- China

- /

- Auto Components

- /

- SHSE:605133

L&K Engineering (Suzhou)Ltd And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

As global markets experience a rally with major indices like the S&P 500 and Nasdaq Composite reaching all-time highs, attention is turning towards Asia where economic conditions present unique opportunities. Amidst this backdrop, small-cap stocks in the region are gaining interest for their potential to offer growth and diversification, making them intriguing options for investors seeking to capitalize on emerging market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Argosy Research | NA | 6.09% | 11.72% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Zhejiang Sling Automobile Bearing | NA | 6.76% | 24.26% | ★★★★★★ |

| Yibin City Commercial Bank | 136.61% | 11.29% | 20.39% | ★★★★★★ |

| ShenZhen Click TechnologyLTD | 4.03% | 31.94% | 12.56% | ★★★★★☆ |

| Daoming Optics&ChemicalLtd | 33.83% | 1.38% | 5.82% | ★★★★★☆ |

| Guangdong Transtek Medical Electronics | 18.14% | -7.58% | -3.26% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Uniplus Electronics | 32.17% | 46.30% | 75.33% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

We'll examine a selection from our screener results.

L&K Engineering (Suzhou)Ltd (SHSE:603929)

Simply Wall St Value Rating: ★★★★★★

Overview: L&K Engineering (Suzhou) Co., Ltd. offers specialized engineering technical services in China and has a market capitalization of CN¥7.49 billion.

Operations: L&K Engineering (Suzhou) Co., Ltd. generates revenue through its specialized engineering technical services in China. The company's net profit margin was 7.5% last year, reflecting its ability to manage costs effectively relative to its revenue streams.

L&K Engineering (Suzhou) Ltd. has demonstrated strong financial health, with no debt and earnings growth of 62% over the past year, significantly outpacing the construction industry's -5.4%. Trading at 16.7% below its estimated fair value, it offers good relative value compared to peers. Recent first-quarter results showed sales of CNY 835 million and net income of CNY 81.99 million, both lower than last year's figures due to strategic downsizing aimed at optimizing operations and reducing costs. Despite these challenges, the company remains free cash flow positive and is forecasted for a steady annual earnings growth rate of 9.1%.

- Dive into the specifics of L&K Engineering (Suzhou)Ltd here with our thorough health report.

Gain insights into L&K Engineering (Suzhou)Ltd's past trends and performance with our Past report.

Jiangsu Rongtai Industry (SHSE:605133)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Rongtai Industry Co., Ltd. specializes in the research, development, production, and sale of automotive aluminum alloy precision die casting products both within China and internationally, with a market capitalization of CN¥9.51 billion.

Operations: Rongtai Industry generates revenue primarily from the sale of automotive aluminum alloy precision die casting products. The company's cost structure includes expenses related to research, development, and production. Its financial performance is highlighted by a net profit margin trend that provides insight into its profitability over time.

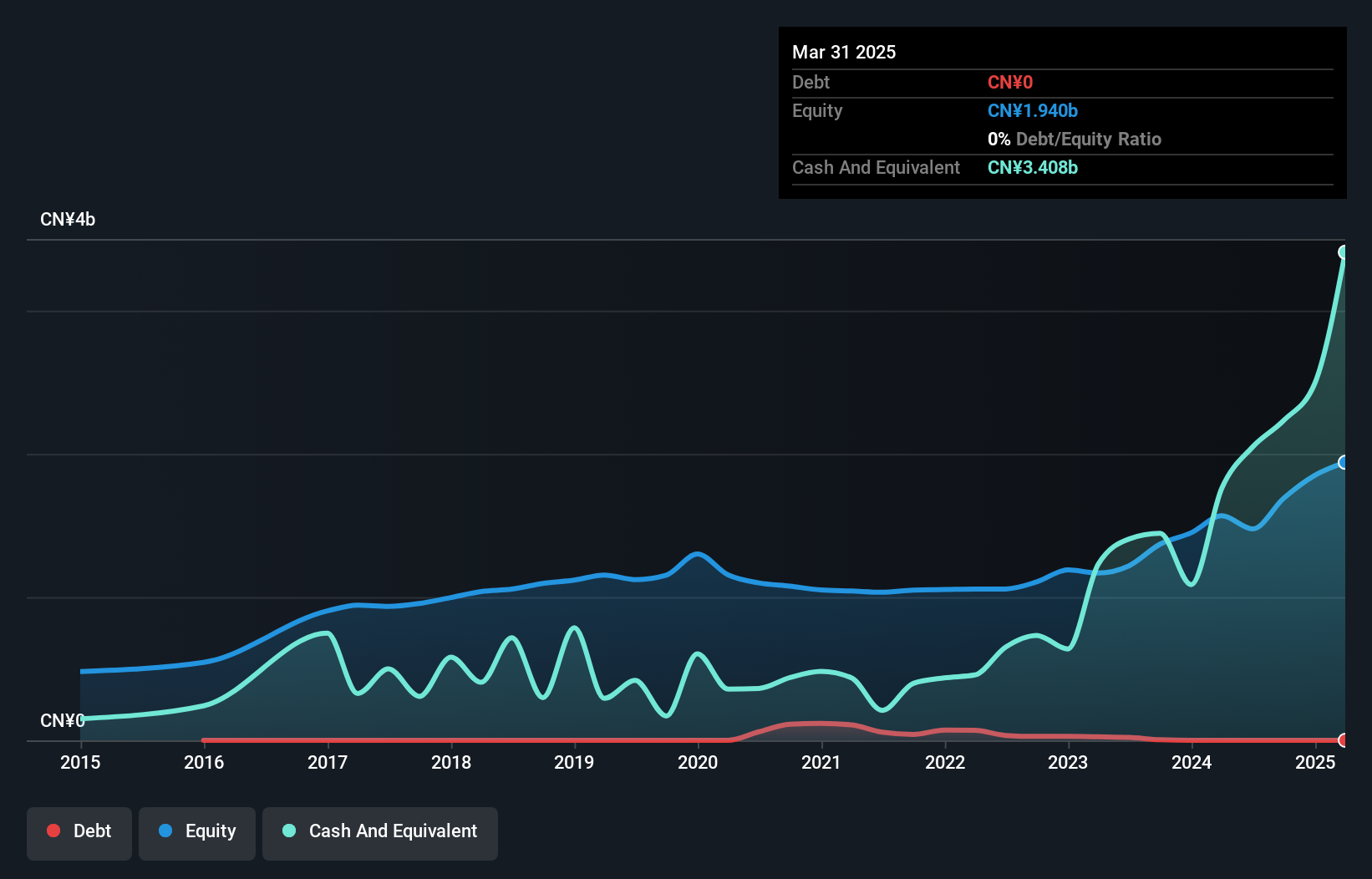

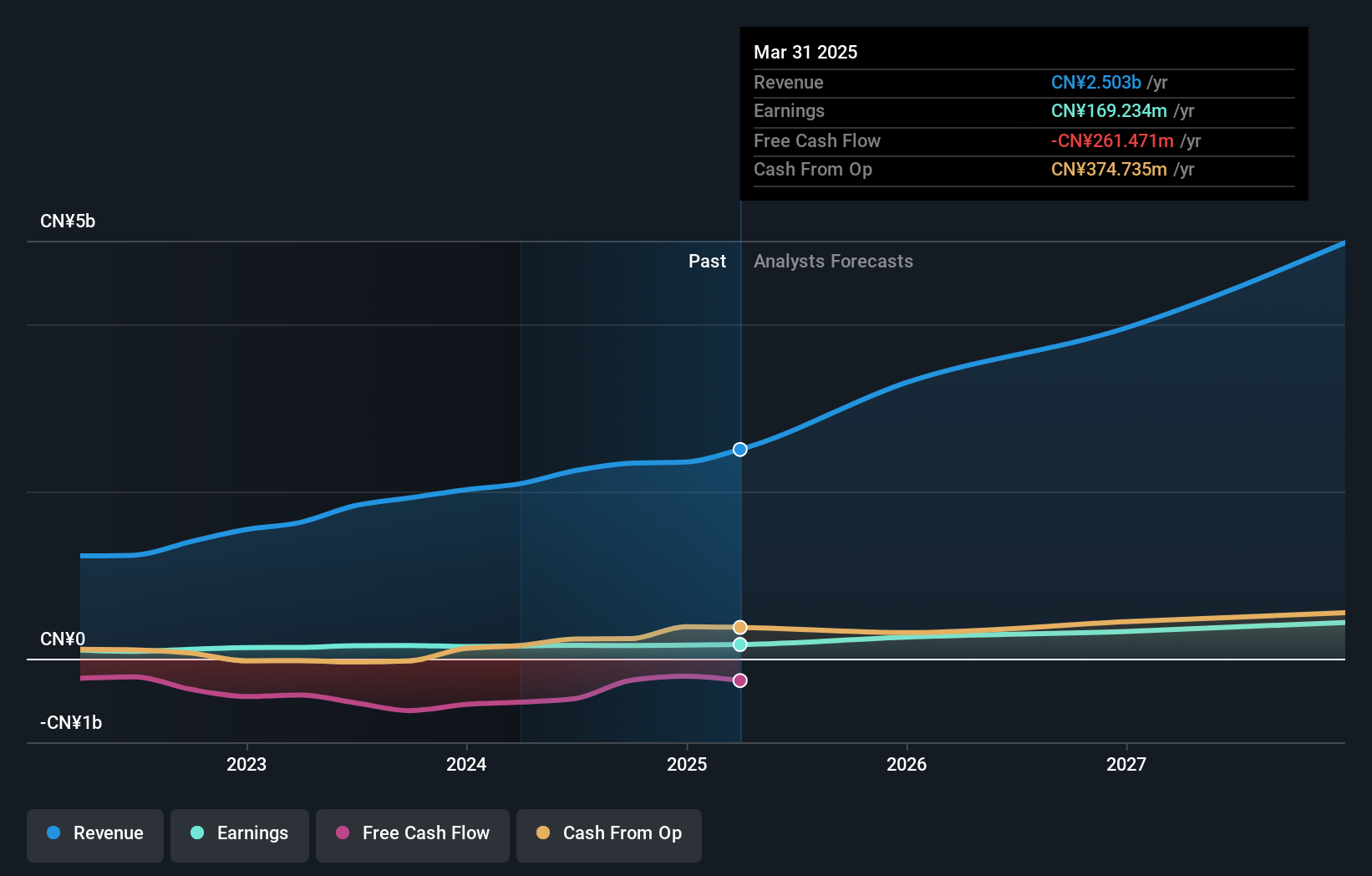

Jiangsu Rongtai Industry, a smaller player in the auto components sector, has seen its earnings grow by 10.8% over the past year, outpacing the industry's 4.7% growth. Despite a volatile share price recently, it boasts high-quality earnings and a debt-to-equity ratio that has improved significantly from 62.3% to 23.6% over five years. The company reported CNY 2,351.92 million in revenue for last year with net income at CNY 163.4 million and basic EPS of CNY 0.89 compared to CNY 0.82 previously; however, shareholders experienced dilution during this period despite strong interest coverage of debt by EBIT at nearly fifteen times.

- Take a closer look at Jiangsu Rongtai Industry's potential here in our health report.

Understand Jiangsu Rongtai Industry's track record by examining our Past report.

Shandong Senter ElectronicLtd (SZSE:001388)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Senter Electronic Co., Ltd. specializes in providing industrial Internet of Things (IoT) smart terminals and solutions for the communications and electric power industries in China, with a market cap of approximately CN¥1.92 billion.

Operations: Senter Electronic generates revenue primarily from the communications equipment segment, amounting to CN¥1.01 billion.

Shandong Senter Electronic, a dynamic player in the electronics sector, recently completed an IPO raising CNY 640.38 million. The company's earnings surged by 15%, outpacing the industry's 2.8% growth rate over the past year. With net income climbing to CNY 142.78 million from CNY 124.04 million and basic EPS rising to CNY 1.22 from CNY 1.06, it demonstrates robust financial health and high-quality earnings despite its illiquid shares. Trading at a significant discount of nearly 80% below estimated fair value, Shandong Senter's reduced debt-to-equity ratio from 3.2 to just 0.2 over five years further underscores its financial stability and potential for future growth in this competitive market space.

Seize The Opportunity

- Navigate through the entire inventory of 2614 Asian Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605133

Jiangsu Rongtai Industry

Engages in the research and development, production, and sale of automotive aluminum alloy precision die casting products in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives