Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SZSE:002055

Shenzhen Deren Electronic (SZSE:002055 shareholders incur further losses as stock declines 11% this week, taking three-year losses to 45%

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Shenzhen Deren Electronic Co., Ltd. (SZSE:002055) shareholders, since the share price is down 45% in the last three years, falling well short of the market decline of around 28%. And the ride hasn't got any smoother in recent times over the last year, with the price 36% lower in that time. The last week also saw the share price slip down another 11%.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Shenzhen Deren Electronic

Shenzhen Deren Electronic isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

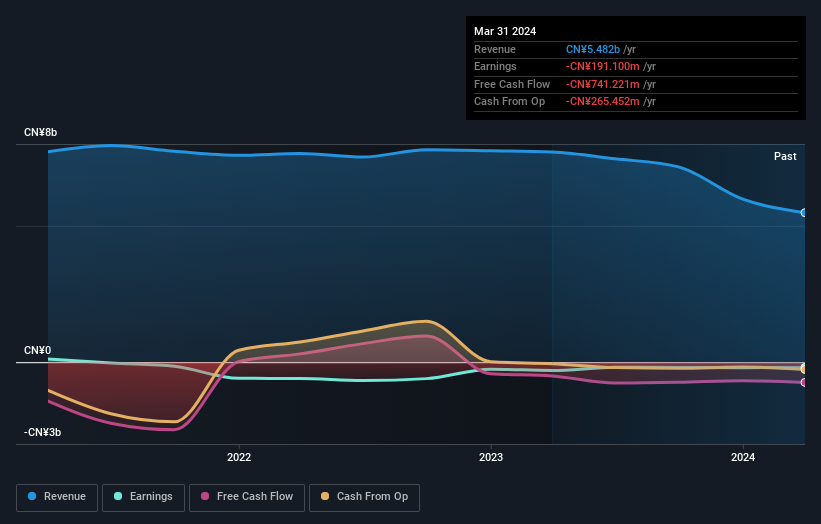

In the last three years Shenzhen Deren Electronic saw its revenue shrink by 7.7% per year. That's not what investors generally want to see. The stock has disappointed holders over the last three years, falling 13%, annualized. That makes sense given the lack of either profits or revenue growth. However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Shenzhen Deren Electronic's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 17% in the twelve months, Shenzhen Deren Electronic shareholders did even worse, losing 36%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Shenzhen Deren Electronic you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002055

Shenzhen Deren Electronic

Engages in the research, development, manufacture, and sale of connectors and precision components for the home appliance, consumer and automotive electronics, and telematics technology sectors worldwide.

Adequate balance sheet low.