In recent weeks, global markets have experienced a notable upswing, with major U.S. stock indexes rebounding amid easing core inflation and robust bank earnings. This positive momentum has been reflected in the S&P MidCap 400 and Russell 2000 indices, which saw significant gains as investors showed renewed interest in small-cap stocks. In this environment, identifying promising stocks involves looking for companies that demonstrate resilience and potential growth within their sectors, especially those poised to benefit from current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hunan Valin Wire & CableLtd (SZSE:001208)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hunan Valin Wire & Cable Co., Ltd. is involved in the research, development, production, and sales of wires and cables in China, with a market capitalization of CN¥4.85 billion.

Operations: Valin Wire & Cable generates revenue primarily from the sale of wires and cables. The company's financial performance is influenced by its cost structure, which includes raw materials, labor, and manufacturing expenses. It has a market capitalization of CN¥4.85 billion.

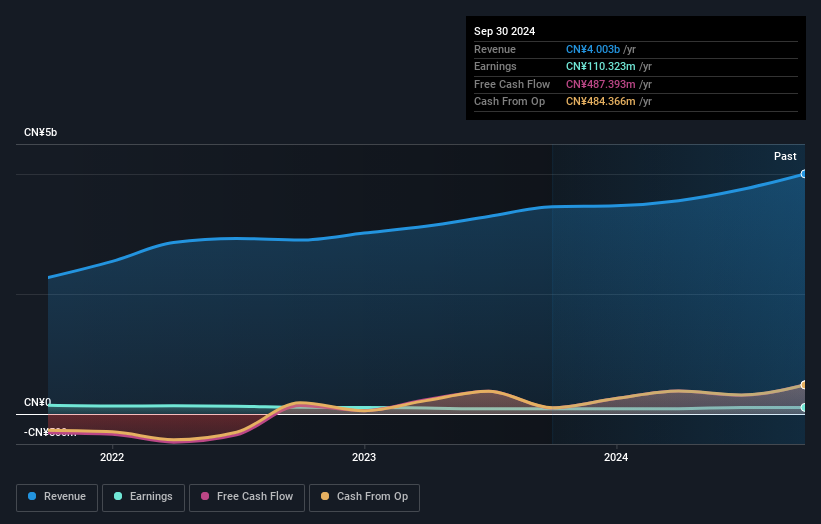

Hunan Valin Wire & Cable, a smaller player in the electrical industry, has shown promising growth with earnings rising by 24.4% last year, outpacing the sector's modest 1.1%. The company's net debt to equity ratio stands at a satisfactory 12.7%, indicating prudent financial management despite an increase from 52% to 54.8% over five years. Recent earnings highlight robust performance with sales reaching CNY3.11 billion and net income climbing to CNY86 million for the first nine months of 2024, up from CNY62 million previously. Trading at a significant discount to its estimated fair value further underscores its potential appeal as an investment opportunity.

Eastcompeace TechnologyLtd (SZSE:002017)

Simply Wall St Value Rating: ★★★★★★

Overview: Eastcompeace Technology Co. Ltd offers smart card and system solutions both in China and internationally, with a market cap of CN¥5.89 billion.

Operations: The company generates revenue through its smart card and system solutions, operating both domestically and internationally. It has a market cap of CN¥5.89 billion.

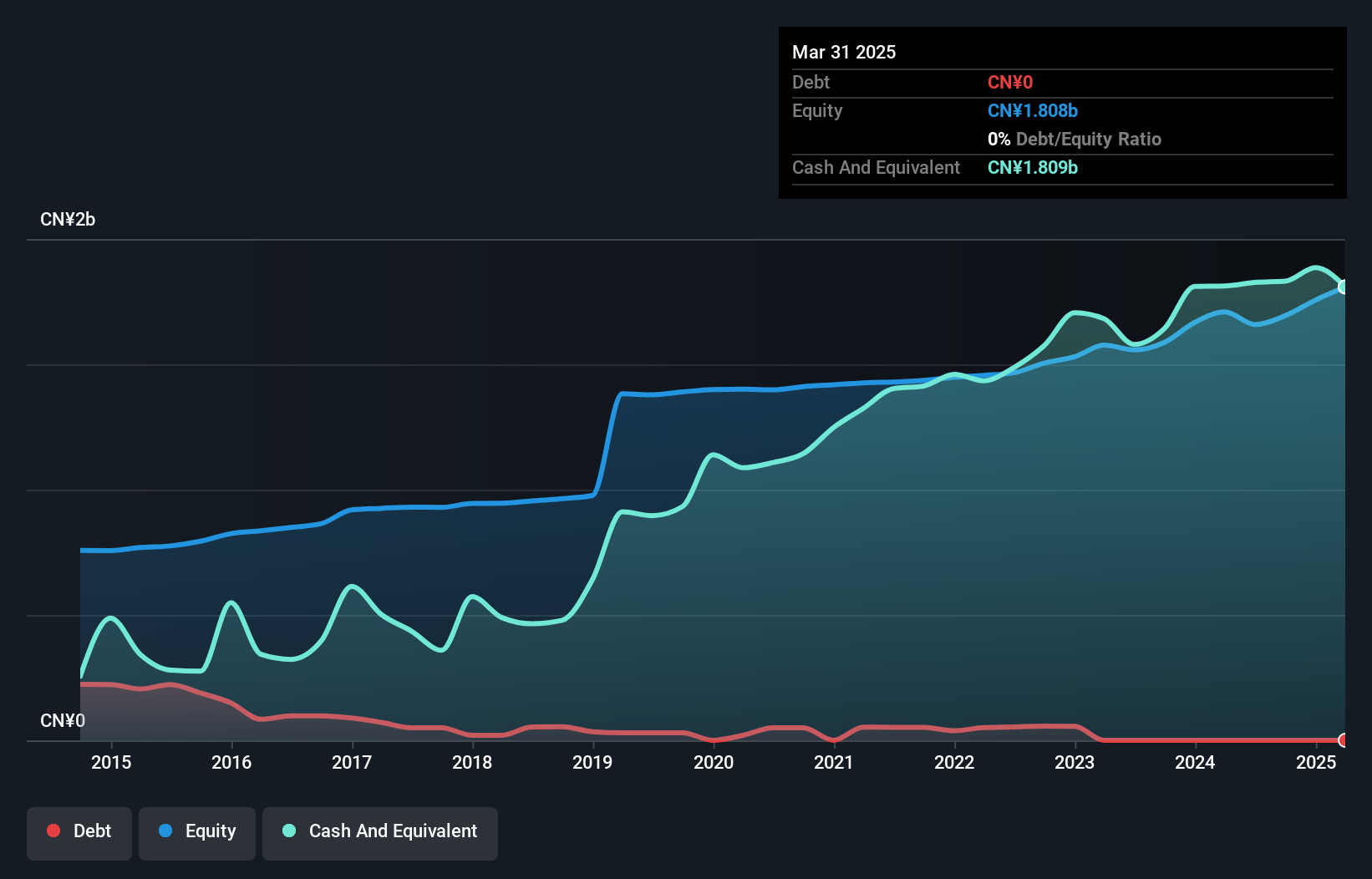

Eastcompeace Technology, a smaller player in the tech industry, is making waves with its impressive financial health and growth. The company reported earnings of CNY 118.92 million for the nine months ending September 2024, up from CNY 103.87 million the previous year. With no debt on its balance sheet now compared to a debt-to-equity ratio of 2.2% five years ago, Eastcompeace shows strong fiscal discipline. Trading at about 24% below estimated fair value and boasting a robust earnings growth of 38.5%, outpacing the tech sector's average, it seems well-positioned for continued success in its market niche.

- Click to explore a detailed breakdown of our findings in Eastcompeace TechnologyLtd's health report.

Astro-century Education&TechnologyLtd (SZSE:300654)

Simply Wall St Value Rating: ★★★★★★

Overview: Astro-century Education&Technology Co., Ltd focuses on the planning, design, production, and distribution of supplementary teaching books for primary, elementary, and high schools in China with a market cap of CN¥3.69 billion.

Operations: Astro-century Education&Technology Co., Ltd generates revenue primarily from the publishing of supplementary teaching books, amounting to CN¥526.82 million.

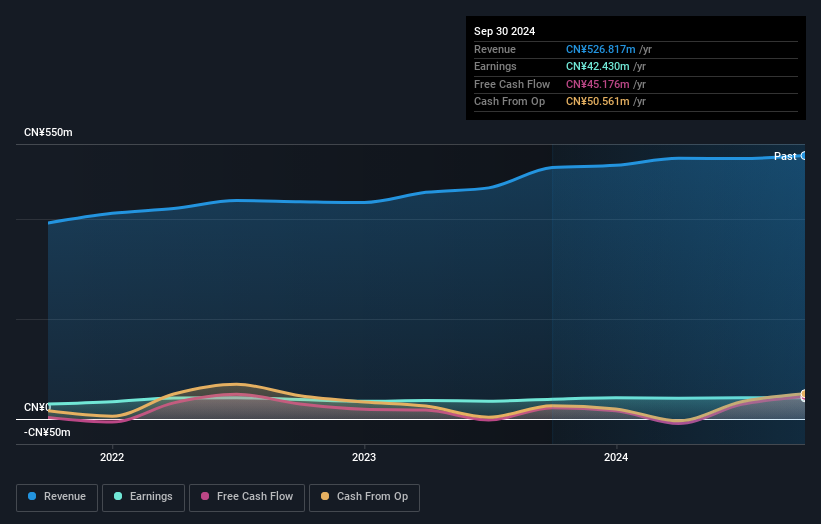

Astro-century Education & Technology Ltd. seems to be making strides with its recent earnings report, showing sales of CNY 388.27 million for the nine months ending September 2024, a slight rise from CNY 368.87 million the previous year. Net income remained stable at CNY 31.48 million compared to CNY 31.39 million last year, reflecting consistent performance despite market volatility over the past three months. With no debt on its books and a positive free cash flow position, Astro-century appears financially robust and well-positioned within its industry context where it has outpaced sector growth by achieving a 7.2% earnings increase over the past year.

Next Steps

- Reveal the 4651 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300654

Astro-century Education&TechnologyLtd

Engages in planning, design, production, and distribution of supplementary teaching books for primary, elementary, and high schools in China.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives