- China

- /

- Tech Hardware

- /

- SZSE:002180

Ninestar (SZSE:002180) ascends 4.4% this week, taking five-year gains to 24%

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, long term Ninestar Corporation (SZSE:002180) shareholders have enjoyed a 23% share price rise over the last half decade, well in excess of the market return of around 2.2% (not including dividends).

Since it's been a strong week for Ninestar shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Ninestar

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Ninestar's earnings per share are down 41% per year, despite strong share price performance over five years.

Since the EPS are down strongly, it seems highly unlikely market participants are looking at EPS to value the company. Given that EPS is down, but the share price is up, it seems clear the market is focussed on other aspects of the business, at the moment.

The revenue growth of 2.9% per year hardly seems impressive. So why is the share price up? It's not immediately obvious to us, but a closer look at the company's progress over time might yield answers.

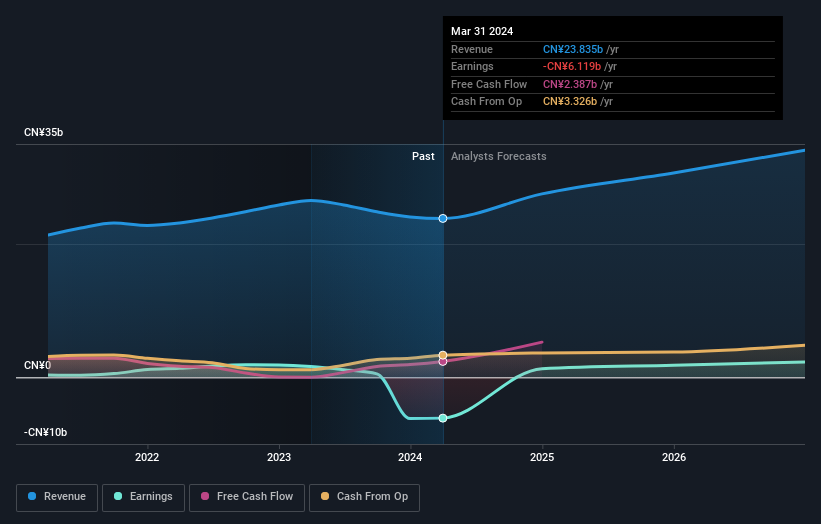

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Ninestar's financial health with this free report on its balance sheet.

A Different Perspective

The total return of 18% received by Ninestar shareholders over the last year isn't far from the market return of -17%. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. It's always interesting to track share price performance over the longer term. But to understand Ninestar better, we need to consider many other factors. For instance, we've identified 1 warning sign for Ninestar that you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ninestar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002180

Ninestar

Engages in the research and development, production, processing, and sales of self-produced printers, and printer consumables and accessories.

Very undervalued with adequate balance sheet.