Chinese Exchange Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The Chinese stock market has recently faced challenges, with major indices like the Shanghai Composite and CSI 300 experiencing notable declines. Amid this backdrop, identifying growth companies with high insider ownership can provide investors with unique opportunities to align their interests with those of company insiders who have a vested interest in the firm's success. In today's volatile market environment, stocks that exhibit strong growth potential and significant insider ownership often signal confidence from those closest to the company's operations. This alignment can be particularly compelling for investors seeking stability and long-term value amidst broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 26.5% |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 28.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Let's dive into some prime choices out of the screener.

Jinan Shengquan Group Share Holding (SHSE:605589)

Simply Wall St Growth Rating: ★★★★☆☆

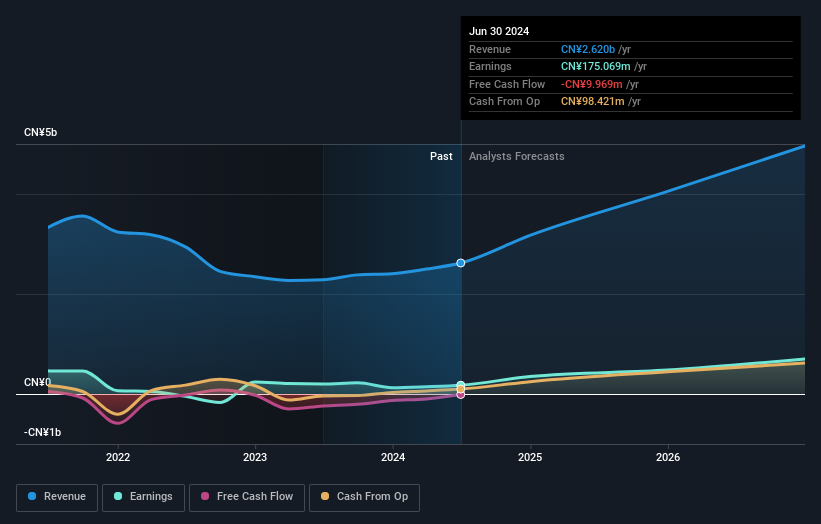

Overview: Jinan Shengquan Group Share Holding Co., Ltd. operates in the manufacturing sector and has a market cap of CN¥16.87 billion.

Operations: Jinan Shengquan Group Share Holding Co., Ltd. operates in the manufacturing sector and has a market cap of CN¥16.87 billion. The company's revenue segments include various divisions within its manufacturing operations, generating substantial income across multiple areas of production and services.

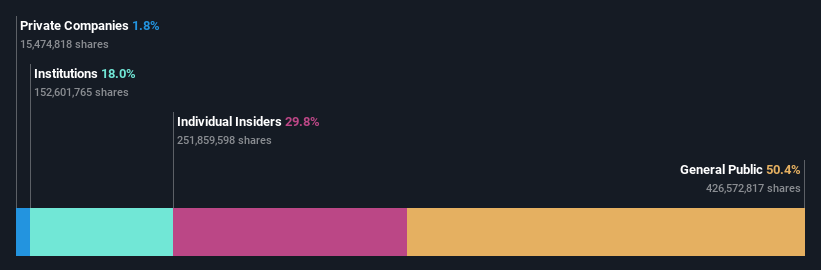

Insider Ownership: 29.8%

Revenue Growth Forecast: 16.3% p.a.

Jinan Shengquan Group Share Holding is trading at a good value with a P/E ratio of 21.1x compared to the CN market's 27.5x. Revenue growth is forecasted at 16.3% per year, outpacing the market's 13.6%. Earnings are expected to grow significantly at 23.14% annually, faster than the CN market's 22.1%. A recent share repurchase program worth CNY250 million aims to boost investor confidence and support future development plans, highlighting strong insider commitment despite past shareholder dilution and low ROE forecasts (11.9%).

- Delve into the full analysis future growth report here for a deeper understanding of Jinan Shengquan Group Share Holding.

- Insights from our recent valuation report point to the potential undervaluation of Jinan Shengquan Group Share Holding shares in the market.

Weihai Guangtai Airport EquipmentLtd (SZSE:002111)

Simply Wall St Growth Rating: ★★★★★☆

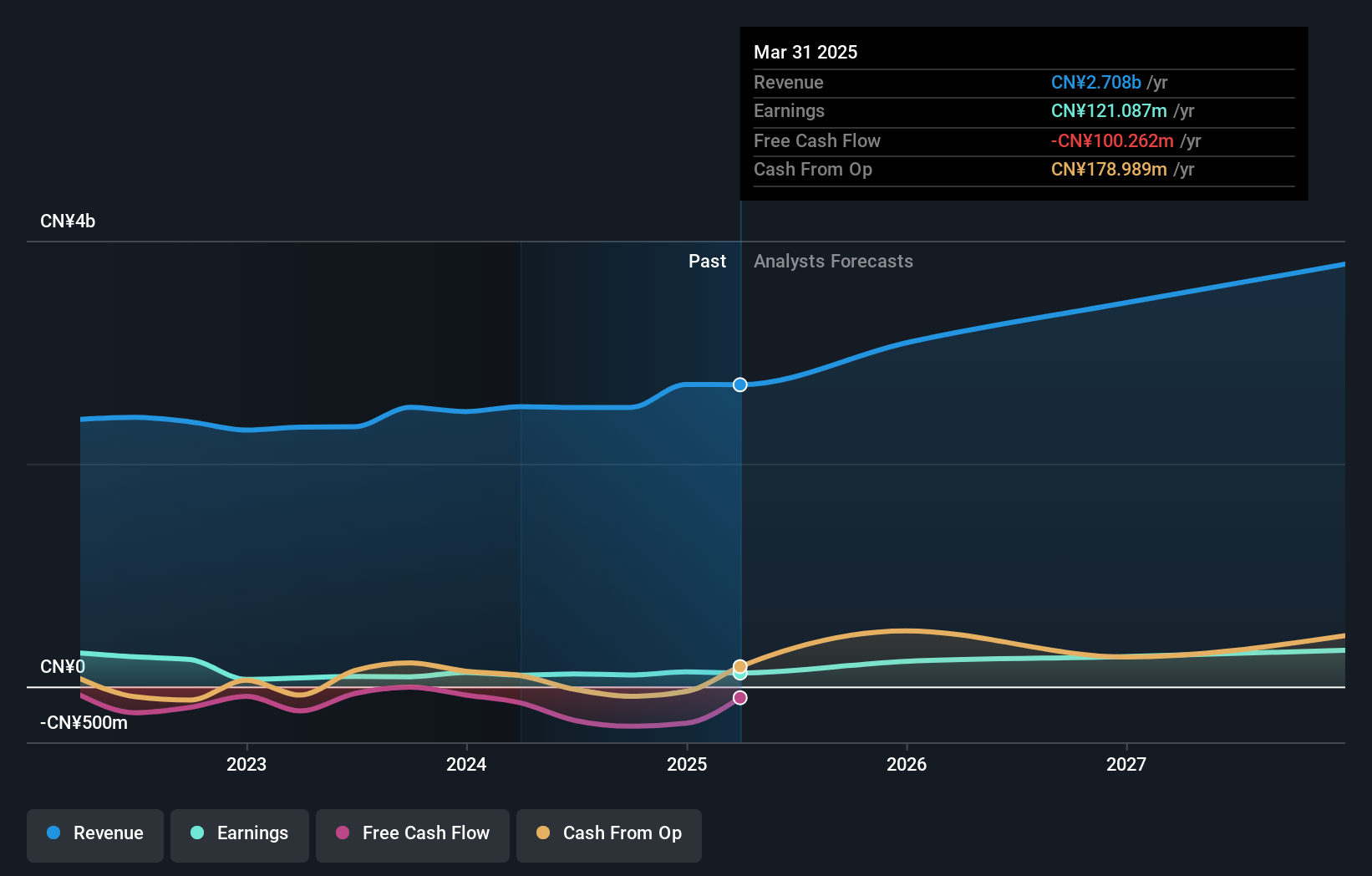

Overview: Weihai Guangtai Airport Equipment Co., Ltd. manufactures and sells ground support and fire-fighting equipment in China and internationally, with a market cap of approximately CN¥5.54 billion.

Operations: The company's revenue segments include ground support equipment and fire-fighting equipment.

Insider Ownership: 17.1%

Revenue Growth Forecast: 24.3% p.a.

Weihai Guangtai Airport Equipment Ltd. is forecasted to achieve robust earnings growth of 46.29% annually over the next three years, significantly outpacing the CN market's 22.1%. Revenue is also expected to grow at a strong rate of 24.3% per year, surpassing market averages. Despite lower profit margins compared to last year and a dividend yield of only 0.93%, recent insider activities such as share repurchases worth CNY75 million signal confidence in future prospects and high insider ownership stability.

- Click here to discover the nuances of Weihai Guangtai Airport EquipmentLtd with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Weihai Guangtai Airport EquipmentLtd shares in the market.

Longhua Technology GroupLtd (SZSE:300263)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Longhua Technology Group Co., Ltd. manufactures and sells heat transfer and energy-saving equipment in China, with a market cap of CN¥4.79 billion.

Operations: The company's revenue segments include manufacturing and selling heat transfer and energy-saving equipment in China.

Insider Ownership: 22.4%

Revenue Growth Forecast: 18.5% p.a.

Longhua Technology Group Ltd. is expected to see its earnings grow significantly at 37.7% annually, outpacing the CN market's 22.1%. Revenue growth is forecasted at 18.5% per year, also above the market average of 13.6%. Despite a lower future return on equity (9.1%), recent moves like reallocating surplus funds and a final cash dividend of CNY0.30 per 10 shares indicate strategic financial management and potential for sustained growth amidst high insider ownership stability.

- Unlock comprehensive insights into our analysis of Longhua Technology GroupLtd stock in this growth report.

- Upon reviewing our latest valuation report, Longhua Technology GroupLtd's share price might be too optimistic.

Make It Happen

- Delve into our full catalog of 364 Fast Growing Chinese Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605589

Jinan Shengquan Group Share Holding

Jinan Shengquan Group Share Holding Co., Ltd.

Flawless balance sheet with solid track record.