- China

- /

- Electronic Equipment and Components

- /

- SZSE:000925

UniTTECLtd's (SZSE:000925) three-year decline in earnings translates into losses for shareholders

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term UniTTEC Co.,Ltd (SZSE:000925) shareholders, since the share price is down 26% in the last three years, falling well short of the market decline of around 21%. And the ride hasn't got any smoother in recent times over the last year, with the price 23% lower in that time.

On a more encouraging note the company has added CN¥351m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for UniTTECLtd

Given that UniTTECLtd only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years, UniTTECLtd's revenue dropped 11% per year. That's not what investors generally want to see. The annual decline of 8% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

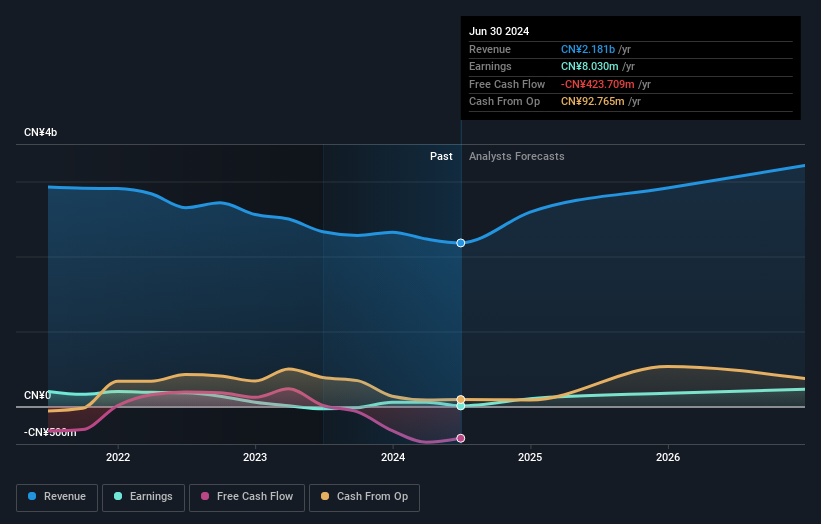

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that UniTTECLtd has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for UniTTECLtd in this interactive graph of future profit estimates.

A Different Perspective

While the broader market lost about 6.0% in the twelve months, UniTTECLtd shareholders did even worse, losing 23% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for UniTTECLtd you should be aware of, and 1 of them is potentially serious.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000925

UniTTECLtd

Provides integrated solutions in the areas of rail transit, and energy saving and environmental protection in China.

Excellent balance sheet with reasonable growth potential.