- China

- /

- Electronic Equipment and Components

- /

- SZSE:000050

There's No Escaping Tianma Microelectronics Co., Ltd.'s (SZSE:000050) Muted Revenues

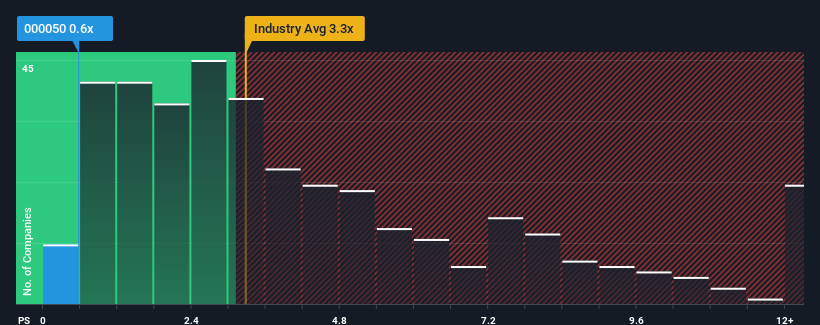

With a price-to-sales (or "P/S") ratio of 0.6x Tianma Microelectronics Co., Ltd. (SZSE:000050) may be sending very bullish signals at the moment, given that almost half of all the Electronic companies in China have P/S ratios greater than 3.3x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Tianma Microelectronics

How Has Tianma Microelectronics Performed Recently?

Recent revenue growth for Tianma Microelectronics has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on Tianma Microelectronics will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tianma Microelectronics.Is There Any Revenue Growth Forecasted For Tianma Microelectronics?

The only time you'd be truly comfortable seeing a P/S as depressed as Tianma Microelectronics' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 6.0%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 8.8% as estimated by the four analysts watching the company. With the industry predicted to deliver 25% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Tianma Microelectronics is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Tianma Microelectronics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Tianma Microelectronics, and understanding should be part of your investment process.

If you're unsure about the strength of Tianma Microelectronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tianma Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000050

Tianma Microelectronics

Designs, manufactures, and supplies display solutions and related support services worldwide.

Undervalued with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)