- China

- /

- Communications

- /

- SZSE:002151

Beijing BDStar Navigation Co., Ltd. (SZSE:002151) Stock Rockets 30% As Investors Are Less Pessimistic Than Expected

Those holding Beijing BDStar Navigation Co., Ltd. (SZSE:002151) shares would be relieved that the share price has rebounded 30% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

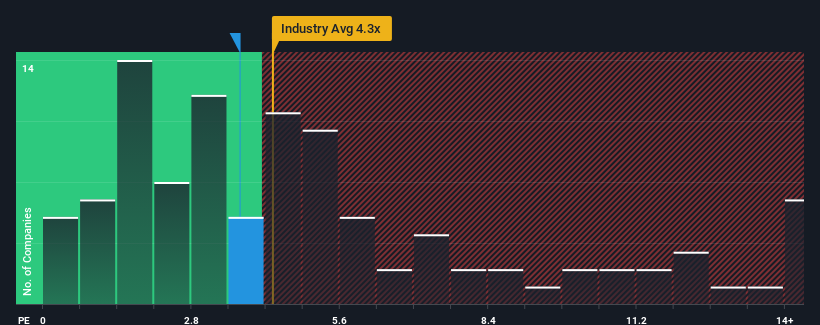

Even after such a large jump in price, it's still not a stretch to say that Beijing BDStar Navigation's price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" compared to the Communications industry in China, where the median P/S ratio is around 4.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Beijing BDStar Navigation

What Does Beijing BDStar Navigation's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Beijing BDStar Navigation has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing BDStar Navigation.How Is Beijing BDStar Navigation's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Beijing BDStar Navigation's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.0% last year. The solid recent performance means it was also able to grow revenue by 13% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 16% over the next year. That's shaping up to be materially lower than the 52% growth forecast for the broader industry.

With this information, we find it interesting that Beijing BDStar Navigation is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Beijing BDStar Navigation's P/S

Beijing BDStar Navigation appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Beijing BDStar Navigation's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you take the next step, you should know about the 1 warning sign for Beijing BDStar Navigation that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing BDStar Navigation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002151

Beijing BDStar Navigation

Provides chips and data services, navigation products, and ceramic components worldwide.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives