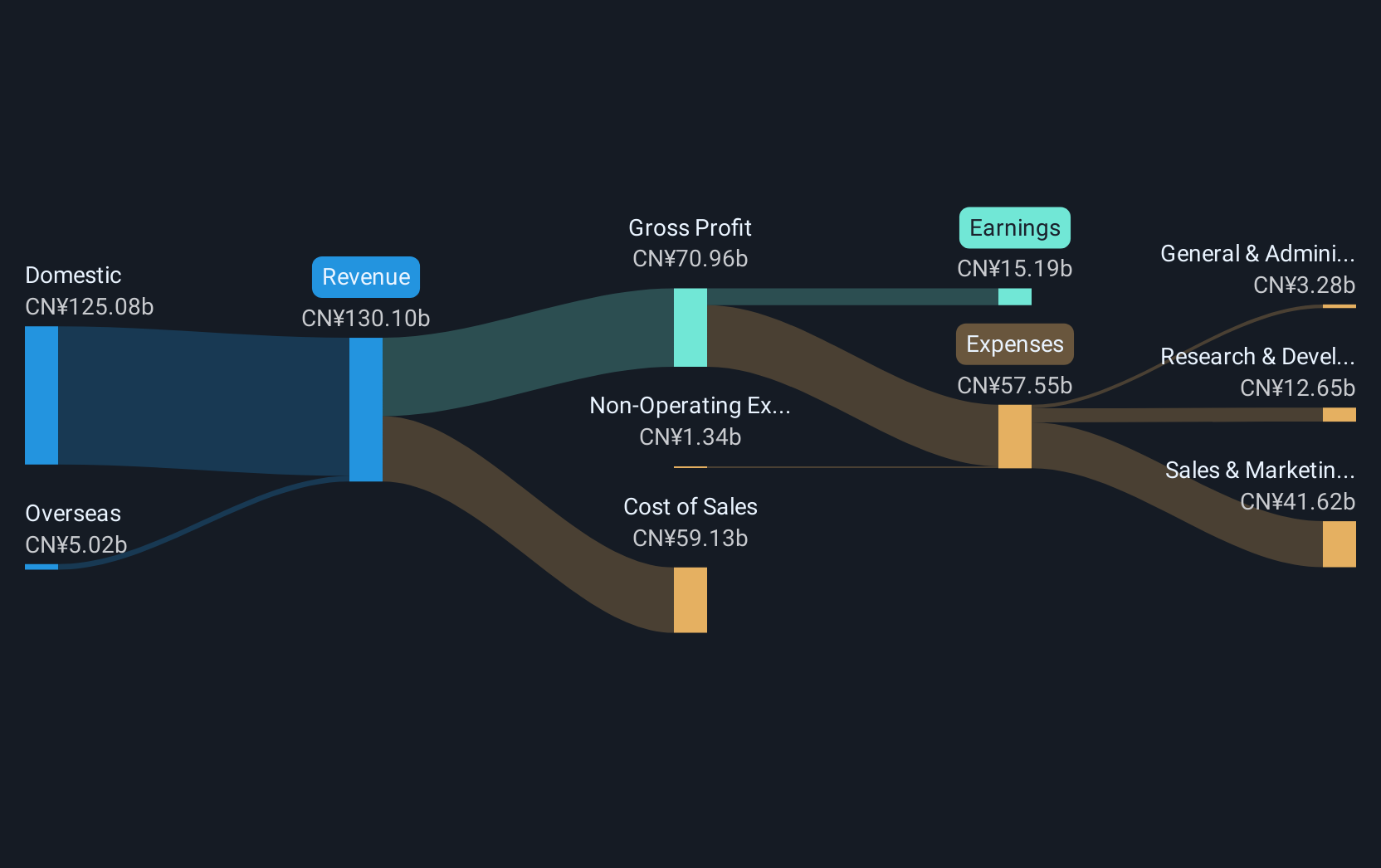

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China, with a market capitalization of HK$324 billion.

Operations: The company's revenue is primarily derived from domestic operations, amounting to CN¥128.93 billion, with overseas activities contributing CN¥5.24 billion.

Kuaishou Technology's recent launch of the Kling AI 2.5 Turbo Video Model underscores its commitment to innovation, significantly enhancing its AI-driven video generation capabilities at reduced costs, a move likely to bolster its competitive edge in the interactive media space. This strategic product enhancement coincides with robust financial performance, evidenced by a notable increase in quarterly sales from CNY 30.98 billion to CNY 35.05 billion and a rise in net income from CNY 3.98 billion to CNY 4.92 billion year-over-year. The company also demonstrated shareholder confidence through substantial share repurchases totaling HKD 5.65 billion and announcing a special dividend, reflecting strong financial health and commitment to returning value to shareholders.

- Unlock comprehensive insights into our analysis of Kuaishou Technology stock in this health report.

Gain insights into Kuaishou Technology's past trends and performance with our Past report.

Wuhan Dameng Database (SHSE:688692)

Simply Wall St Growth Rating: ★★★★☆☆

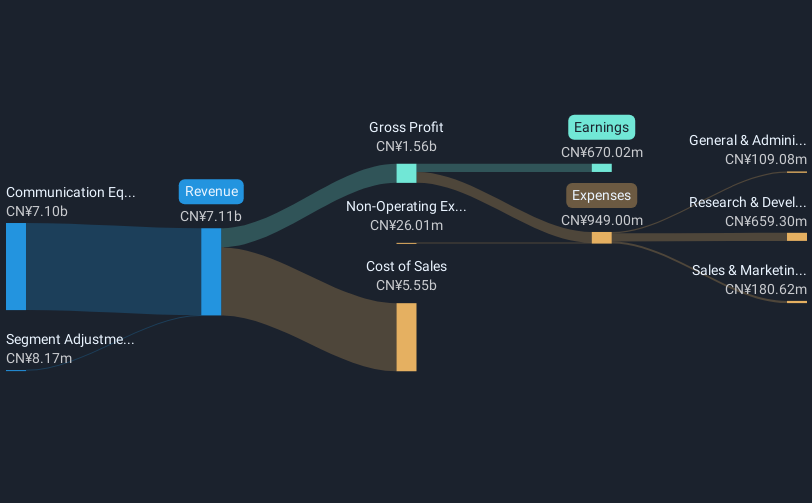

Overview: Wuhan Dameng Database Company Limited specializes in database product development services in China and has a market cap of CN¥29.55 billion.

Operations: The company generates revenue primarily from data processing services, amounting to CN¥1.22 billion.

Wuhan Dameng Database has demonstrated significant growth, with its earnings surging by 42.2% over the past year, outpacing the software industry's average. This performance is bolstered by a strategic focus on R&D, crucial for maintaining its competitive edge in a rapidly evolving tech landscape. The company's recent inclusion in the S&P Global BMI Index underscores its rising prominence within the sector. Looking ahead, Wuhan Dameng is poised to expand further, with earnings expected to grow by 21% annually, slightly below China’s market average but still robust. This growth trajectory is supported by a strong increase in revenue from CNY 351.9 million to CNY 523.08 million year-over-year and an impressive net income rise from CNY 103.19 million to CNY 204.68 million, indicating effective cost management and operational efficiency.

- Click here and access our complete health analysis report to understand the dynamics of Wuhan Dameng Database.

Assess Wuhan Dameng Database's past performance with our detailed historical performance reports.

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Accelink Technologies Co., Ltd. engages in the research, development, manufacturing, and sale of optoelectronic chips, devices, modules, and subsystem products primarily in China with a market cap of CN¥51.02 billion.

Operations: The company focuses on optoelectronic technology, offering a range of products from chips to subsystems. It provides technical services alongside its product offerings, primarily targeting the Chinese market.

Accelink Technologies has shown robust financial performance, with a significant revenue jump from CNY 5.38 billion to CNY 8.53 billion year-over-year, and net income increasing from CNY 464 million to CNY 719 million in the same period. This growth is underpinned by a strategic emphasis on R&D, allocating substantial resources to foster innovation—critical in staying ahead in the competitive tech landscape of Asia. The company's recent private placement of shares worth CNY 3.5 billion highlights its proactive approach to fuel further expansion and technological advancement, positioning it well for sustained growth amidst evolving industry dynamics.

- Click to explore a detailed breakdown of our findings in Accelink Technologies CoLtd's health report.

Understand Accelink Technologies CoLtd's track record by examining our Past report.

Key Takeaways

- Embark on your investment journey to our 184 Asian High Growth Tech and AI Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuhan Dameng Database might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688692

Wuhan Dameng Database

Provides database product development services in China.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion