Zhongyuan Bank And 2 Other Undiscovered Gems In Asia With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer sentiment and economic indicators, Asian stocks have shown resilience, with easing U.S.-China trade tensions boosting confidence in the region. In this dynamic environment, identifying promising small-cap stocks requires a focus on companies that demonstrate strong fundamentals and adaptability to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Shenyang Yuanda Intellectual Industry GroupLtd | NA | 9.86% | 33.52% | ★★★★★★ |

| Chin Hsin Environ Engineering | 5.28% | 24.51% | 40.62% | ★★★★★☆ |

| Nantong Guosheng Intelligence Technology Group | 0.07% | 5.01% | -3.27% | ★★★★★☆ |

| Advancetek EnterpriseLtd | 57.48% | 28.66% | 48.38% | ★★★★★☆ |

| Daewon Cable | 23.95% | 7.90% | 48.06% | ★★★★★☆ |

| MNtech | 66.79% | 12.39% | -12.13% | ★★★★★☆ |

| Qijing Machinery | 38.27% | 3.10% | -2.56% | ★★★★☆☆ |

| Aurora OptoelectronicsLtd | 4.59% | -12.12% | 20.63% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhongyuan Bank (SEHK:1216)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhongyuan Bank Co., Ltd. offers a range of banking products and services across the Asia Pacific, North America, and internationally, with a market capitalization of HK$12.06 billion.

Operations: Zhongyuan Bank's revenue primarily stems from its Retail Banking segment, generating CN¥6.47 billion, followed by the Financial Markets Business at CN¥4.20 billion and Corporate Banking at CN¥1.93 billion.

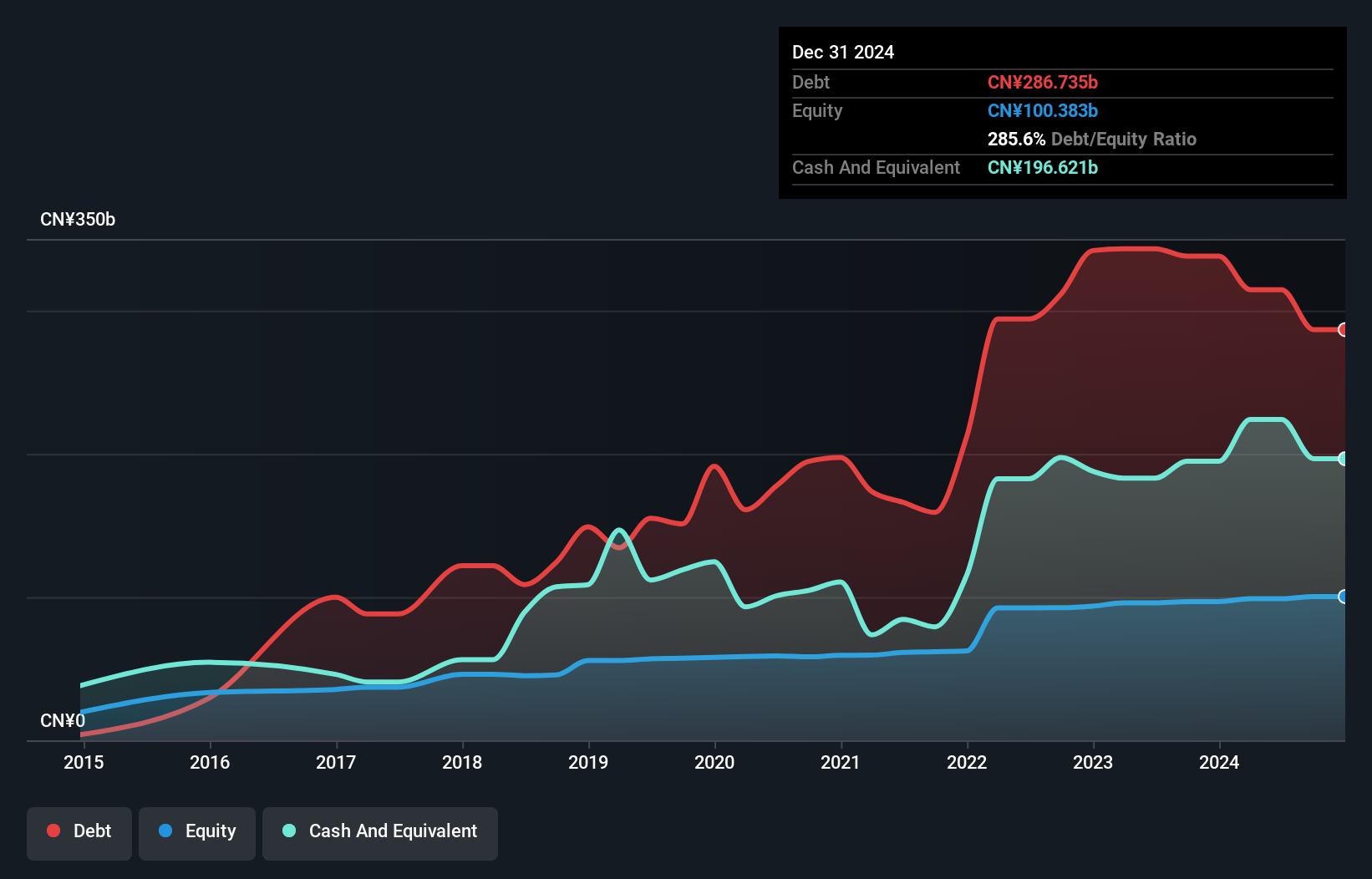

Zhongyuan Bank, a relatively small player in the Asian banking landscape, is making notable strides. With total assets of CN¥1,407.9 billion and equity of CN¥100.8 billion, it showcases a robust balance sheet. The bank's earnings growth over the past year at 13% outpaced the industry average of 4.6%, highlighting its competitive edge. Its price-to-earnings ratio stands attractively low at 4x compared to Hong Kong's market average of 12.6x, suggesting potential value for investors. Additionally, Zhongyuan maintains a sufficient allowance for bad loans at 1.9% of total loans, reflecting prudent risk management practices amidst executive leadership changes and strategic expansions through acquisitions.

- Dive into the specifics of Zhongyuan Bank here with our thorough health report.

Understand Zhongyuan Bank's track record by examining our Past report.

Shenzhen Best of Best HoldingsLtd (SZSE:001298)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Best of Best Holdings Co., Ltd. is engaged in the distribution of electronic components in the People's Republic of China, with a market capitalization of CN¥10.65 billion.

Operations: The company generates revenue primarily from distributing electronic components within China. Its financial performance is marked by a notable trend in its gross profit margin, which has shown fluctuations over recent periods.

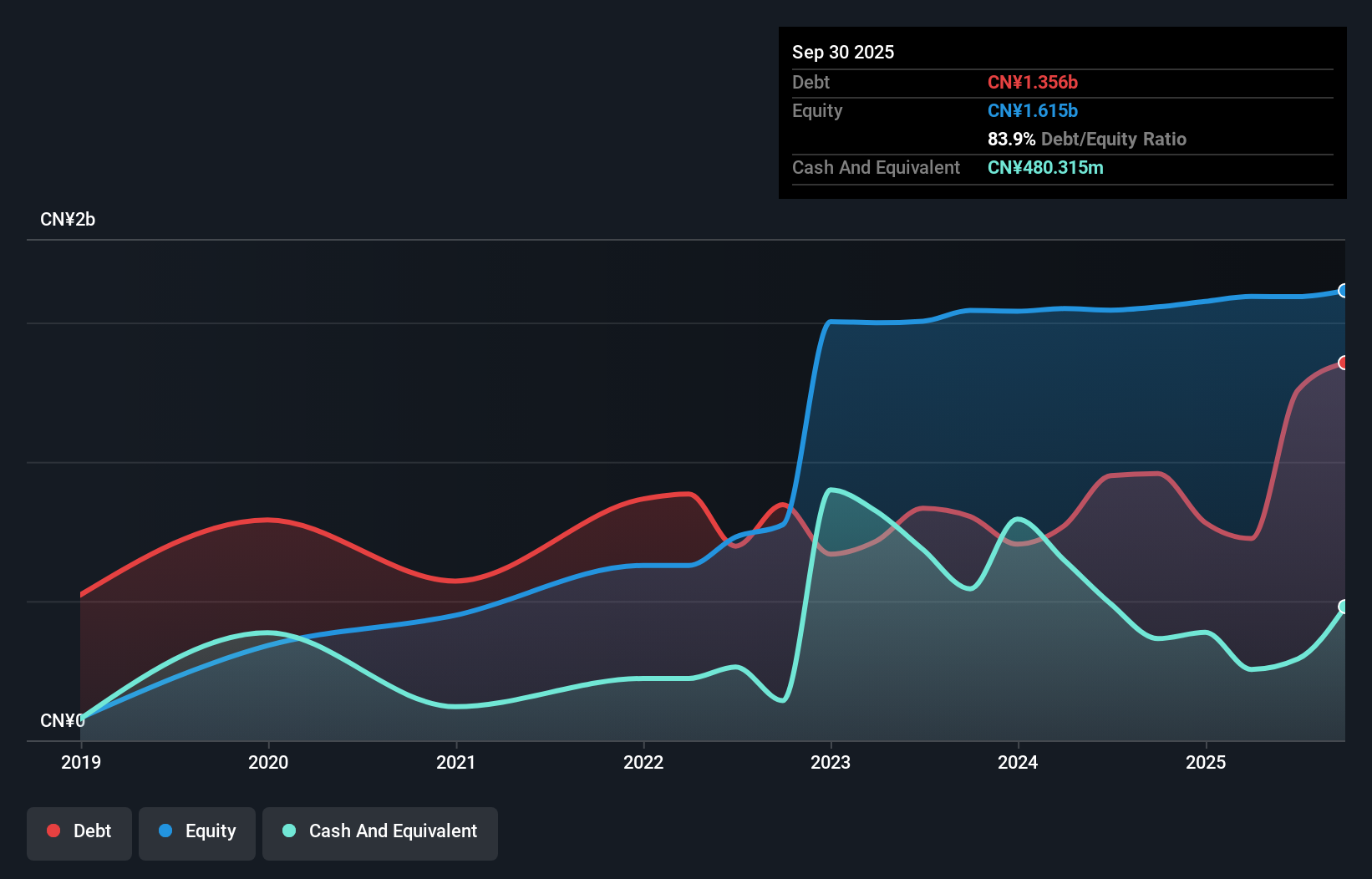

Shenzhen Best of Best Holdings, a small player in the electronics sector, has shown impressive earnings growth of 68.7% over the past year, surpassing the industry's 9%. Despite a volatile share price recently, its debt-to-equity ratio has improved significantly from 148.8% to 83.9% over five years. However, challenges persist with negative free cash flow and a high net debt-to-equity ratio at 54%. The company reported nine-month sales of CNY 6.13 billion and net income of CNY 49.15 million as of September 2025, reflecting steady progress despite one-off losses impacting results.

- Click to explore a detailed breakdown of our findings in Shenzhen Best of Best HoldingsLtd's health report.

Learn about Shenzhen Best of Best HoldingsLtd's historical performance.

Shenzhen Lions King Hi-Tech (SZSE:301305)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Lions King Hi-Tech Co., Ltd focuses on the investment, construction, and operation of biomass waste resource treatment projects both in China and internationally, with a market cap of CN¥6.29 billion.

Operations: Lions King Hi-Tech generates revenue primarily through its biomass waste resource treatment projects. The company has a market cap of CN¥6.29 billion, reflecting its scale and presence in the industry.

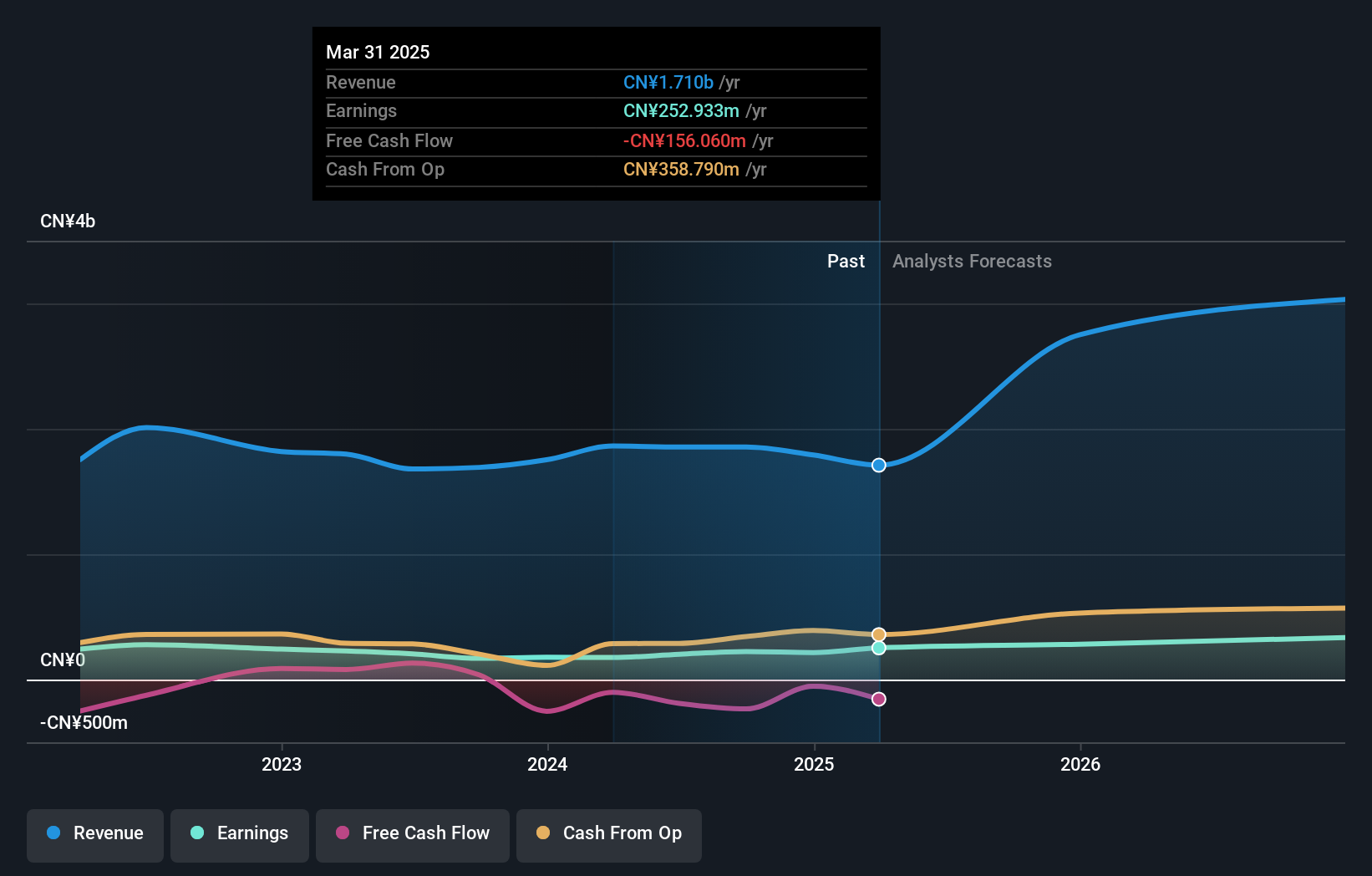

Shenzhen Lions King Hi-Tech, a relatively small player in the tech sector, has shown promising financial health with a net debt to equity ratio of 15.1%, which is considered satisfactory. Over the past five years, its debt to equity ratio improved significantly from 115.7% to 42.7%. The company's earnings growth of 21.7% over the last year outpaced the industry average by a wide margin, indicating robust performance. Recent earnings reports for nine months ending September 2025 reveal sales at CNY 1,386 million and net income at CNY 249 million, reflecting solid profitability improvements compared to previous periods.

Key Takeaways

- Click this link to deep-dive into the 2448 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongyuan Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1216

Zhongyuan Bank

Provides various banking products and services in the Asia Pacific, North America, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives