Optimistic Investors Push CETC Cyberspace Security Technology Co., Ltd. (SZSE:002268) Shares Up 27% But Growth Is Lacking

CETC Cyberspace Security Technology Co., Ltd. (SZSE:002268) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 41% over that time.

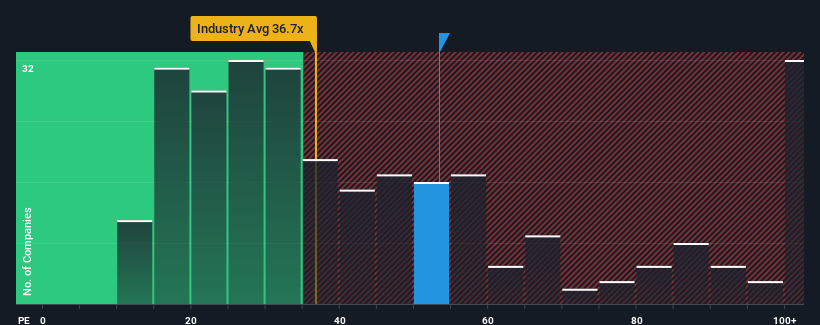

After such a large jump in price, CETC Cyberspace Security Technology may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 53.4x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for CETC Cyberspace Security Technology recently, which is pleasing to see. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for CETC Cyberspace Security Technology

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as CETC Cyberspace Security Technology's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a worthy increase of 14%. This was backed up an excellent period prior to see EPS up by 183% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's about the same on an annualised basis.

With this information, we find it interesting that CETC Cyberspace Security Technology is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

CETC Cyberspace Security Technology's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of CETC Cyberspace Security Technology revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for CETC Cyberspace Security Technology with six simple checks.

Of course, you might also be able to find a better stock than CETC Cyberspace Security Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002268

CETC Cyberspace Security Technology

CETC Cyberspace Security Technology Co., Ltd.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives