- China

- /

- Communications

- /

- SHSE:688027

Exploring 3 High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

As the Asian markets navigate a landscape marked by Japan's interest rate hikes and China's mixed economic indicators, investors are paying close attention to sectors that promise robust growth amidst these shifting dynamics. In this environment, identifying high-growth tech stocks requires a keen understanding of how companies leverage innovation and adapt to regional economic shifts, making them potentially attractive in an evolving market.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 36.73% | 38.14% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.60% | 32.84% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

QuantumCTek (SHSE:688027)

Simply Wall St Growth Rating: ★★★★★☆

Overview: QuantumCTek Co., Ltd. is involved in the research, development, production, and sale of quantum communication, computing, and precision measurement products in China with a market capitalization of CN¥51.85 billion.

Operations: QuantumCTek focuses on quantum communication, computing, and precision measurement products. The company generates revenue primarily through the sale of these advanced technology products in China.

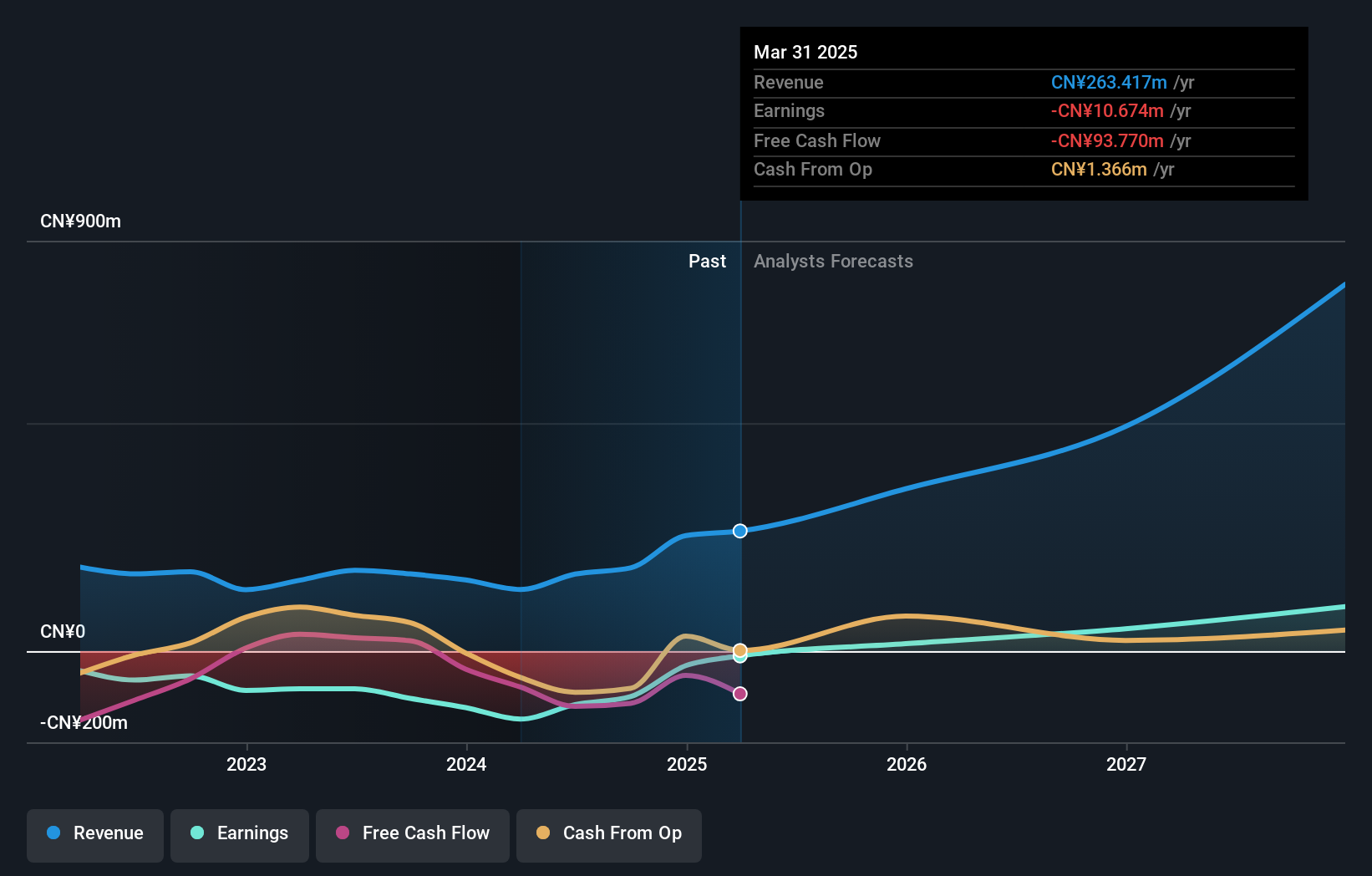

QuantumCTek has demonstrated notable resilience and potential within the high-growth tech sector in Asia, particularly through its recent financial performance. Despite a net loss, the company's revenue nearly doubled to CNY 189.73 million from CNY 99.71 million year-over-year, reflecting a robust growth rate of 32.7%. This surge is supported by significant reductions in losses, down to CNY 26.47 million from CNY 55.12 million, showcasing effective cost management and operational improvements. Looking ahead, QuantumCTek is expected to turn profitable within three years with an annual earnings growth forecast at an impressive rate of 134.7%, positioning it well against industry averages and highlighting its upward trajectory in leveraging advanced technologies for market expansion.

- Click to explore a detailed breakdown of our findings in QuantumCTek's health report.

Examine QuantumCTek's past performance report to understand how it has performed in the past.

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Accelink Technologies Co., Ltd. is engaged in the research, development, manufacturing, sales, and provision of technical services for optoelectronic chips, devices, modules, and subsystem products primarily in China with a market capitalization of CN¥56.66 billion.

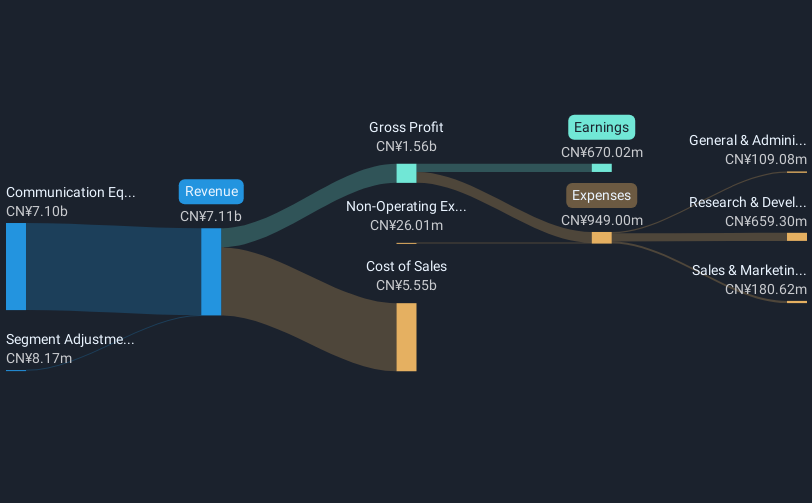

Operations: The company generates revenue primarily from its Communication Equipment Manufacturing segment, which accounted for CN¥11.38 billion.

Accelink Technologies CoLtd, amidst a dynamic tech landscape in Asia, has showcased robust financial health and strategic adaptability. With an 18.6% annual revenue growth outpacing the Chinese market's 14.4%, coupled with a significant earnings increase of 29.7% per year, the company is evidently scaling efficiently. Recent structural changes and leadership appointments underscore its readiness to leverage these gains for future expansion strategies. Moreover, R&D investments have been pivotal in maintaining this momentum, ensuring Accelink remains at the forefront of technological advancements within its sector.

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection systems globally with a market cap of CN¥21.25 billion.

Operations: The company operates in the micro electronic connectors and interconnection systems sector, targeting markets across China, North America, Europe, Japan, and the Asia Pacific. It focuses on research, design, development, manufacturing, and sales activities within this industry.

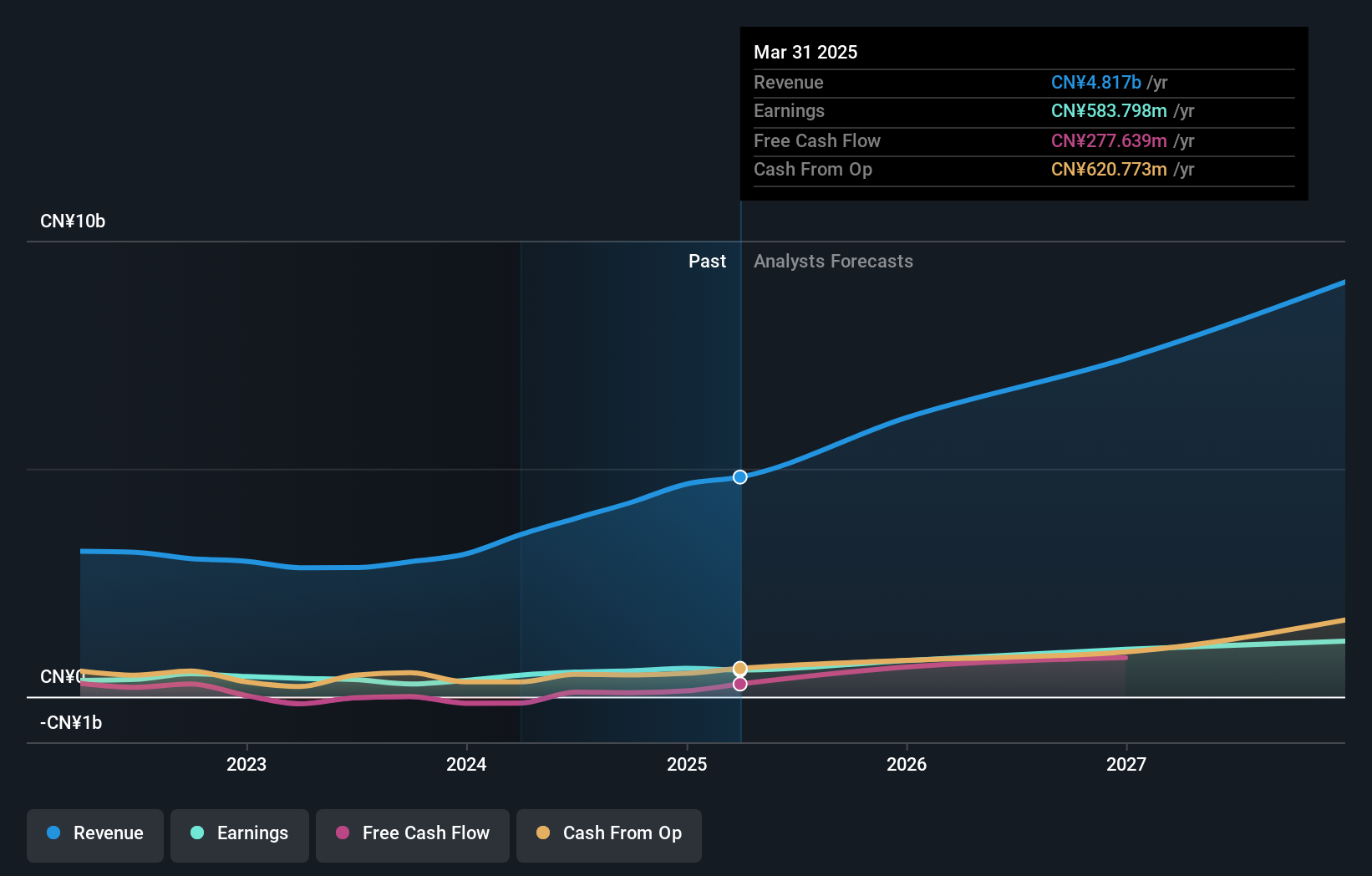

Electric Connector Technology, navigating through a competitive tech environment in Asia, has demonstrated notable financial resilience and strategic foresight. With revenue surging by 21.2% to CNY 4.04 billion and an anticipated robust annual earnings growth of 30.9%, the company is well-positioned for sustained expansion. Despite a temporary dip in net income to CNY 372.78 million from last year's CNY 458.59 million, strategic investments in R&D are poised to bolster future capabilities and market position, particularly as it prepares for its upcoming special shareholders meeting aimed at enhancing executive operational security.

Key Takeaways

- Get an in-depth perspective on all 189 Asian High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QuantumCTek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688027

QuantumCTek

Engages in the research, development, production, and sale of quantum communication, computing, and precision measurement products in China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion