- Israel

- /

- Electronic Equipment and Components

- /

- TASE:NYAX

High Growth Tech Stocks to Watch in November 2025

Reviewed by Simply Wall St

As global markets face a downturn with U.S. stocks snapping a three-week winning streak amid concerns over high valuations and AI spending, the technology-heavy Nasdaq Composite has led major indices lower, highlighting investor caution in the current economic climate. In such an environment, identifying high-growth tech stocks requires careful consideration of their resilience to market volatility and potential for sustained innovation despite broader economic challenges.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.08% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Pharma Mar | 26.56% | 44.88% | ★★★★★★ |

| Hacksaw | 32.71% | 37.88% | ★★★★★★ |

| KebNi | 24.89% | 61.24% | ★★★★★★ |

| Gold Circuit Electronics | 27.50% | 35.18% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CD Projekt | 35.69% | 51.01% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

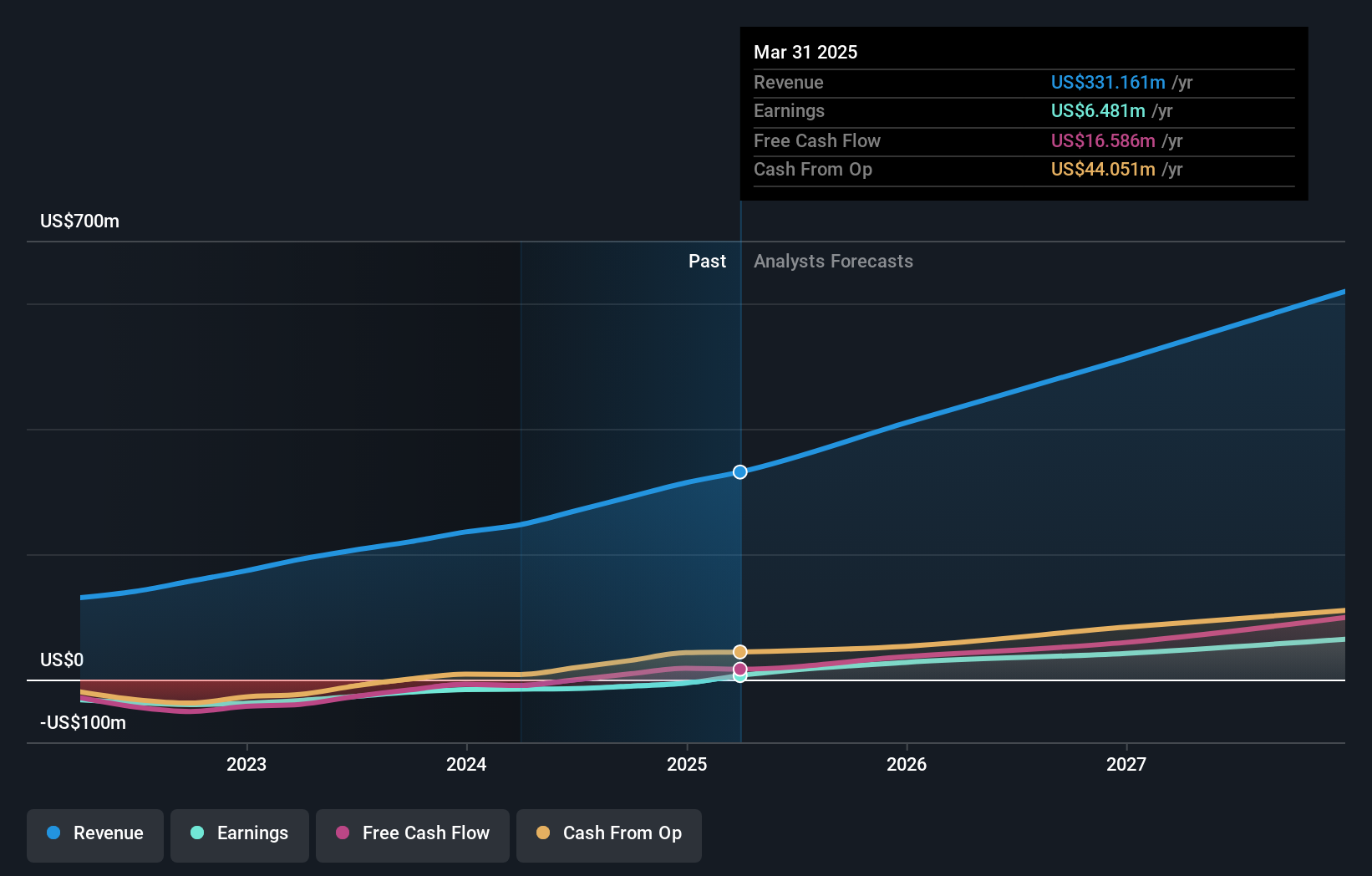

Indra Sistemas (BME:IDR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Indra Sistemas, S.A. is a global technology and consulting company specializing in aerospace, defense, and mobility sectors with a market capitalization of €8.79 billion.

Operations: Indra Sistemas generates revenue primarily from its Minsait (IT) segment, contributing €3.07 billion, followed by the Defense segment at €1.12 billion and Air Traffic at €520.38 million. The Mobility sector adds another €364.45 million to the company's revenue streams.

Indra Sistemas, a key innovator in tech, reported robust growth with a 12.5% annual revenue increase and an impressive 57.5% spike in earnings over the past year, surpassing the IT industry's average of 1.3%. This performance is underpinned by significant R&D investments which accounted for substantial portions of their revenue, reflecting their commitment to advancing technology solutions like the C-V2X Toll system in North Carolina. This initiative not only marks a first in U.S. highway tech but also enhances road safety through advanced LiDAR and connected vehicle technologies, demonstrating Indra's pivotal role in transforming modern transportation infrastructure while securing its market position through innovative client solutions.

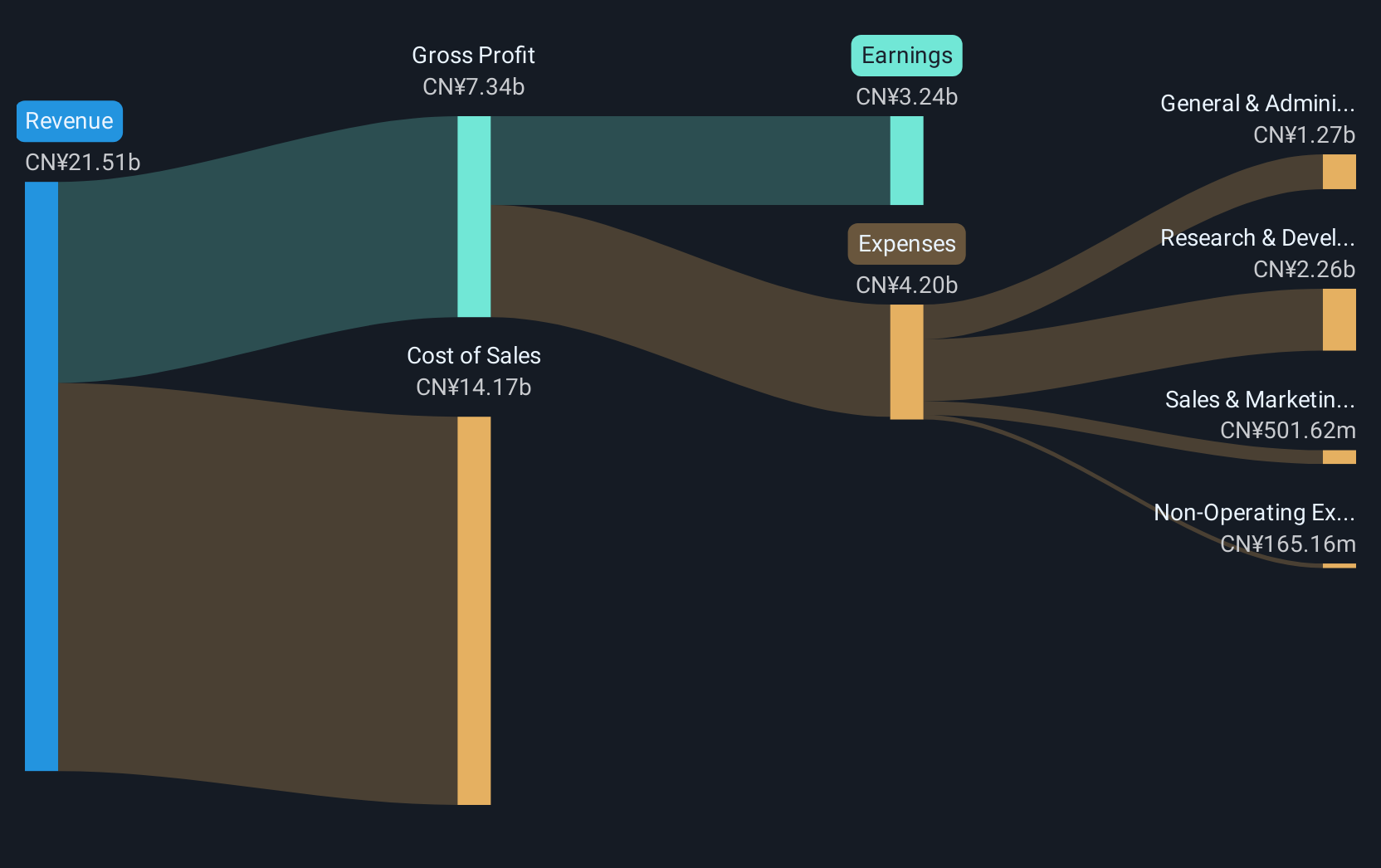

Jonhon Optronic Technology (SZSE:002179)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jonhon Optronic Technology Co., Ltd. focuses on the research and development of optical, electrical, and fluid connection technologies and equipment in China, with a market capitalization of CN¥75.96 billion.

Operations: Jonhon Optronic Technology specializes in developing and manufacturing advanced connection technologies for optical, electrical, and fluid systems. The company operates primarily within China, leveraging its expertise in these areas to generate revenue.

Jonhon Optronic Technology has demonstrated resilience with a 12.3% increase in revenue, reaching CNY 15.84 billion this year, despite a challenging market environment. This growth is paired with a strategic focus on R&D, which is evident from their recent enhancements to optoelectronic products—a sector poised for significant expansion as industries increasingly rely on advanced sensing technologies. However, the company faced a dip in net income by 30.8%, reflecting the competitive pressures and increased investment costs that often accompany rapid innovation and market expansion efforts. Looking ahead, Jonhon's commitment to technological advancements and its strong market position may well navigate it through the volatile tech landscape, supported by robust revenue growth projections of 14.7% annually.

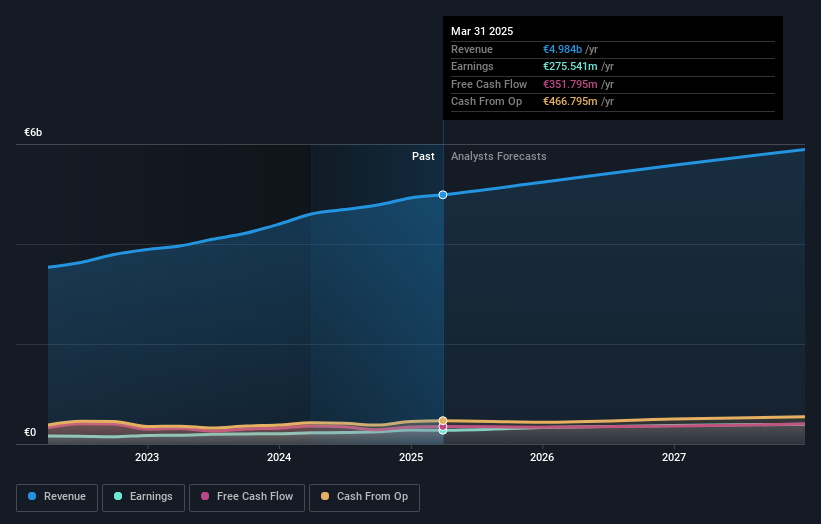

Nayax (TASE:NYAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nayax Ltd. is a fintech company that provides comprehensive solutions for automated self-service retailers and merchants globally, with a market cap of ₪4.92 billion.

Operations: The company focuses on developing solutions for automated self-service retailers and merchants across multiple regions, generating revenue primarily from its Internet Software and Services segment, which amounts to $348.66 million.

Nayax stands out in the high-growth tech sector with a robust annual revenue increase of 18.9% and an even more impressive earnings growth of 38.8% per year, signaling strong operational efficiency and market demand. The company's strategic partnership with ChargeSmart EV highlights its innovative approach in expanding into the U.S. EV charging market, positioning Nayax as a key player in integrated payment solutions for this rapidly growing industry. Moreover, its commitment to R&D is evident as it dedicates substantial resources to developing cutting-edge payment technologies that enhance user experiences across various platforms, ensuring Nayax remains at the forefront of technological advancements within the fintech space.

- Click to explore a detailed breakdown of our findings in Nayax's health report.

Explore historical data to track Nayax's performance over time in our Past section.

Make It Happen

- Click through to start exploring the rest of the 244 Global High Growth Tech and AI Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nayax might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:NYAX

Nayax

A fintech company, develops a complete solution for automated self-service retailers, commerce, and other merchants in the United States, Europe, the United Kingdom, Australia, Israel, and rest of the world.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives