- China

- /

- Tech Hardware

- /

- SZSE:002180

Investors Still Aren't Entirely Convinced By Ninestar Corporation's (SZSE:002180) Revenues Despite 39% Price Jump

Ninestar Corporation (SZSE:002180) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 27%.

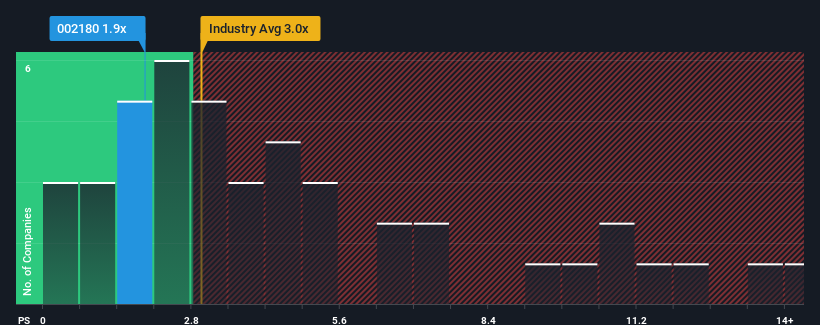

In spite of the firm bounce in price, Ninestar's price-to-sales (or "P/S") ratio of 1.9x might still make it look like a buy right now compared to the Tech industry in China, where around half of the companies have P/S ratios above 3x and even P/S above 6x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ninestar

What Does Ninestar's P/S Mean For Shareholders?

Ninestar could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ninestar.Is There Any Revenue Growth Forecasted For Ninestar?

Ninestar's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.0%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 9.6% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the five analysts following the company. That's shaping up to be similar to the 15% growth forecast for the broader industry.

With this information, we find it odd that Ninestar is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Ninestar's P/S?

Despite Ninestar's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Ninestar remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about this 1 warning sign we've spotted with Ninestar.

If you're unsure about the strength of Ninestar's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Ninestar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002180

Ninestar

Engages in the research and development, production, processing, and sales of self-produced printers, and printer consumables and accessories.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success